According to KMPG’s 2023 CEO Outlook report, CEOs are reassessing their strategic priorities. (Image by Shutterstock)

What the KPMG 2023 CEO Outlook in India and Singapore tells us

- KMPG 2023 CEO Outlook report highlights geopolitics and political uncertainty as biggest concern for CEOs.

- Generative AI remains a key area of interest – despite concern on the risks it brings.

- CEOs struggling with achieving ESG goals due to a lack of finance in the area.

If there is one thing that businesses around the world have in common, it’s the vision of their company being successful, no matter what it takes. To achieve that, the CEO of any company needs to make the right decisions. That includes not only planning the forward strategy of the business, but also ensuring any changes are implemented effectively.

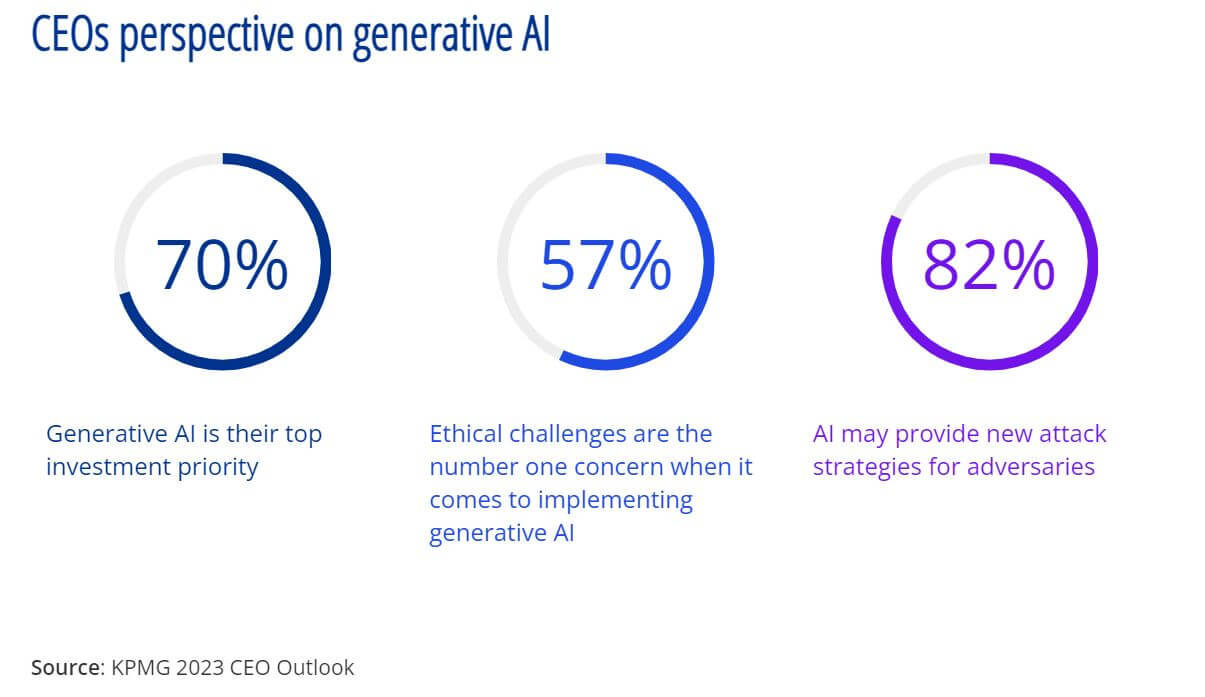

Over the last few months, CEOs around the world have been drawn into the generative AI hype. There is no denying that generative AI has changed the way business leaders think about technology today. Investments in these technologies have increased substantially, with more planned for in 2024.

But apart from generative AI, what other sectors are CEOs looking at?

According to KMPG’s 2023 CEO Outlook report, CEOs are reassessing their strategic priorities, focusing on the rise of generative AI, talent management and high stakeholder expectations in addressing environmental, social and governance (ESG) issues. The 9th edition of the KPMG CEO Outlook was conducted with 1,325 CEOs between 15 August and 15 September 2023, and provides insight into the mindset, strategies and planning tactics of CEOs.

