Chinese data giants are supplying information to traditional stores in China. Source: Shutterstock

Chinese data giants coming to a local store near you soon

WHILE the figures for Chinese e-commerce annual sales are almost beyond human comprehension (US$1 trillion this year, and rising), this is only about a quarter of overall retail sales in the country. It is with this in mind that names more commonly associated with online activity – Alibaba, and JD – are turning their attention to traditional bricks and mortar retail.

The two retail giants are each using a catchphrase to describe their latest realm of interest: JD terms it “borderless retail” and Alibaba prefers “new retail”. Neither is building great swathes of new retail outlets, but their interest is in others using the item of which they both possess a great deal – data.

In short, both phrases mean tracking shoppers wherever they might be; from online to in-store, using a voice assistant and so forth. By monitoring shoppers’ behavior, and by utilizing the data already collected on each individual, the two tech giants aim to get to know consumers better than any other companies in the world.

While the trend for online shopping is growing in China, it is thought shoppers are growing savvier and beginning to enjoy – and in some cases expect – a physical, in-store experience to inform their decisions.

Both companies are hoping to attract brands with a variety of tech services, including location-based inventory management, precision marketing and even facial recognition-based payment systems. This type of technology is of course nothing new: Apple stores have employed their proprietary ‘beacon’ technology for several years.

In an #Alibaba warehouse. #IoT #AI #Robotics pic.twitter.com/ma1PE9kD89

— Naman Bhutani (@reachnaman) November 7, 2017

Amazon and Alibaba are racing toward commercial ubiquity, but China's Alibaba is miles ahead pic.twitter.com/hBGD4m1SnJ

— The Economist (@TheEconomist) November 5, 2017

What is new here is the two-way exchange of information (or sale of information) between otherwise independent retailers and the big data providers. Alibaba and JD own a great deal of valuable data, from spending habits to where customers receive physical packages – which usually reveals customers’ work addresses, as well as home. By using this type of data, brick-and-mortar stores can localize what they offer, how it is advertised and to whom.

For stores which turn over more than just a little, Alibaba offers a one- or two-day delivery service, help with stock levels via demand-prediction algorithms, and even small loan financing. JD is testing a concept which uses RFID tags and facial recognition to enable unmanned stores to operate. Cameras on the ceiling give retailers heat maps of their store floor to track which products customers prefer, literally showing where they pause. This tech can combine with “smart shelves” which, by tracking the weight of products on them, can flag up to automated systems when restocking is required.

“To put it simply, we’re finding all data that has to do with people – their behavior, what they like, what they buy – and binding this online data to real people,” Chris Tung, chief marketing officer at Alibaba, told media at a pre-Singles’ Day event last week.

By tracking customers on- and offline, coupons, discounts, special offers and memberships can be consistent across all media. Sharing data will also help brands refine their online advertising spend, with in-store purchases informing advertising choices when the shopper is online. Advertising is a major source of revenue for Taobao: Alibaba captured the largest share of China’s digital advertising market in 2016, even beating giant Baidu.

Further data is being gathered by social media platforms. In a press release, Lei Xu, chief marketing officer at JD said: “In more than three years since we began leveraging our Tencent partnership, about a quarter of first-time users’ [information] have come from WeChat and Mobile QQ.”

While China’s huge retail market is big enough to be carved up between the two behemoths, partnering with brands on data or experimentation with smart stores won’t be exclusive to JD and Alibaba. It has always made sense for retailers to obtain as much information as they can about their customers, whoever might provide it. But with tech, information previously locked away online will now start to become available to so-called “mom and pop” outfits.

READ MORE

- China’s window into Southeast Asia’s digital scene through Malaysia

- Indonesia’s e-commerce landscape: Bigger market, bigger challenges

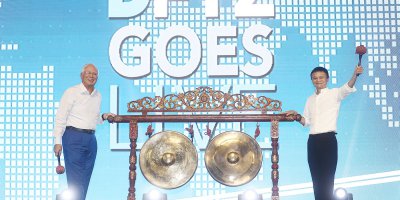

- Alibaba opens first Southeast Asia office in Malaysia

- How are online retailers transforming themselves?

- Singapore: A distinct e-commerce market in SEA