In 2023, Apple unseated Samsung at the top of the smartphone market, marking a significant power shift since 2010. (Photo by Nic Coury/AFP).

Apple iPhone overtakes Samsung as best-selling smartphone in 2023

- In 2023, Apple unseated Samsung at the top of the smartphone market.

- The Apple iPhone now comprises 20% of the global market – approximately 235 million shipments in the past year.

- With a double-digit decline in shipments to 226.6 million, Samsung secured the second position, surpassing Chinese device makers like Xiaomi.

In the global smartphone market, two tech giants, Apple and Samsung Electronics Co., have been locked in a long-standing battle for supremacy. Their flagship devices, the iPhone and Samsung Galaxy series, have become synonymous with innovation and style. But in a significant turn of events and for the first time since 2010, Apple has outperformed its longtime rival, Samsung Co., in global smartphone sales.

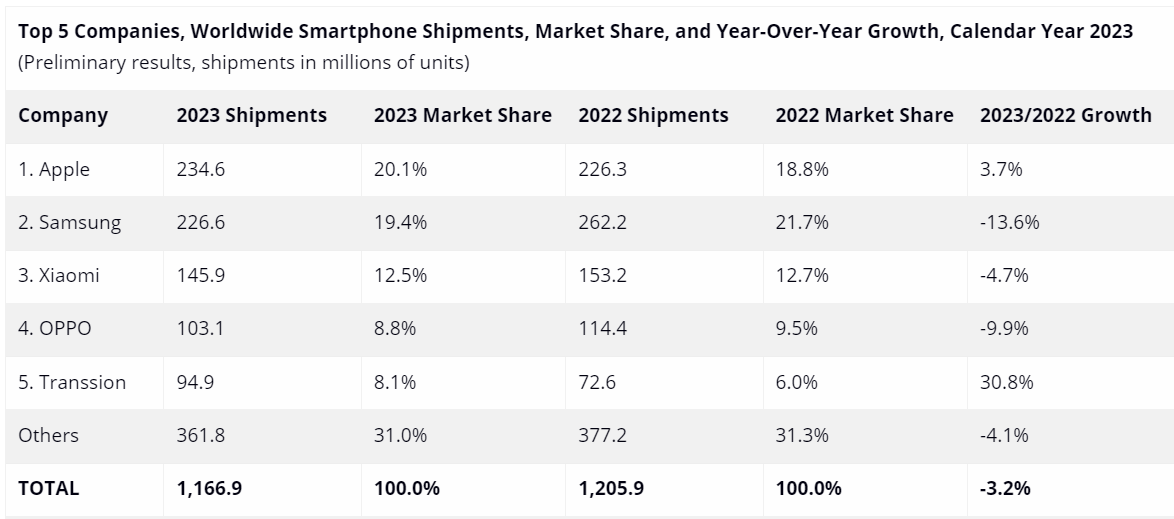

The iPhone dethroned the Samsung Galaxy to become the best-selling smartphone series globally, marking a notable shift in the industry’s competitive landscape. According to preliminary data from the International Data Corporation’s (IDC) Worldwide Quarterly Mobile Phone Tracker, the iPhone accounted for a substantial fifth of the global smartphone market, with nearly 235 million shipments in the past year.

“The last time a company not named Samsung was at the top of the smartphone market was in 2010, and for 2023, it is now Apple. A shifting of power at the top of the largest consumer electronics market was driven by Apple’s all-time high market share and a first time at the top,” IDC’s report reads. In other words, the unprecedented market share demonstrates Apple’s ability to capture a significant portion of consumer demand. It solidifies its position as a frontrunner in the highly competitive smartphone industry.

Apple’s dominance during the holiday quarter has been a recurring theme in recent years. However, its unprecedented lead over Samsung throughout the year indicates that Apple is navigating the challenges of an industrywide slump more effectively than its competitors.

Apple vs Samsung: a decade-defying achievement

While Samsung remains a formidable player in the smartphone market, its shipments experienced a double-digit slump, totaling 226.6 million. “The overall shift in ranking at the top of the market further highlights the intensity of competition within the smartphone market,” said Ryan Reith, group VP with IDC’s Worldwide Mobility and Consumer Device Trackers.

