JH Han, CEO of Samsung Electronics speaks at the Samsung press conference on January 8, 2024. (Photo by Frederic J. BROWN/AFP).

Samsung’s leap: Securing 2nm AI chip deal, nipping at TSMC’s Heels

- Insider reveals that Japan’s PFN, partnered with TSMC since 2016, had opted for 2nm AI chips by Samsung instead.

- The deal is a first for Samsung and a big win against TSMC in the advanced chip processing technology race.

- Samsung aims to lure customers with lower prices for its 2nm process, eyeing Qualcomm’s flagship chip orders.

In semiconductor manufacturing, there is a battle raging between Taiwan Semiconductor Manufacturing Company (TSMC) and Samsung Electronics. As the demand for advanced chips skyrockets in the era of AI, 5G, and the Internet of Things (IoT), the competition between these industry giants has intensified, with each vying for dominance in the lucrative chip market.

Not too long ago, in a compelling twist unveiled during Samsung Electronics’ fourth-quarter financial disclosure of 2023, whispers of a meaningful deal echoed through the tech sphere: the company’s foundry division had clinched a coveted contract for 2-nanometer (nm) AI chips. At that point, shrouded in mystery, Samsung kept the identity of this pivotal partner concealed.

Earlier this week, a revelation from Business Korea unveiled the patron: Japanese AI startup Preferred Networks Inc. (PFN). Since its inception in 2014, PFN has emerged as a powerhouse in AI deep learning, drawing substantial investments from industry giants like Toyota, NTT, and FANUC, a leading Japanese robotics firm.

Samsung vs TSMC

Samsung, headquartered in Suwon, South Korea, is set to unleash its cutting-edge 2nm chip processing technology to craft AI accelerators and other advanced AI chips for PFN, as confirmed by industry insiders on February 16, 2024.

Should news of this landmark deal be legitimate, it would prove mutually advantageous. It empowers PFN with access to state-of-the-art chip innovations for a competitive edge while propelling Samsung forward in its fierce foundry market rivalry with TSMC, as per insider reports.

Ironically, PFN has had a longstanding partnership with TSMC dating back to 2016 but is opting to shift gears hereon, going for Samsung’s 2nm node for its upcoming AI chip lineup, according to a knowledgeable insider. PFN also chose Samsung over TSMC due to Samsung’s full-service chip manufacturing capabilities, covering everything from chip design to production and advanced packaging, sources revealed.

Experts also speculate that although TSMC boasts a more extensive clientele for 2nm chips, PFN’s strategic move to Samsung hints at a potential shift in the Korean giant’s favor. This pivotal decision may pave the way for other significant clients to align with Samsung, altering the competitive landscape in the chipmaking realm.

No doubt, in the cutthroat world of contract chipmaking, TSMC reigns supreme, clinching major deals with industry giants like Apple Inc. and Qualcomm Inc. But, as the demand for top-tier chips escalates, the race for technological superiority is heating up, with TSMC and Samsung at the forefront of the battle. While TSMC currently leads the pack, boasting 2nm chips for clients like Apple and Nvidia, Samsung is hot on its heels.

“Apple is set to become TSMC’s inaugural customer for the 2nm process, positioning TSMC at the forefront of competition in the advanced process technology,” TrendForce stated in its report. Meanwhile, according to Samsung’s previous roadmap, its 2nm SF2 process is set to debut in 2025.

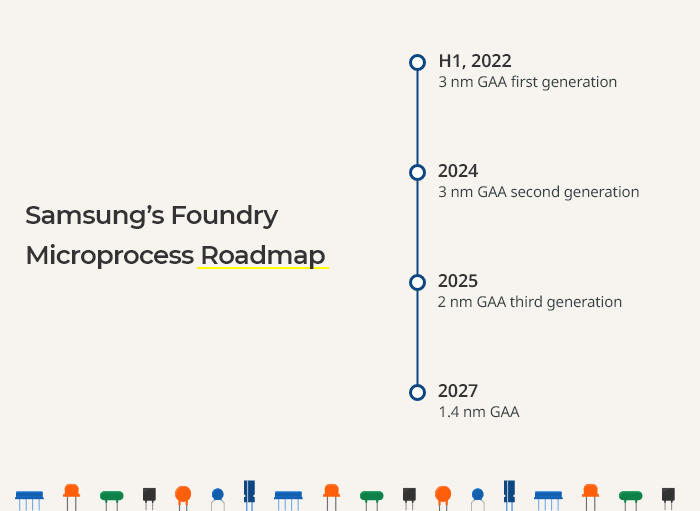

Samsung’s Advanced Node Roadmap Down to 1.4nm in 2027. Graph: The Korean Economic Daily.

“As stated in Samsung’s Foundry Forum (SFF) plan, Samsung will begin mass production of the 2nm process (SF2) in 2025 for mobile applications, expand to high-performance computing (HPC) applications in 2026, and further extend to the automotive sector and the expected 1.4nm process by 2027,” TrendForce noted.

Compared to the second-generation 3GAP process at 3nm, it offers a 25% improvement in power efficiency at the same frequency and complexity and a 12% performance boost at the same power consumption and complexity while reducing chip area by 5%. In short, with TSMC eyeing mass production of 2nm chips by 2025, the competition between these tech titans is set to reach new heights.

Yet, in a strategic maneuver reported by the Financial Times, Samsung is gearing up to entice customers with discounted rates for its 2nm process, a move poised to shake up the semiconductor landscape. With its sights set on Qualcomm’s flagship chip production, Samsung aims to lure clients away from TSMC by offering competitive pricing.

This bold initiative signals Samsung’s determination to carve out a larger market share and challenge TSMC’s dominance in the semiconductor industry.

READ MORE

- Safer Automation: How Sophic and Firmus Succeeded in Malaysia with MDEC’s Support

- Privilege granted, not gained: Intelligent authorization for enhanced infrastructure productivity

- Low-Code produces the Proof-of-Possibilities

- New Wearables Enable Staff to Work Faster and Safer

- Experts weigh in on Oracle’s departure from adland