“Business leaders are facing challenges and obstacles to growth on multiple fronts — from geopolitical uncertainty and politicization to increased stakeholder expectations in the ESG space and the adoption of generative AI. For CEOs — the opportunity to drive a return to a more equitable, successful planet is right in front of us. The key to success will be an unrelenting focus on long-term strategic planning and commitment to avoid the danger of short-term, reactive leadership, which is always a threat during a period of deep uncertainty,” said Bill Thomas, global chairman and CEO at KPMG International.

While the CEOs surveyed all foreseen growth opportunities, geopolitics and political uncertainty remain the biggest concern for them. The ongoing trade war between the US and China, the Russia-Ukraine conflict, and now the Israel-Palestinian conflict continue to be a concern, especially when it comes to making business decisions.

This is a big shift compared to the concerns CEOs had in 2022. Last year, the biggest concern was emerging and disruptive technologies. The change indicates that most businesses have adopted newer technologies in the last few months. Operational issues remain a concern, but this is an ongoing issue for years, especially with the global lack of talent.

Geopolitics and political uncertainty remain the biggest concern for CEOs. (Image by Shutterstock)

CEOs in India and Singapore

Taking a deeper dive into two emerging markets in Asia – India and Singapore – the report findings paint a similar picture. While CEOs in India are seeing an increase in the growth prospects of the global economy, their perception of risk has undergone a profound transformation. The perpetually shifting geopolitical landscape, coupled with the dynamic interplay of trade dynamics and global relations, has woven a multifaceted tapestry of challenges.

“CEOs in India are facing challenges and obstacles to growth on multiple fronts – from geopolitical uncertainty and politicization to increased stakeholder expectations in the ESG space and the adoption of generative AI. Even though leaders in India are having to deal with macroeconomic and geopolitical challenges right now, they are fairly positive about the growth prospects of the global economy, as well as their organization, which is very reassuring. There’s general optimism, that we can, in time, gradually return to long-term sustainable growth,” commented Yezdi Nagporewalla, chief executive officer for KPMG in India.

Over in Singapore, it’s a different scenario. Singapore CEOs identify operational risk and emerging and disruptive technology as the principal threats to growth. As such, they are approaching this dynamic and demanding environment with resilience, adopting a purpose-driven, proactive strategy focused on technology, ESG, and talent management. Over half of Singapore’s CEOs have already adjusted their growth plans to tackle these interconnected challenges, and an additional 40% are planning to follow suit.

“Singapore CEOs are showcasing exceptional resilience and adaptability in the face of complex geopolitical and economic landscapes. They are strategically preparing their organizations for a future steered by generative AI and ESG initiatives, with human expertise as the foundational pillar. A significant shift is evident, with 52% of Singapore’s CEOs transitioning from a focus on technology acquisition to prioritizing the upskilling of their workforce in AI and ESG,” said Lee Sze Yeng, managing partner at KPMG in Singapore.

It is essential for CEOs to lead from the front, ensuring their organizations adopt responsible, robust AI frameworks and focus on safeguarding and governance. (Source – KPMG)

The impact of AI and cybersecurity

For Indian CEOs, AI seems to be a double-edged sword. Despite the potential benefits of generative AI, Indian CEOs also acknowledge the potential risks associated with its use. When it comes to cybersecurity, 77% of CEOs believe generative AI can both enhance cybersecurity efforts and create new vulnerabilities for adversaries to exploit.

Despite these concerns, a higher number of CEOs in India feel confident in their organization’s preparedness for potential cyberattacks. As cyberattacks increase and become more sophisticated, Indian CEOs are feeling underprepared for a cyberattack.

Meanwhile, 64% of Singapore CEOs believe that generative AI could aid their cybersecurity strategy. However, just like Indian CEOs, they are also cognisant that it may bring new dangers by providing new attack strategies for adversaries. 68% of CEOs in Singapore say they are ‘very prepared’ to deal with cyberthreats.

Singaporean CEOs also cite ethical challenges (64%) as their top concern when implementing generative AI in their organizations. All the CEOs surveyed in Singapore agree that disruptive technology, which also includes machine learning, blockchain and robotics, could negatively impact their organization’s prosperity over the next three years, but many are expecting to see a return on their investments beyond that.

