Malaysia’s digital economy is still capable of hitting up to US$70 billion by 2030

Can Malaysia achieve its digital economy ambitions by 2030?

- The e-Conomy SEA report predicts Malaysia will have positive growth by 2030.

- Domestic demand will drive economic growth in Malaysia with household spending, employment and wages on the rise.

- Adoption of digital financial services continues to grow, with digital payments the sector’s biggest value driver.

The digital economy in Southeast Asia is not just the fastest growing in the world, but is also one of the most diverse. Despite challenges in the global economy, the region continues to see positive growth in its digital economy, especially within emerging markets like Indonesia, Vietnam and Thailand.

According to the 8th edition of the e-Conomy SEA report by Google, Temasek and Bain & Company, despite global macroeconomic headwinds, the region’s gross merchandise value (GMV) continues on an upward trajectory and is set to reach US$218 billion, growing 11% year-on-year (YoY). The report also reveals that SEA’s revenue from the digital economy is poised to hit $100 billion this year, growing 1.7x as fast as the region’s GMV.

Taking a deeper look into the different economies in the region, each country is expected to increase its growth and revenue in the digital economy. Digital businesses in particular have successfully monetized the digital economy by moving from user acquisition to deepening engagement with existing customers.

In fact, monetization seems to be the core concern of investors in the region. According to Samuele Saini, country director at Google Malaysia, businesses and investors have increased their focus on monetization when it comes to the digital economy. Specifically, there is a focus now on realistic entry valuations for investing, which includes a clear path to profitability, a proven monetization model, and variable exit pathways.

Cash is no longer king in Southeast Asia.

This has resulted in a drop in funding across the board, including in previously popular sectors like e-commerce and digital financial services. It is important to note that this scenario is not unique to Malaysia, as other countries in the report also experience a similar scenario.

However, Saini highlighted that Malaysia’s digital economy is still capable of hitting up to US$70 billion by 2030.

“There is tremendous headroom for growth in SEA. The digital economy is expected to grow ahead of GDP across all markets in SEA. For Malaysia, there is a 14% growth in the digital economy, and this does not include digital financial services. Seven years ahead is a long time, but there have been lots of developments in e-commerce and with opportunities in new sectors like health tech, edtech and digital lending services,” said Saini.

According to Samuele Saini, country director at Google Malaysia, businesses and investors have increased their focus on monetization when it comes to the digital economy.

A deeper look into the Malaysian digital economy

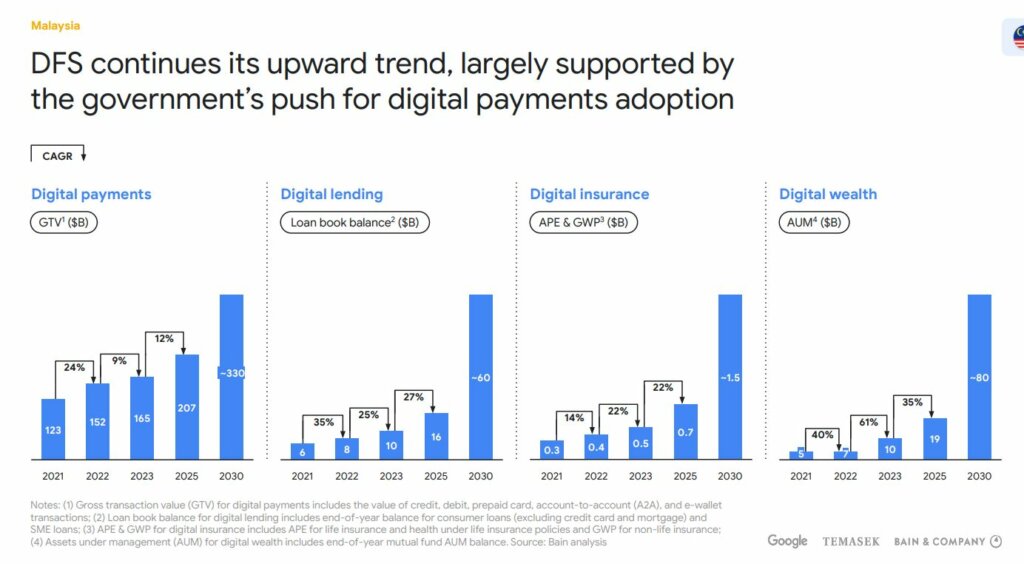

Taking a deeper look into digital financial services, Malaysia continues to see an upward trend, especially with the government’s push for digital payments adoption. Malaysia is already known for having the highest number of e-wallet providers in the region and has also seen increased adoption of digital payments using e-wallets and similar services.

The country will also be witnessing the debut of digital banks, which is expected to boost the financial ecosystem in the region. Given the increase in digital lending and digital payments, it’s no surprise that Malaysia is the second biggest digital payment market in SEA in 2023, with a gross transaction value (GTV) of US$165 billion in 2023.

As the competition between digital financial service players intensifies, pure-play fintech companies have extended their lending services to the underbanked segment, while established financial services institutions have been quick to move their large existing customer bases to digitalized services.

Malaysia is the seconnd biggest digital payment market in SEA in 2023

Despite this, the biggest contributor to the digital economy in Malaysia is actually the travel economy. Online travel is the main driver for Malaysia’s digital economy in 2023, reaching US$4 billion. The sector recorded the fastest growth across the digital economy sectors – 49% YoY. Outbound travel demand remains elevated, providing support for continued recovery and near-term growth in the digital travel industry.

On digital inclusion, the country has improved services to rural areas to bridge connectivity gaps. The percentage of households with internet access saw an increase from 76% to 97% for urban and 49% to 89% for rural, within the time frame of 2015-2022. However, consumers outside of metro areas are at risk of facing a widening digital economic divide when it comes to digital participation – active involvement in the digital economy through the consumption of products or services across sectors.

“It is remarkable that both Southeast Asia’s digital economy GMV and revenue continued their double-digit growth momentum, with revenue breaking the $100B mark in 2023. This shows the resilience of the Southeast Asian digital economy, and that the key players are making progress towards more healthy unit economics and sustainable business models,” commented Willy Chang, of Bain & Company.

READ MORE

- Safer Automation: How Sophic and Firmus Succeeded in Malaysia with MDEC’s Support

- Privilege granted, not gained: Intelligent authorization for enhanced infrastructure productivity

- Low-Code produces the Proof-of-Possibilities

- New Wearables Enable Staff to Work Faster and Safer

- Experts weigh in on Oracle’s departure from adland