GXBank, led by Grab, has launched the beta version of its digital banking app for an exclusive group of 20,000 Malaysians since last week. Photo: Shutterstock

GXBank: Everything you need to know about Malaysia’s first digital bank

- GXBank, led by Grab, has launched the beta version of its digital banking app for an exclusive group of 20,000 Malaysians since last week.

- GXBank presently provides a 3.00% annual interest rate credited to your account daily.

- GXBank’s primary constraint currently lies in its exclusive focus on savings accounts.

On April 29, 2022, Bank Negara Malaysia (BNM) unveiled the five successful applicants for the country’s digital bank licenses. Successful candidates have been undergoing operational readiness, subject to BNM’s audit validation before starting operations. The process is expected to last 12 to 24 months since the April 2022 announcement. Last week, GXBank finally launched its beta digital banking app for an exclusive group of 20,000 Malaysians, marking the official debut of Malaysia’s inaugural digital bank.

In other words, GXBank was the first to receive approval to commence digital banking operations ahead of BNM’s April 2024 deadline. This follows a successful internal testing phase conducted among GXBank’s employees and partners. GXBank is a subsidiary of GXS Bank, a digital bank joint venture in Singapore involving Grab, SingTel, and investors like Malaysia’s Kuok Group.

Source: GXBank

Only limited to savings accounts – for now

GXBank’s primary constraint currently lies in its exclusive focus on savings accounts. It lacks options for DuitNow QR spending and does not offer debit Mastercard or Visa cards for online and offline transactions. Simply put, during the beta-testing phase, users can only create a GXBank Savings Account and up to 10 “Pockets.”

What are ‘Pockets’?

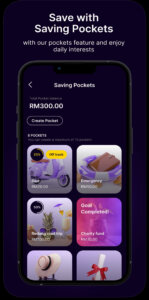

‘Pockets’ in GXBank.

“Pockets” serve as dedicated savings goals to foster a savings mindset for specific goals. Users can allocate funds towards various purposes, such as retirement, upcoming holidays, or a new home. Funds stored in “Pockets” accrue daily interest of up to 3% p.a., allowing users to track their savings progress and receive periodic tips to expedite their savings goals.

However, GXBank CEO Pei Si Lai shared that this is just the beginning of a whole suite of financial services, products, and benefits. “As we continue to test the stability of our app and gather user feedback, we hope to develop a digital banking experience and app uniquely tailored to the financial needs of Malaysians of all generations.”

How ‘seamless’ is the eKYC process?

For starters, one can access the app on both the Apple App Store and Google Play Store and register to join the waiting list. Any interested individual must provide their name and email upon the app download. Should they be among the 20,000 chosen Malaysians, they would be notified to explore the app.

While one might assume GXBank, as a digital bank, aims to serve the underbanked or unbanked communities with limited physical bank access, it’s essential to note that any interested parties must possess an existing account with a local bank to use GXBank. A minimum deposit of RM10 is mandatory and must originate from a bank account registered under the user’s name. This makes it only an option for individuals with a pre-existing bank account.

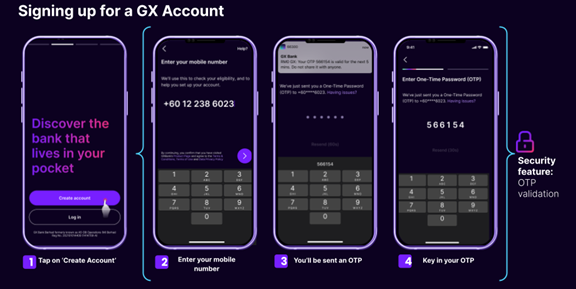

Registration process of GXBank.

Once the app is accessible, standard procedures include undergoing an electronic Know Your Customer (eKYC) verification using a local identification card and a one-time password (OTP). Additionally, users are prompted to configure security features, including facial recognition through biometrics. Existing Grab users can access GXBank directly within the former’s app.

- Download the app from the Google Play Store or Apple App Store

- Upload a digital copy of the national identity card (MyKad)

- Complete the eKYC process as stated in the app

- Add a minimum of RM10 into the savings account and set up Pockets (if so desired)

GXBank selling points

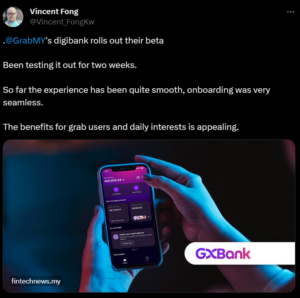

Source: X.com

Users can lock and secure their accounts in response to fraudulent or unauthorized transactions. They can even establish daily spending limits to adhere to their budget, facilitating enhanced financial management. Other notable advantages include a cashback reward of RM20, attained with a minimum deposit of RM100, and a complimentary GrabUnlimited subscription lasting up to six months.

All deposits are also assured with the protection of up to RM250,000 per depositor by Perbadanan Insurans Deposit Malaysia (PDIM). Additionally, GXBank said they will soon waive the RM1 processing fee for cash withdrawals at MEPS automated teller machines (ATMs) nationwide. The digital bank will also allow unlimited cashback every time they spend with GXBank’s debit card.

Once it is officially launched, Lai said that the GXBank app will be updated to support other languages, namely Bahasa Malaysia and Mandarin. “As a bank built predominantly by Malaysians, we are uniquely positioned to understand and develop financial solutions that address the needs and challenges of the everyday Malaysian. We are one step closer to our nation’s vision of a financially resilient country where Malaysians can have equitable access to financial products that cater to their individual needs, without the intimation and hassle of elaborate paperwork, processes, and jargon,” Lai concluded.

READ MORE

- Safer Automation: How Sophic and Firmus Succeeded in Malaysia with MDEC’s Support

- Privilege granted, not gained: Intelligent authorization for enhanced infrastructure productivity

- Low-Code produces the Proof-of-Possibilities

- New Wearables Enable Staff to Work Faster and Safer

- Experts weigh in on Oracle’s departure from adland