At the same time, 68% of Singapore CEOs believe there is a need to address the lack of current regulations and direction for generative AI in their industry, which has been a barrier to their success.

CEOs in India as well as globally, acknowledge that addressing ESG challenges remains a key component of their business operations and long-term corporate strategy. (Source – KPMG)

ESG or more greenwashing

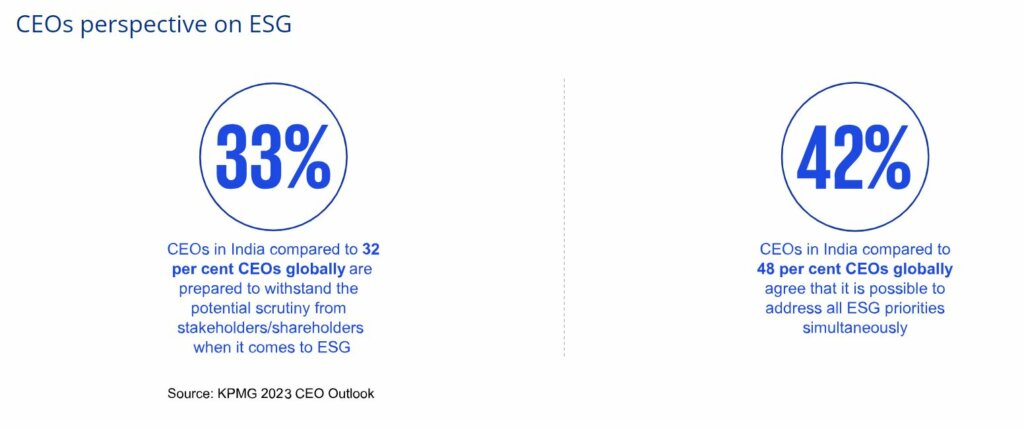

Despite a polarizing debate surrounding the term environmental, social, and corporate governance (ESG), CEOs recognize that it remains an integral part of their business operations and corporate strategies and are taking a more outcomes-based approach than they previously did. More than two-thirds of global CEOs have fully embedded ESG into their business as a means to create value.

But here’s the problem. How much of this actually creates value – and how much is just more greenwashing? Greenwashing remains the biggest problem for ESG, especially with some organizations finding ways to make it work for them. While more countries are having regulators take a closer look at some of their ESG initiatives, it does keep the debate going on what exactly the end goal for ESG is.

Looking at India, CEOs see ESG strategy as having the greatest impact over the next three years, especially when it comes to building customer relationships. In fact, CEOs in India increasingly understand that businesses embracing ESG will best be able to drive shareholder returns, form new partnerships and alliances, strengthen their employee value proposition, attract the next generation of talent, build a brand reputation, and drive financial performance.

But here’s another problem. Planning ESG and implementing ESG are two different things. As KMPG highlights, higher costs and difficulty in raising finance continue to be the principal reasons why 32% of Indian CEOs do not meet the expectations of stakeholders when it comes to ESG.

“This heightened importance of ESG that we are seeing in India today is primarily driven by an increasing awareness among shareholders who aspire to associate with organizations that prioritize purpose over profit,” the report explained.

On the other hand, 52% of Singapore CEOs have fully embedded ESG into their businesses to create value. In fact, 96% of Singapore CEOs say that they have a responsibility to drive greater social mobility. Compared to India, 72% of Singapore CEOs anticipate that it will take three to seven years for their ESG investments to pay off, with the greatest impact likely on their capital allocation, partnerships, alliances and M&A strategy and talent attraction for the next generation.

Just like India though, Singapore CEOs are also having trouble raising finance to meet ESG expectations. Two in five Singapore CEOs rank the lack of internal governance and controls to operationalize these goals as their top challenge.

READ MORE

- Safer Automation: How Sophic and Firmus Succeeded in Malaysia with MDEC’s Support

- Privilege granted, not gained: Intelligent authorization for enhanced infrastructure productivity

- Low-Code produces the Proof-of-Possibilities

- New Wearables Enable Staff to Work Faster and Safer

- Experts weigh in on Oracle’s departure from adland