Samsung smartphone shipments dropped by 16% YoY, four times more than Apple.Source: Shutterstock

Smartphone market slump: Samsung worse off than Apple

|

Getting your Trinity Audio player ready... |

- Samsung smartphone shipments dropped by 16% YoY, four times more than Apple.

- The first half of 2023 saw the most significant shipments drop in years.

- OPPO was the only smartphone vendor among the top five whose shipments increased in H1 2023.

The global smartphone market is currently in a slump – and has been for the past two years. However, the first half of 2023 saw the biggest shipments drop in years, and most smartphone players, including the big players like Samsung and Apple, continued recording dips in their shipments.

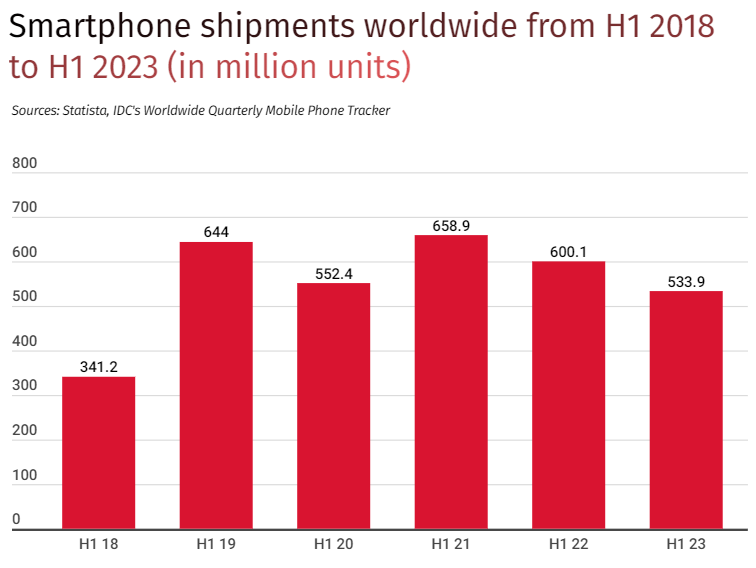

Inflation has crumbled consumer purchasing power and forced consumers and businesses to cut spending budgets over the last two years, leading to global smartphone shipments dropping below 2019. According to data presented by CasinosEnLigne.com, global smartphone shipments fell 11% year-over-year (YoY) to 534 million units in the first half of the year.

IDC’s Worldwide Quarterly Mobile Phone Tracker Separately showed that the global smartphone market saw four straight quarters of shipments decline, resulting in the lowest number of shipments in years. For context, statistics show global smartphone shipments hit 644 million units in the first half of 2019.

After falling to 552.4 million in the first half of 2020, this figure surged to nearly 659 million in the first half of 2021. But it was downhill from there. “After a huge technology refresh of PCs and mobile phones in 2021 due to remote work and education amid the COVID-19 pandemic, the chaotic supply and skyrocketing inflation have cut global smartphone shipments by almost 20%,” IDC noted.

Smartphone shipments worldwide from H1 2018 to H1 2023 (in million units). Source: CasinosEnLigne.com

As for the preliminary figures from Counterpoint Research’s latest Global Smartphone Shipment Forecast, this year’s shipments are predicted to decline by 6% to 1.15 billion units, the lowest in a decade. “There’s been a decoupling between what’s happening in the economy and consumers buying phones. So far this year, it’s been record low upgrades across all carriers,” Counterpoint’s research director for North America, Jeff Fieldhack, said.

Smartphones shipment: Samsung vs. Apple

Sources: Statista, IDC’s Worldwide Quarterly Mobile Phone Tracker

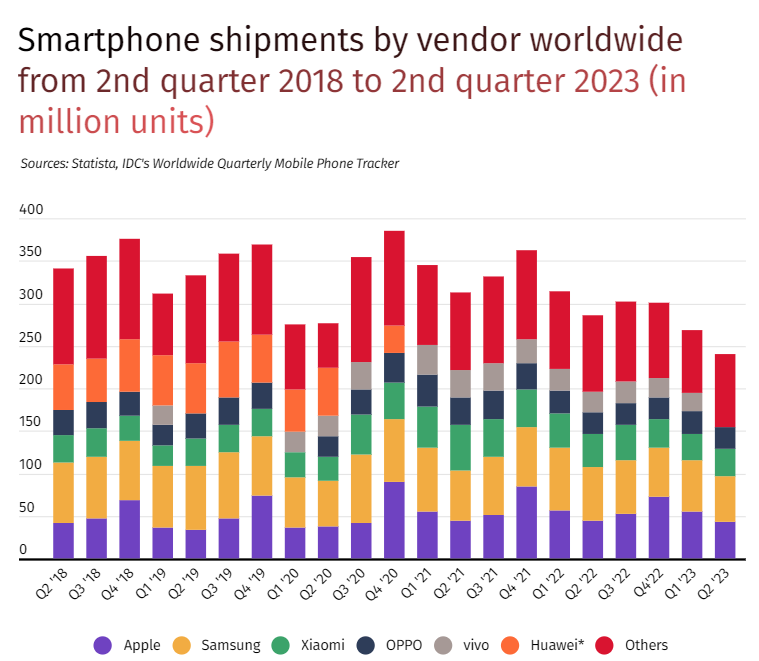

While the falling demand for smartphones has affected all major players in the market, some saw much bigger shipments drop than others. An IDC survey indicated Apple’s smartphone shipments fell by 4% YoY. The tech giant sold 97.7 million iPhones in the first half of 2023, down from 101.1 million in the same period a year ago.

But it’s worse for Apple’s biggest competitor, Samsung, which saw an even more significant drop. The South Korean tech giant, based on data by CasinosEnLigne.com, apparently shipped 114 million smartphones in the year’s first half, a 16% drop from the 136 million reported in the first half of last year.

As a result, experts reckon 2023 could mark the start of a new era for Apple as a resilient premium market, and a strong showing in the US could help it become number one globally in terms of annual shipments for the first time, “It’s the closest Apple’s been to the top spot. We’re talking about a spread that’s a few days’ worth of sales,” Counterpoint’s Fieldhack noted.

Moreover, the fourth quarter of this year would be interesting for Apple because of the iPhone 15 launch – a window for carriers to steal high-value customers. “With that big iPhone 12 installed, the base up for grabs promos will be aggressive, leaving Apple in a good spot. Assuming Apple doesn’t run into production problems like it did last year, it’s a toss-up at this point,” Fieldhack added.

Even in China, Counterpoint noted that Apple is well positioned as the premium segment continues to gain share. Overall, Samsung and Apple continued to dominate the global smartphone market in the first half of this year while leading the premium handset segment.

As for China’s leading technology company, Xiaomi, suffered a 20% shipments drop in this period, falling from 79.4 million to 63.7 million YoY. Statistics show that overallOPPO was the only smartphone vendor among the top five whose shipments increased in the first half of this year.

Between January and June this year, the Chinese consumer electronics manufacturer shipped 52.8 million smartphones, 700,000 more than in the same period last year.

READ MORE

- Safer Automation: How Sophic and Firmus Succeeded in Malaysia with MDEC’s Support

- Privilege granted, not gained: Intelligent authorization for enhanced infrastructure productivity

- Low-Code produces the Proof-of-Possibilities

- New Wearables Enable Staff to Work Faster and Safer

- Experts weigh in on Oracle’s departure from adland