Experts suspect Huawei is plotting a return to the 5G smartphone industry by the end of this year.Source: Shutterstock

Huawei planning its comeback in 5G smartphones

- Experts think Huawei is planning a return to the 5G smartphone industry by the end of this year.

- The Chinese telecommunications giant can procure 5G chips domestically with the help of SMIC.

Not too long ago, Huawei was seen as a compelling rival to Apple and Samsung in the global smartphone industry. However, a long-running US trade ban gradually turned things upside down for the Chinese technology giant. The embattled Chinese smartphone maker has gone from threatening Samsung as a number two player to dropping out of the top five in global market share. But the downfall may soon be a thing of the past as Huawei is staging a comeback, this time with 5G smartphones.

Huawei was once the world’s top smartphone seller; in the second quarter of 2020 it overtook Samsung for the first time. It obtained the crown amid a years-long US pressure campaign against Huawei that handicapped the Shenzhen-based firm’s global business. Globally, Huawei shipped 240.6 million smartphones worldwide in 2019, its peak year, according to Canalys.

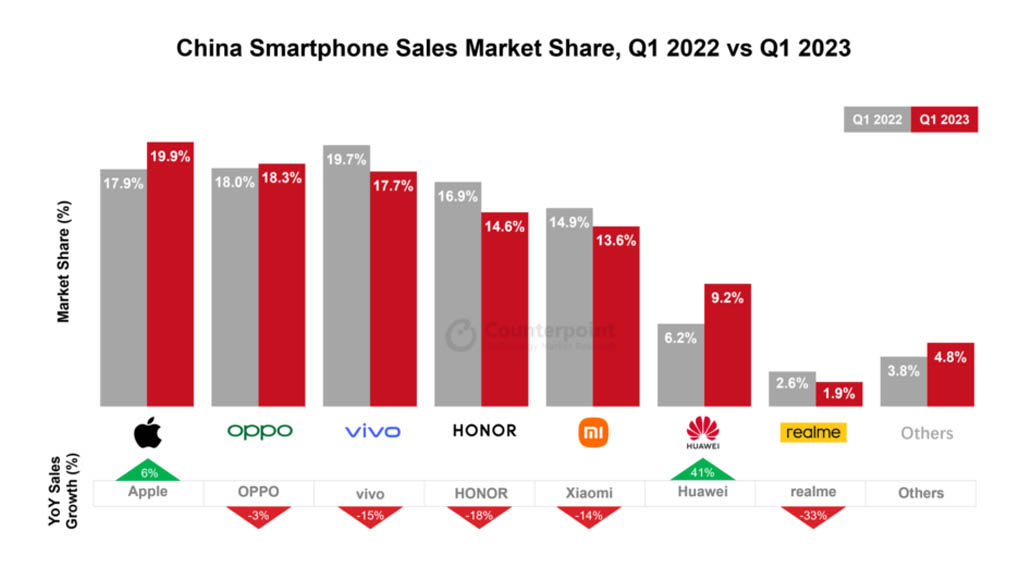

Unfortunately, after topping the global smartphone industry, the Chinese tech giant began its descent as its smartphone business started feeling the brunt of the US sanctions that continued to stifle its growth, cutting off the company’s ability to obtain critical components for its devices. By the first quarter of this year, Huawei stands as only the sixth-largest smartphone brand globally, with a mere 16% market share.

Huawei appear to be grabbing its foot back in the smartphone market share despite lacking 5G in the newest flagship devices. Huawei has even achieved growth in China’s smartphone shipment for the Q1 of 2023. Source: Huawei Central

Of course, Huawei continued to launch devices from smartphones to smartwatches. Still, the company has struggled to sell those devices outside of China as it cannot use Android, a commonly used operating system globally. Huawei eventually launched its operating system, HarmonyOS, installed on 330 million devices at the end of 2022, up 113% year-on-year. That operating system, unfortunately, failed to gain traction outside of China.

Making matters worse, the US has been on an anti-Huawei campaign, urging countries over the past few years to ban the Chinese tech giant from their next-generation 5G networks. Countries like the UK, Canada, Denmark, Sweden, Estonia, Latvia, and Lithuania, have already done so, while a few others are reportedly considering banning some Huawei equipment in its 5G networks.

Alas, stuck selling last-generation 4G handsets, Huawei fell from most rankings worldwide last year, when sales reached a low point. However, it rose to a 10% market share in China in the first quarter, according to consultancy Canalys.

A 5G smartphone by Huawei soon?

According to research firms of late, Huawei is plotting a return to the 5G smartphone industry by the end of this year, and that means a comeback despite a US ban on equipment sales decimating its consumer electronics business.

Three third-party technology research firms covering China’s smartphone sector told Reuters Huawei should be able to procure 5G chips domestically using its advances in semiconductor design tools along with chipmaking from Semiconductor Manufacturing International Co (SMIC), China’s largest chipmaker.

“Returning to the 5G phone market would mark a victory for the company that for almost three years said it was in “survival” mode. Huawei’s consumer business revenue peaked at 483 billion yuan (US$67 billion) in 2020 before plummeting by almost 50% a year later,” Reuters iterated.

Reuters also shared that one of the research firms expects Huawei to use SMIC’s N+1 manufacturing process, “though with a forecast yield rate of usable chips below 50%, 5G shipments would be limited to around two to four million units.” A second firm estimated shipments could reach 10 million units without providing further details.

It is forecasted that Huawei could produce 5G versions of flagship models like the iPhone rival P60 this year, with new launches likely in early 2024. The three research firms said that the predictions were based on information they had received via checks with contacts in Huawei’s supply chain and recent company announcements.

READ MORE

- Safer Automation: How Sophic and Firmus Succeeded in Malaysia with MDEC’s Support

- Privilege granted, not gained: Intelligent authorization for enhanced infrastructure productivity

- Low-Code produces the Proof-of-Possibilities

- New Wearables Enable Staff to Work Faster and Safer

- Experts weigh in on Oracle’s departure from adland