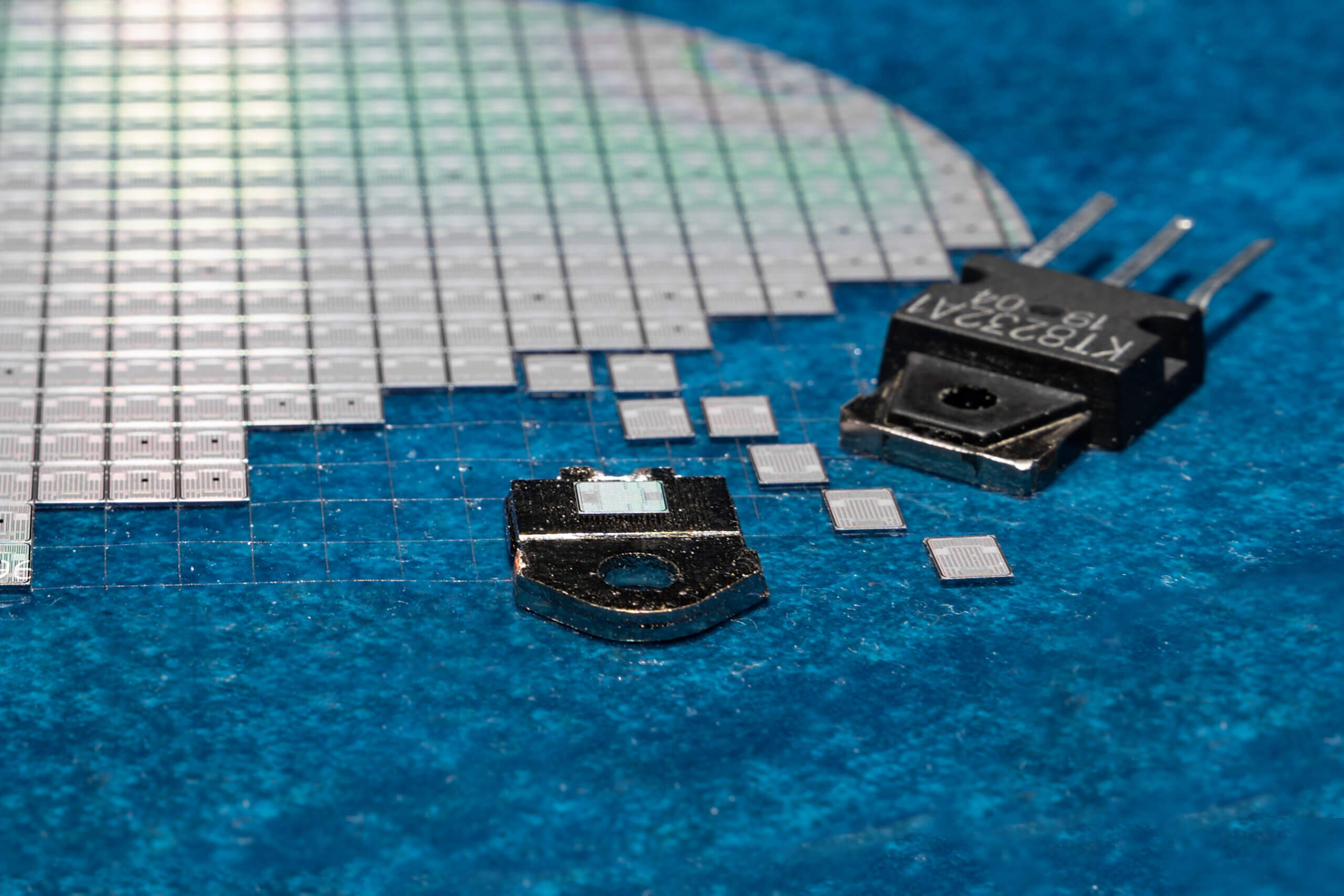

The US-China chip war is about to get thornier/Source: Shutterstock

The US-China chip war is about to get thornier

- First, the US escalated the chip war with new curbs on AI chip exports to China.

- Beijing said it’d impose export controls on two rare elements essential for manufacturing semiconductors.

For as long as the chip war between the United States (US) and China has been going on, the latter has done little to nothing to retaliate. Many viewed Beijing’s nonchalant stand as a way to avoid hurting Chinese ambitions in telecoms, artificial intelligence, and other related industries.

