Singapore’s Sea Group launches MariBank. Does this signal an invite-only digital bank trend?Source: MariBank’s website

Singapore’s Sea Group launches MariBank. Does this signal an invite-only digital bank trend?

- The parent company of Shopee and Garena has opened its digital bank, MariBank, to the public on an invite-only basis.

- Singapore’s Grab-Singtel launched its digital bank called GXS Bank last August on an invite-only basis.

- The restricted phase is apparently due to the MAS policy, which aims to minimize the impact of initial operational issues and allows banks to fine-tune their business before catering to the broader public.

Last week, Singapore tech giant Sea Group, the parent company of Shopee and Garena, finally unveiled its digital bank, MariBank. Singapore’s second digital bank has existed since the third quarter of 2022 but is limited to Sea group employees. However, MariBank was tacitly opened to the public in the past week but on an invite-only basis.

The move by Sea is not uncommon. It replicates that of Grab and Singtel’s GXS Bank, which was Singapore’s first digital bank. GXS Bank was launched last August on an invite-only basis too. “We are rolling out our services progressively on an invite-only basis,” MariBank said on its new website launched on March 14, 2023.

MariBank and GXS’s restricted phase reflects the Monetary Authority of Singapore (MAS)’s policy, which aims to minimize the impact of initial operational issues and allows banks to fine-tune their business before catering to the broader public.

Singapore’s other digital banks — Ant Group’s ANEXT and Green Link Digital Bank — are wholesale banks that can serve micro, small, and medium-sized enterprises and non-retail clients. Trust Bank is another digital bank that also operates online only but holds a full bank license, allowing it to function in a similar way to traditional lenders.

What do we know about MariBank?

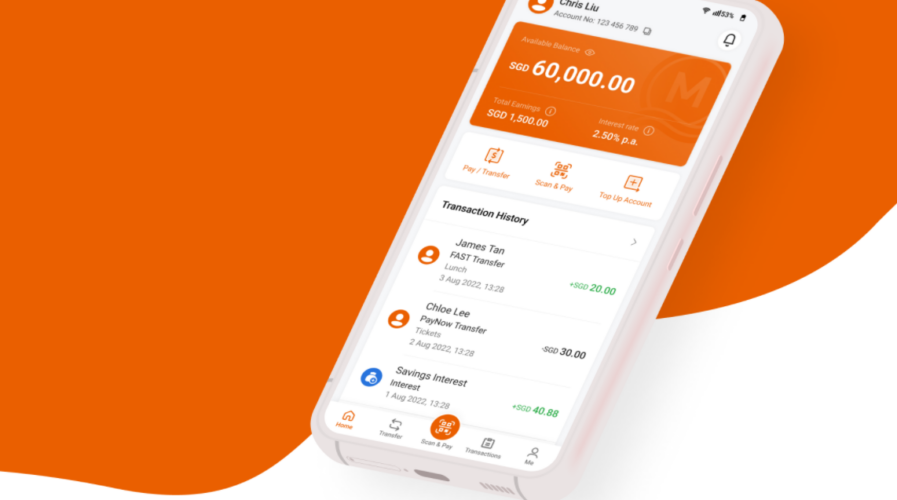

Based on the bank’s website, it only offers a savings account that earns depositors an annual interest rate of 2.5%. To have an account, no minimum deposit, minimum spending amount, or salary credit is needed. Even GXS Bank, launched by Grab-Singtel last August on an invite-only basis, offers customers and employees only a single product – a savings account at 3.48% per annum.

To open a Mari Savings Account, customers must be Singaporean or permanent residents at least 18 years old. The bank’s invitations are currently limited to users of its ecosystem, such as Shopee customers and individual sellers. Those with an invitation can download the MariBank app from the Apple App Store, Google Play Store, or Huawei AppGallery.

Once an account is established, interest is accrued daily and calculated based on the previous day’s balance. The website shows that customers can also send and receive money instantly through PayNow in the bank’s app and pay at stores that accept PayNow QR codes. Since MariBank is rolling out its services progressively, it will be interesting to see how it fares in a highly competitive digital banking landscape, also on an invite-only basis.

Singapore-based consortia, GXS Bank and Sea Limited, were also among the five winners of Malaysia’s digital bank licenses. But it remains to be seen if they replicate the same invite-only approach in Malaysia. In the Philippines, UnionDigital, the local digital bank, is also taking a more conservative approach to growth by remaining an invite-only platform.

READ MORE

- Strategies for Democratizing GenAI

- The criticality of endpoint management in cybersecurity and operations

- Ethical AI: The renewed importance of safeguarding data and customer privacy in Generative AI applications

- How Japan balances AI-driven opportunities with cybersecurity needs

- Deploying SASE: Benchmarking your approach