GenAI has pushed the semiconductor industry to its first revenue increase after five straight quarters of declining revenue. Source: Shutterstock

The genAI explosion is driving the chip industry up

- GenAI has pushed the semiconductor industry to its first revenue increase after five straight quarters of declining revenue.

- The data processing segment, driven by AI chips in the server space, grew 15% QoQ, making up nearly one-third of semiconductor revenue in 2Q23.

- Nvidia, a giant in AI chips, led the semiconductor turnaround in 2Q23.

It has been quite a ride for the semiconductor industry since 2020 – but it seems like there is more in store for the market, especially with the growing interest and appetite in generative AI (genAI). The race for faster, more efficient chips has disrupted the industry and pushed the market higher, even as players struggle with shortages and supply gluts.

According to the latest data from Omdia’s Competitive Landscape Tracker, the semiconductor industry recorded its first revenue increase in the second quarter of 2023 after five straight quarters of decline. This growth is mainly attributed to the explosion in the AI segment, led by genAI.

“The data processing segment, driven by AI chips into the server space, grew 15% quarter-over-quarter (QoQ) and makes up nearly one-third of semiconductor revenue (31% in 2Q23),” Omdia noted. The research firm noted quarterly revenue grew 3.8% to US$124.3 billion in the same period.

Total semiconductor revenue: Source: Omdia

However, it should also be noted that the growth is in line with historical patterns for the total semiconductor market, with the second quarter revenue usually increasing by 3.4% from the first quarter (based on Omdia’s data from 2002 through 2022). “Growth within semiconductor segments continues to diverge from historical trends. For example, the DRAM market was up 15% in 2Q23 with the historical pattern of 7.5% in the second quarter,” it added.

Omdia’s report signals welcome growth for the semiconductor industry after the most prolonged period of decline since the firm began tracking the market in 2002. On the upside, the market contraction has led to a current market size that is 79% of what it was one year ago, with a total revenue of US$160 billion in 2Q22.

“It will take time to return to the revenue levels of late 2021,” Omdia stated. Considering genAI has pushed the semiconductor market to grow, the company that led the turnaround was Nvidia, which sells 70% of the world’s AI chips. Since wide semiconductor revenue grew US$4.6 billion from the previous quarter, US$2.5 billion of that increased quarterly revenue came from Nvidia alone.

“The rapid, recent growth in demand for generative AI, a market that Nvidia dominates, is pushing Nvidia up the market share rankings,” Omdia reiterated. Nvidia has led the turnaround, increasing semiconductor revenue by 47.5% from the previous quarter. Just one year ago, Nvidia was the ninth-largest semiconductor company by revenue, and by the end of the second quarter of this year, the company’s ranking was third.

Movement of current top five semiconductor companies. Source: Omdia

“While Nvidia was the biggest influence on the growing market, most major firms also contributed. Of the top ten firms, eight increased semiconductor revenue in 2Q23, illustrating that the turnaround is not limited to one sector of the overall market,” Omdia stated.

The wireless segment (dominated by smartphones) is the second largest sector but declined by 3% QoQ as end demand continues to be weak. On the other hand, the automotive semiconductor sector continues to grow, up 3.2%.

The boom in genAI demand is causing supply constraints

During the recent SEMICON Taiwan industry fair, Taiwan Semiconductor Manufacturing Co. (TSMC) chairman Mark Liu shared how the ongoing supply constraints on AI chips are due not to a lack of physical chips but limited capacity in advanced chip packaging services, a critical step in the manufacturing process.

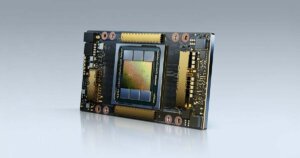

Liu estimates that it will take about 18 months to ease the constraints. The world’s largest contract chipmaker believes the squeeze on AI chip supplies is “temporary” and could be alleviated by the end of 2024. For context, TSMC is the sole manufacturer of Nvidia’s powerful H100 and A100 AI processors, the hardware that powers AI tools like ChatGPT and is also used in most AI data centers.

NVIDIA A100 Tensor Core GPU. Source: Nvidia

“It’s not the shortage of AI chips. It’s the shortage of our COWOS [advanced chip packaging] capacity,” Liu said on the SEMICON Taiwan industry fair’s sidelines, as Nikkei Asia reported. Demand for COWOS picked up “suddenly,” he said, tripling in a year. He was frank in noting that TSMC can’t fulfill 100% of its customers’ needs but instead tries to support about 80%. “We think this is a temporary phenomenon. After we expand [advanced chip packaging capacity], it should be alleviated in one and a half years.”

According to Nikkei, COWOS is an advanced chip packaging technique developed by TSMC to connect different types of chips together. The process combines a graphic processor unit (GPU) with six high-bandwidth memory chips to enable high-speed data transmission and the overall performance needed to train large language models for use in AI. Both Nvidia’s A100 and H100 series are made with TSMC’s COWOS process.

Basically, Liu’s comments on the bottleneck in AI chip output underscore the importance of advanced chip packaging and stacking technologies in the race to produce more powerful and efficient semiconductors. He said the semiconductor industry should embrace a “paradigm shift” of new ways to connect, package, and stack chips to meet the surging demand for AI products.

Today’s premium AI accelerators have about 100 billion transistors, and TSMC forecasts that there will be chips with more than one trillion transistors within the next ten years. In short, the demand for higher computing power will continue to grow.

READ MORE

- Safer Automation: How Sophic and Firmus Succeeded in Malaysia with MDEC’s Support

- Privilege granted, not gained: Intelligent authorization for enhanced infrastructure productivity

- Low-Code produces the Proof-of-Possibilities

- New Wearables Enable Staff to Work Faster and Safer

- Experts weigh in on Oracle’s departure from adland