When China moved to impose a ban on American chip maker Micron Technology’s products over a month ago, it was the most significant retaliation from the Eastern powerhouse, and still remarkably measured compared to the long list of export controls and tech sanctions imposed by Washington.

At the same time, when China’s cyberspace regulator announced that Micron poses “serious network security risks,” the latters product was banned from crucial infrastructure projects in the world’s second-largest economy. Because all this while the tech war has been one-sided, the Micron ban shows that Beijing will not stand still.

Beijing knew the pain point exactly – Micron was to lose its 28% share of the Chinese market’s DRAM memory chips – used in all electronics. Micron comes second only to Samsung’s 43% share, which means China is an important market for Micron. In 2022, Micron reported total revenue of $30.7bn (£24.6 billion ), of which US$3.3 billion came from mainland China.

After China announced the Micron ban, the US chipmaker announced its plans to invest over US$600 million in a packing and testing factory located in northern China.

Source: Twitter

It also has manufacturing facilities in the country. In short, China found the right target, and its retaliation is well thought out – not just a shot in the dark.

A tit-for-tat chip war

While it is unusual for China to retaliate, it’s foreseeable that the Biden administration will impose more restrictions against the former, further complicating the ongoing chip war. Not too long after Micron’s ban was announced, the US shared its intention to impose new restrictions on the export of AI chips to China.

The latest layer of restriction is an extension to the export curbs announced in October, including restrictions on selling some AI chips to China. To recall, earlier this year, Nvidia designed less-capable chips. This A800 chip falls under thresholds that require a license from the US Commerce Department before export to China or other countries of concern.

However, Washington’s latest move means expanding the October curbs to include those lower-powered semiconductors. Ultimately, its ulterior motive for Washington is to ramp up efforts to cut China off from critical technologies, especially those that can support its military.

Fast forward to this week, China decided to escalate the technology trade standoff with the US – and responded to the US move to extend its ban on AI chips with semiconductor-related export control. On July 3, the Ministry of Commerce (MOFCOM) and the General Administration of Customs (GAC) announced they would impose new export restrictions on two materials crucial to making semiconductors and other electronic components.

“In order to safeguard national security and interests, with the approval of the State Council, it is decided to implement export controls on items related to gallium and germanium,” a notice reads. According to the notice, starting on August 1, items meeting certain characteristics shall not be exported without approval. The ministries listed eight items related to gallium and six items on germanium.

As with the export moratorium imposed by Washington, the restrictions by the Chinese authorities require exporters to file an application with the local commerce body for exports of the relevant items. The Ministry of Commerce must approve the application before exporting such items, and exporters would face fines and criminal charges if they export such items without permission.

What’s the big deal about gallium and germanium?

In the latest step in a tit-for-tat chip war, China will limit exports of two key metals from August.

Source: Shutterstock

Both key materials in the making of semiconductors and other electronics, germanium is used in fiber optics and chips, while gallium is used in making chipsets for electronic devices such as computer motherboards or portable phones.

Globally, China is the top producer of raw gallium, which is used in making chipsets to generate high-frequency radio waves in 5G base stations, accounting for 95% of the global output, according to industry information provider Fierce Electronics. China is also a significant supplier of germanium, mainly used in fiber and infrared optics, PET plastics, electronics, and solar panels.

The EU has listed the metal as a critical raw material, as it imports about 17% of its supplies from China, according to media reports. China’s move came just days after the Dutch government announced new restrictions on exports of some semiconductor equipment, drawing an angry response from Beijing, according to Reuters.

The new Dutch rules mean that ASML, Europe’s largest chip firm, must apply for export licenses for products used to make microchips. Japan has taken steps to limit Chinese companies access to chips and chip-making equipment. Last month, Italy imposed several curbs on Pirelli’s biggest shareholder, Sinochem, to block the Chinese government’s access to sensitive chip technology.

A prominent state-owned newspaper China Daily has hinted that Beijing’s new policy on raw materials was simply retaliation for similar moves by Washington and its allies. Interestingly, China’s announcement of the new export curbs comes just days before a planned visit by US Treasury Secretary Janet Yellen to Beijing from July 6 to July 9.

READ MORE

- Strategies for Democratizing GenAI

- The criticality of endpoint management in cybersecurity and operations

- Ethical AI: The renewed importance of safeguarding data and customer privacy in Generative AI applications

- How Japan balances AI-driven opportunities with cybersecurity needs

- Deploying SASE: Benchmarking your approach