Indonesia plans to ban selling goods on social media under new trade regulations. Source: Shutterstock

The clock is ticking for TikTok in Indonesia. Here’s why

- Indonesia plans to ban selling goods on social media under new trade regulations.

- The ruling will impede TikTok Shop, which sees Indonesia as its first and biggest market.

- Local ministers see predatory pricing on social media platforms as threatening offline markets in Southeast Asia’s biggest economy.

Indonesia will soon be a pioneer in Southeast Asia in taking a stand against TikTok. The local authorities are expected to issue a regulation on the use of social media to sell goods in the country as soon as this week. The stance could deal a blow to TikTok, which has Indonesia as its biggest e-commerce market.

“Social media and social commerce cannot be combined,” the country’s Deputy Trade Minister Jerry Sambuaga said earlier this month, vowing to ban the mix. For Indonesia, banning the selling of goods on social media under new trade regulations is intended to quell threats to offline markets in Southeast Asia’s biggest economy.

Sambuaga specifically cited TikTok’s “live” features that allow people to sell goods. He and other local ministers have been highlighting their concerns over TikTok Shop playing a role in the downslide of local MSMEs and traditional markets. Even the country’s President, Joko Widodo, has been voicing his concerns over e-commerce sellers using predatory pricing on social media platforms, threatening offline markets in Indonesia.

“TikTok is supposed to be a social media, not an ‘economic media,'” he said during a trip to East Kalimantan last week. Current trade regulations in Indonesia do not specifically cover direct transactions on social media. “Revisions to the trade regulations that are currently underway will firmly and explicitly ban this,” Sambuaga told parliament earlier this month.

On Monday, Trade Minister Zulkifli Hasan said the move, directed at ByteDance Ltd.’s TikTok, would mean companies can only advertise products but not conduct direct transactions. For context, Indonesia is home to 64.2 million micro, small, and medium enterprises that contribute to 61% of its gross domestic product.

Therefore, the policy seeks to keep those millions of MSMEs from being squeezed out by social commerce companies. In Indonesia to date, TikTok is the only social media company that allows direct e-commerce transactions on its platform. “India and the US dared to reject and ban TikTok from simultaneously running social media and e-commerce businesses. Meanwhile, in Indonesia, TikTok can do both,” Teten Masduki, Indonesia’s minister of cooperatives and SMEs, said in a statement.

Masduki also argued that TikTok could potentially monopolize the market because online shoppers are ‘influenced by conversations on social media.’ During a government meeting earlier this month, he shared concerns about TikTok Shop’s control over payment and logistics systems.

There have also been reports indicating that the Indonesian government is also considering a ban on selling imported goods priced below US$100 through cross-border services on e-commerce platforms and barring marketplaces from acting as manufacturers.

What will the ban mean for TikTok in Indonesia?

It’s been TikTok’s ambition over the last two years to boost its vast audience into a money-making shopping arm, TikTok Shop. Unfortunately, the endeavor has faced obstacles in the US due to fears of a nationwide ban. TikTok also faced setbacks in the UK last year due to unmet goals and managerial issues. But TikTok Shop has rapidly gained ground in Indonesia, the company’s second-largest market after the US.

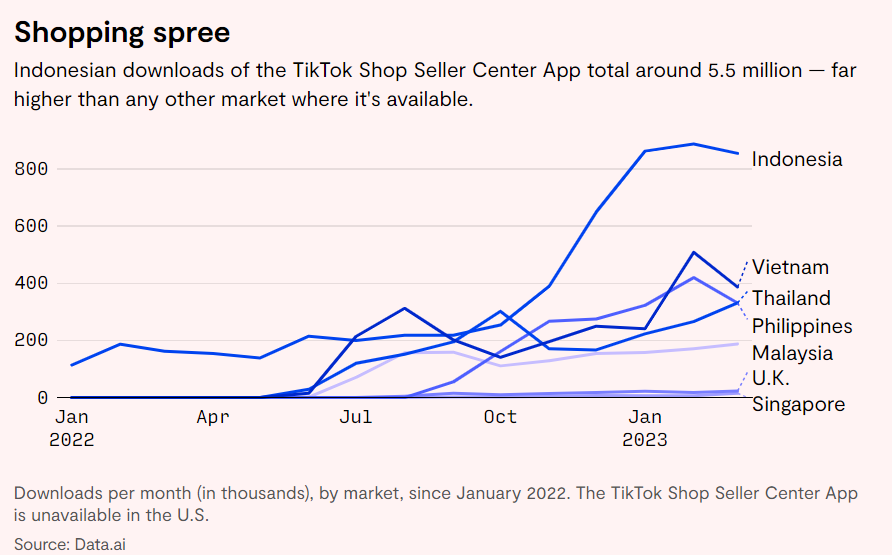

Indonesian downloads of the TikTok Shop Seller Center App

So much so that TikTok is betting on Indonesia as a blueprint to expand into other online shopping markets, including the US. It all started in April 2021, when TikTok Shop fully launched in Indonesia, one of the first countries to pilot the feature outside China. Today, the country is home to an estimated 125 million users, according to TikTok, including two million small businesses on TikTok Shop.

By the end of 2022, TikTok Shop had become the fifth-largest e-commerce platform in Indonesia, according to data from Singapore-based venture outfit Momentum Works. Despite its operations, TikTok has yet to receive an Indonesian payment license and relies on third-party payment service providers within the country. A license would enable TikTok to earn from transaction fees and compete more effectively with other payment services entities.

