Where does ASML actually stand in the US-China chip feud?Source: ASML

Where does ASML actually stand in the US-China chip feud?

- ASML CEO Wennink said China accounted for around 15% of sales in 2022 and will be at a “similar” amount this year, despite US chip export restrictions.

- The Netherlands and Japan, home to key suppliers of semiconductor manufacturing equipment, are apparently close to joining a Biden administration-led effort to curb exports of the technology to China.

“To be, or not to be”, — the question among Taiwan, South Korea and Japan, the supposed members of the proposed ‘Chip 4 Alliance’ by the US. To join the US in the alliance would mean severing ties with China to an extent, especially within the semiconductor supply chain. After all, the alliance was proposed as part of the US’ wider plans aimed at reducing the world’s reliance on chips made in China.

Interestingly, besides the four Asian semiconductor powerhouses, the US has also tried to bring the Netherlands into the equation, not to join the alliance per se, but to support the recently-announced export restrictions by the Biden administration against China. The US issued sweeping new rules in October last year that include restrictions on the supply of US manufacturers’ most advanced chip making equipment to Chinese customers.

The new rules also limit Americans working for Chinese semiconductor firms, a move aimed at choking access to certain expertise. Unfortunately, as experts have stated, the export restrictions won’t have much effect if the US is alone with them. That’s why, a few weeks after announcing it, the Biden administration started persuading allies to join its campaign.

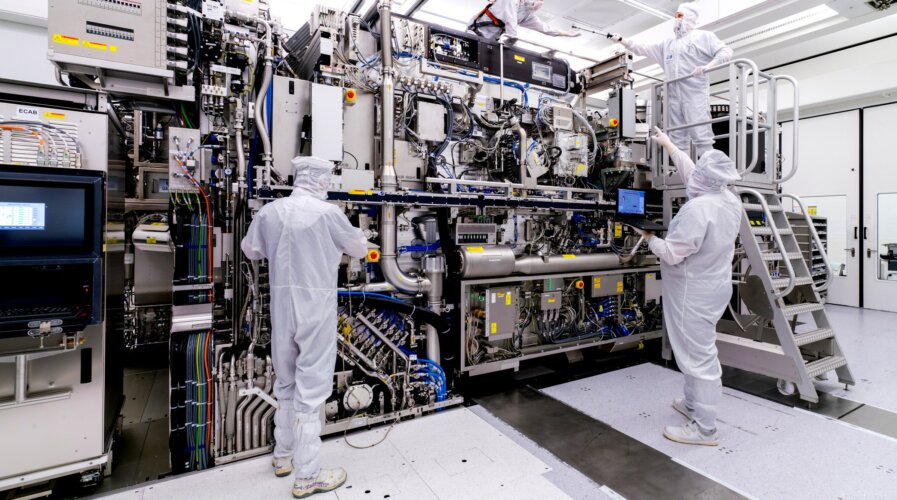

The Netherlands, along with Japan, are home to key suppliers of semiconductor manufacturing equipment. While the US is home to the biggest group of chip gear makers, the Netherlands boasts ASML Holding NV, which controls the market for lithography technology that’s one of the most important steps in producing the electronic components.

On the other hand, Japan’s Tokyo Electron Ltd. is a major rival to US companies in other types of machinery. Without access to their state-of-the-art products and those supplied by US firms Applied Materials Inc, Lam Research Corp. and KLA Corp, Chinese companies would find it almost impossible to build production lines capable of the most advanced chip manufacturing, analysts say.

In with the US but not entirely against China?

Following the announcement of the export control, the most impacting restrictions announced against China by the US, Dutch Foreign Trade Minister Liesje Schreinemacher came forward to say that the US shouldn’t expect the Netherlands to unquestioningly adopt its approach to China export restrictions, signaling a potential obstacle to the Biden administration’s trade fight.

“The Netherlands will not copy the American measures one-to-one,” the minister said in an interview with newspaper NRC. “We make our own assessment — and we do this in consultation with partner countries such as Japan and the US.”

The comments, made in November 2022, marked the first time Dutch officials have publicly outlined their stance on the issue since the Biden administration started pushing for a multilateral agreement to impose restrictions on China. This month, a report by Bloomberg stated that both the Netherlands and Japan are close to joining the Biden administration-led export restrictions against China.

“The Hague and Tokyo likely won’t go as far as Washington’s restrictions, which not only limit exports of American-made machinery but also impede US citizens from working with Chinese chip makers. Even so, Beijing may find itself even more cut off from […] the technology or know-how it needs to build the most advanced kinds of semiconductors once all three countries act,” the report noted.

The Netherlands agreeing to abide by the sanctions, is a matter of grave concern for China, as the former is home to ASML Holdings, the only semiconductor company which makes the lithography machinery that is used to make the latest generation of semiconductors. While there are minimal reactions from China so far, ASML on the other hand have come forward to share their stance.

ASML: Restrictions will “push” China for the better

In an interview with Bloomberg News at the company’s headquarters in Veldhoven, Netherlands, ASML Holding CEO Peter Wennink said he believes that the US-led export control measures against China could eventually push Beijing to successfully develop its own technology in advanced chip making machines.

Semiconductor companies in China “have to compete” against global rivals, so they buy non-Chinese machines, Wennink said. “If they cannot get those machines, they will develop them themselves. That will take time, but ultimately they will get there.” Like America, if put under enough pressure China will increase its chip manugacturing efforts.

Ultimately, Wennink said that the situation is for governments to resolve. “It’s not just between the Dutch and Americans, it involves other European countries, it involves Asian countries, so it’s a complex situation,” Wennink added. “It is up to [governments]. I just have to follow what comes out.” He also shared that China accounted for around 15% of ASML’s sales in 2022 and expects a “similar” amount this year.

READ MORE

- 3 Steps to Successfully Automate Copilot for Microsoft 365 Implementation

- Trustworthy AI – the Promise of Enterprise-Friendly Generative Machine Learning with Dell and NVIDIA

- Strategies for Democratizing GenAI

- The criticality of endpoint management in cybersecurity and operations

- Ethical AI: The renewed importance of safeguarding data and customer privacy in Generative AI applications