Alliance Bank Malaysia has introduced the first virtual credit card in the country.

Can virtual credit cards reduce scams and fraud?

One of the biggest problems with credit cards is how they can easily be compromised. Be it data breaches or credit card fraud, the data from credit cards continues to be targeted by cybercriminals. In fact, credit card information stored in databases can be easily used by cybercriminals to launch fraudulent activities.

So how can consumers solve this problem? Whenever a credit or even debit card is compromised, the first thing a consumer would do is call up the issuing bank, cancel the card and request for a replacement. Then comes the annoyance of resetting all financial and payment details to the new credit card details.

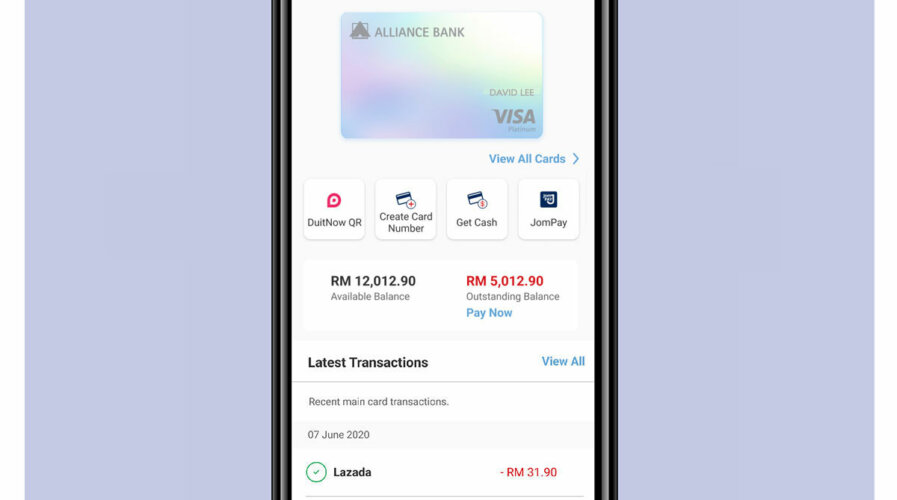

Fortunately, one bank has come up with a way to deal with this hassle. Alliance Bank Malaysia recently launched a virtual credit card that offers enhanced security features for online transactions. The virtual credit card allows users to generate an unlimited number of digital cards for online transactions, including on e-commerce websites and online services that require subscriptions.

The virtual credit card functions the same as a normal credit card. However, what makes it more secure is that it does not have the traditional 16 digit code a normal credit card has. Instead, the digits are generated in real time based on the requirements of a user. For example, if a user wants to spend a certain amount on an e-commerce site, they can set the amount and generate the code which are only valid for half an hour.

For subscription services, an amount can also be preset and a separate set of digits will be created, with the user able to set the number of months they would like the payment to repeat for. Put simply, the virtual credit card will generate 16 digits for each online transaction, making it harder for cybercriminals to use the digits if they were stolen.

Alliance Bank Malaysia introduced a virtual credit card to help deal with scams.

In a demo session with the media, David Lim, Vice President and Head for Credit Card and Personal Loan Products at Alliance Bank Malaysia, also showcased the security features of the virtual credit card, such as its two-factor authentication on the Alliance Bank app. The authentication is also tied to the mobile devices registered.

Lim also pointed out that the bank took about three years to build and test the application before launching it. Working with the bank on the development of the virtual credit card was Red Hat. Red Hat’s technologies have been a trusted partner to support Alliance Bank’s tech stack and new product launches since 2018.

Banks are increasingly embracing open source solutions to enhance agility and flexibility in their systems. This allows them to connect with different APIs and business models, providing the desired functionality in their banking platforms. Red Hat is actively collaborating with various financial institutions, assisting them in their adoption of open source technologies to remain competitive in the FSI market.

Using Red Hat’s open-source tools, Alliance Bank was able to have the agility it needed in developing the app. Specifically, the bank relied on Red Hat OpenShift and Application Foundation such as 3scale, Fuse and AMQ, to develop the virtual card.

“What we’re doing is banking as a service. Everything that we develop is a piece of API. Red Hat is like blocks, whereby we take parts and put them together. We build all the components with Red Hat. After that, we just orchestrate and punch it together,” said Lim.

Red Hat has been partnering with Alliance Bank since 2018.

Technology by Red Hat

Red Hat has been working with banks and other organizations not just in the financial sector but in other industries as well. The open-source giant recently announced several new updates to its technology offerings as well, including the use of generative AI in some of its solutions. This includes an AI-focused portfolio that will be built on Red Hat OpenShift Data Science to make production-ready AI models and applications an achievable reality for modern enterprises.

Apart from that, Red Hat also introduced an expanded set of management capabilities to Red Hat Insights for Red Hat Enterprise Linux. The capabilities are designed to help reduce enterprise Linux complexity across the hybrid cloud without slowing innovation. There is also the general availability of Event-Driven Ansible, a scalable and resilient solution that expands how organizations can activate automation as a reliable strategy across the hybrid cloud. These announcements were made during the Red Hat Summit in Boston few weeks ago.

“Enterprises need to understand where their business is and where they are heading. They need to do a pilot and see the challenges. Usually, technology is not a problem. It’s people and processes. When a company does a pilot, they will learn as a team. Each organization has its own challenges and constraints. Most large enterprises are already halfway in their journey while medium-sized businesses need to engage vendors to get advice on addressing their challenges,” commented Tammy Tan, Country Manager at Red Hat Malaysia.

Tammy Tan, Country Manager at Red Hat Malaysia briefing members of the media.

Are virtual credit cards a game changer?

Virtual credit cards might just be the future of credit cards. Alliance Bank believes they are onto something big and they are definitely right about it. Not only are these cards enhancing security for users, but they can also enable the bank to understand how customers spend their money as well. This data is where the real profit could lie in the future.

In fact, Edwin Lee, Head for Cards and Loans at Alliance Bank Malaysia highlighted that since the bank launched the service, they have witnessed a 25% growth in the number of customers since the introduction of the virtual credit card and believes that the bank could see a 50% growth in the near future.

Interestingly, when asked if banks should just focus on more digital services, Edwin mentioned that an integrated play in the service is still needed.

“In the customer journey, there are times when a customer needs to speak with someone. We can digitize the backend but in the process, customers will have queries, especially for complex products. For example, when it comes to home loans, there is no fully digital process for it. It’s a big purchase and a long commitment. Most users may not feel safe doing that whole process digitally. This is why banks still need humans. But the process of uploading relevant documents upload and such can be digitized,” he explained.

Echoing his views is Ken Yong, Head of Group Transformation Office of Alliance Bank Malaysia. For Yong, Alliance Bank is looking towards an integrated play. He also believes that no customer experience is going to reach a stage whereby the user does not do anything.

“There are many levels of citizens in Malaysia. Bank and tech companies are responsible to deliver secure products and services. We must make sure that if we launch a new product, it is our responsibility to ensure it’s a safe and good product. We don’t want to leave any loopholes for perpetrators. We have to be responsible to users,” added Tan.

READ MORE

- 3 Steps to Successfully Automate Copilot for Microsoft 365 Implementation

- Trustworthy AI – the Promise of Enterprise-Friendly Generative Machine Learning with Dell and NVIDIA

- Strategies for Democratizing GenAI

- The criticality of endpoint management in cybersecurity and operations

- Ethical AI: The renewed importance of safeguarding data and customer privacy in Generative AI applications