But amidst the rave over TikTok Shop in Indonesia, thousands of brick-and-mortar merchants, according to The Jakarta Post, complain about the impact of the app’s booming e-commerce arm on their business. They have urged the government to close or at least regulate TikTok Shop. TikTok has criticized calls for a ban, saying it would harm Indonesian merchants and consumers.

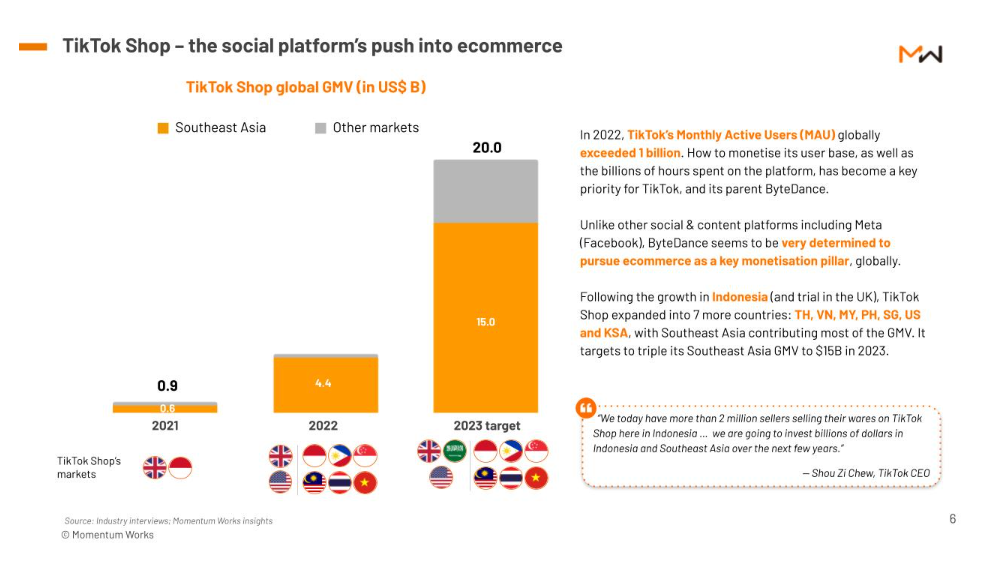

“Close to two million local businesses in Indonesia use TikTok to grow and thrive through social commerce,” Anggini Setiawan, TikTok Indonesia’s head of communications, told AFP earlier this month. According to Momentum Works, the country represented 42% of TikTok’s US$4.4 billion regional gross merchandise value (GMV) last year.

After hitting US$4.4 billion GMV in Southeast Asia in 2022, TikTok Shop aims to triple that this year, as part of its overall US$20 billion target. Source: Momentum Works

In short, managing the conflict with Indonesia will be crucial for TikTok as governments worldwide observe how the largest nation in Southeast Asia responds to the growing e-commerce influence of the social media giant. Moreover, TikTok has only recently announced plans to invest billions of dollars into the Southeast Asian region.

So far, TikTok has shown no sign of bowing down. The social platform giant has pushed back against the proposed policy. It argues that separating social media and e-commerce into different platforms hampers innovation and disadvantages millions of Indonesian merchants and consumers. The company says some rely on its platform to make a living.

“Social commerce was born to solve a real-world problem for local traditional small sellers by matching them with local creators who can help drive traffic to their online shops,” a TikTok Indonesia spokesperson said in a statement, according to Bloomberg. “While we respect local laws and regulations, we hope that the regulations take into account its impact on the livelihoods of more than six million sellers and close to seven million affiliate creators who use TikTok Shop.”

Jakarta, Indonesia – July 2nd, 2023: Hajj souvenirs vendor doing live selling on Tiktok. Live sale online. Source: Shutterstock

Overall, experts reckon if the ban comes through, will deal a massive blow to the social media giant. Bloomberg Intelligence’s analyst, Nathan Naidu, believes TikTok’s possible split of e-commerce and social media operations in Indonesia could impede further conversion of its 125 million local monthly active users (MAU) into shoppers, benefiting Sea’s Shopee, which, like TikTok Shop, relies on beauty and personal care for most of its domestic sales.

“GoTo’s Tokopedia, which had 34 million MAU in August vs. Shopee’s 138 million and Alibaba-owned Lazada’s 37 million, should be better able to defend its GMV share in Indonesia, which drove 90% of the group’s 2022 sales,” Naidu added. Meanwhile, Jianggan Li, CEO of Momentum Works, noted in an e-mail that Shopee has been voicing its support for Indonesian MSME exports yearly.

“Banning TikTok Shop could be operationally very messy (and many of our friends say impractical). There are many different permutations of how things can evolve (e.g., a separate e-commerce app or specific programs for MSMEs). Regardless of how the ban proceeds, TikTok’s vast consumer traffic will continue to be harvested for e-commerce, through TikTok Shop or other means, by TikTok or by other parties,” he noted

Li also believes it is not too late for TikTok “to engage and turn the tide.” He reckons TikTok needs to be bold and local.

READ MORE

- Safer Automation: How Sophic and Firmus Succeeded in Malaysia with MDEC’s Support

- Privilege granted, not gained: Intelligent authorization for enhanced infrastructure productivity

- Low-Code produces the Proof-of-Possibilities

- New Wearables Enable Staff to Work Faster and Safer

- Experts weigh in on Oracle’s departure from adland