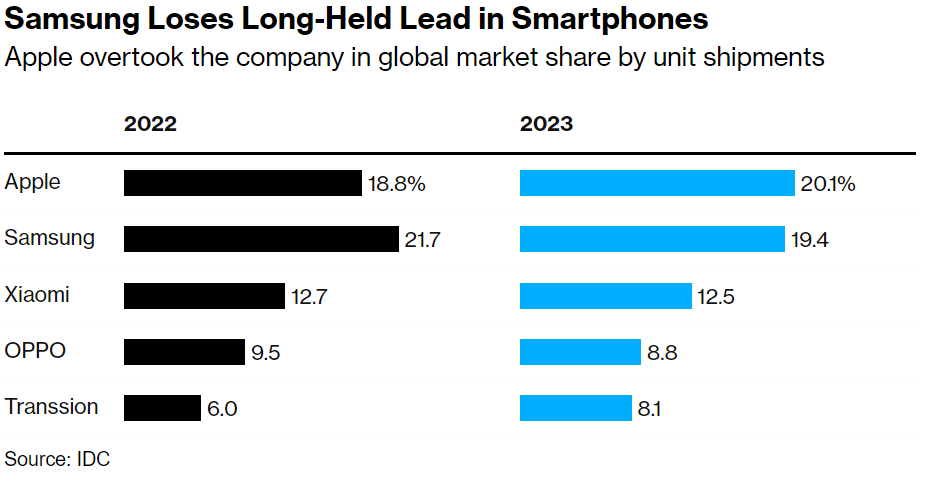

The iPhone sold more than Samsung’s devices globally in 2023. Source: Bloomberg.

Reith believes Apple played a part in Samsung’s drop in rank, but that the overall Android space is diversifying. “Huawei is back and making inroads quickly within China. Brands like OnePlus, Honor, Google, and others are launching very competitive devices in the lower price range of the high-end foldable, and increased discussions around AI capabilities on the smartphone are gaining traction. Overall, the smartphone space is headed towards an exciting time,” he added.

Apple’s surpassing Samsung in global smartphone sales signifies a crucial moment in industry rivalry. It highlights the enduring popularity of the iPhone series and Apple’s ability to connect with a diverse global audience. Consumers can expect more innovations and intense competition between these tech giants as the smartphone landscape evolves.

Global smartphone sales

Source: IDC Worldwide Quarterly Mobile Phone Tracker, January 15, 2024.

Overall, IDC said the global smartphone market remains challenged, but momentum is moving quickly toward recovery. According to initial findings, 2023 witnessed a 3.2% decline in global smartphone shipments, reaching 1.17 billion units. It is also the lowest full-year volume in a decade, primarily driven by macroeconomic challenges and elevated inventory early in the year,

The latter half of the year brought a surge, solidifying expectations for a robust recovery in 2024. IDC noted that the fourth quarter saw 8.5% year-over-year growth and 326.1 million shipments, higher than the forecast of 7.3% growth. “While we saw some strong growth from low-end Android players like Transsion and Xiaomi in the second half of 2023, stemming from rapid growth in emerging markets, the biggest winner is clearly Apple,” said Nabila Popal, research director with IDC’s Worldwide Tracker team.

“Not only is Apple the only player in the Top 3 to show positive growth annually, but it also bags the number 1 spot annually for the first time. All this despite facing increased regulatory challenges and renewed competition from Huawei in China, its largest market. Apple’s ongoing success and resilience is largely due to the increasing trend of premium devices, which now represent over 20% of the market, fueled by aggressive trade-in offers and interest-free financing plans.”

READ MORE

- Safer Automation: How Sophic and Firmus Succeeded in Malaysia with MDEC’s Support

- Privilege granted, not gained: Intelligent authorization for enhanced infrastructure productivity

- Low-Code produces the Proof-of-Possibilities

- New Wearables Enable Staff to Work Faster and Safer

- Experts weigh in on Oracle’s departure from adland