There is an increasing trend toward non-document verification and digital IDs. (Image – Shutterstock)

How verification services can help with fraud detection

- Increasing numbers of fraud cases signal a need for better fraud detection methods.

- Identity verification platforms can give real time insights for fraud detection.

- Sumsub, an identity verification platform provider, expands into APAC

Fraud detection continues to evolve as technology is enabling organizations to have a better chance of defending themselves. Over the years, fraudsters continue to improve their tactics and have been able to bypass traditional fraud detection methods.

According to statistics by IBM, 72% of business leaders cite fraud as a growing concern over the past 12 months. It is also predicted that worldwide losses from fraud can reach up to US$44 billion by 2025.

Fraud detection tools are mostly used by the financial industry as they manage a lot of sensitive data. Today, there are several approaches to fraud detection organizations can consider. This includes statistical data analysis, internal fraud prevention systems as well as applying tools from third-party cloud-based providers and taking a multi-layered process.

As millions of transactions occur in the financial industry daily, some companies are also taking an AI-based approach to fraud detection. The use of AI in fraud detection helps organizations improve their ability to detect fraud in real-time and also reduce false positives which boosts accuracy and can safeguard the customer experience.

Identity verification platforms are an example of an AI-based fraud detection tool. (Image – Shutterstock)

Verification platform for fraud detection

Identity verification platforms are an example of an AI-based fraud detection tool. The software uses a secure method of verifying an individual’s identity without compromising their privacy. For example, an identity verification platform can be used by a fintech company that is providing financial services by providing real-time insights if a user is genuine or not.

One such company that has been specializing in identity verifications is Sumsub. A full-cycle verification platform, Sumsub secures every step of the user journey. Known for its customizable KYC, KYB, AML, transaction monitoring, and fraud prevention solutions, businesses can orchestrate their verification process to meet compliance requirements, reduce costs and protect their business.

Sumsub has also just launched a new full-cycle identity verification platform which is designed to address accelerating fraud threats. Andrew Sever, Sumsub CEO and founder said the new platform is a response to four trends in identity verification. The trends are:

- the increase in global fraud

- the trend toward non-document verification and digital IDs

- tightening regulations in a number of industries

- the democratization of AI technology and innovation.

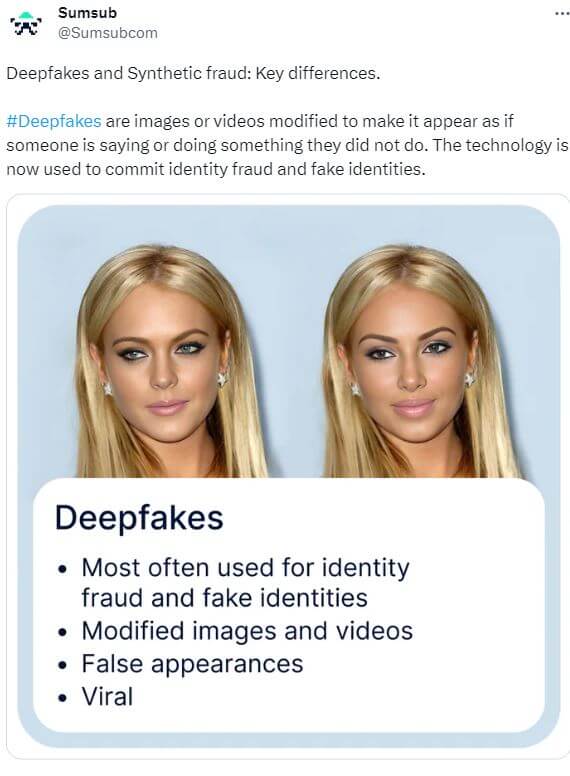

The threat of AI used for fraud is powered by deepfakes and synthetic fraud, making it harder for traditional fraud detection tools. As such, the new AI-enabled platform combines user and business verification, transaction monitoring, fraud prevention, and case management solutions into a single, unified dashboard. Simply put, the platform monitors and analyzes data at every stage to identify potentially suspicious behavior.

A Tweet by Sumsub on how deepfakes are making fraud detection harder.

Expansion into APAC

Fraud detection is essential in almost every organization, wherever it may be located today. In Asia Pacific, fraud remains a big problem for many companies, especially within the fintech industry. Internal statistic from Sumsub shows that countries like Singapore have been experiencing increasing digital fraud in 2023.

In fact, from Q1 to Q2 of 2023, there has been a 33% increase in digital fraud in Singapore. In Hong Kong, the rate of ID card fraud increased 1.5 times, while passport fraud more than doubled, reaching 3.5%. The passport fraud rate in Hong Kong also reached over 4% last quarter, alongside Malaysia. Meanwhile, the Philippines experienced a doubling of residence permits, as with Indonesia and Thailand, which witnessed over 60% increase in ID fraud rate.

Given the increasing number of fraud incidents in the region, Sumsub has decided to make Singapore its APAC headquarters as the company looks to respond to the escalating threat of identity fraud in the region.

With Singapore and Hong Kong being major financial hubs in the region, Sumsub aims to forge valuable partnerships in the region.

“The Asia-Pacific region is one of our top priorities in terms of global expansion. Here, digital startups, especially fintech, are booming, and we see huge business opportunities in the APAC market since instant user onboarding and strong fraud protection are in high demand. Sumsub has already helped thousands of global Western and Eastern companies build high-conversion verification flows while keeping fraud at bay and ensuring regulatory compliance—and we’re ready to serve more customers and partners in the APAC region,” commented Sever.

For Penny Chai. VP of Business Development in APAC at Sumsub, the expansion marks an exciting milestone for the company as it looks to foster a more secure business environment in the region.

With its expansion to the APAC region, Sumsub aims to target fintech, crypto, trading, gaming and mobility industries in which the company already verifies millions of identities annually for its global client base.

READ MORE

- Next-gen CX is based on customer communication management systems.

- Enhancing Business Agility with SASE: Insights for CIOs in APAC

- 3 Steps to Successfully Automate Copilot for Microsoft 365 Implementation

- Trustworthy AI – the Promise of Enterprise-Friendly Generative Machine Learning with Dell and NVIDIA

- Strategies for Democratizing GenAI