Will Bitcoin survive speculation? Source: Pinterest

Bitcoin’s $19k 2017 and $200k 2018?

BITCOIN has grabbed a fair proportion of the tech headlines this year, but some of the ramifications of the cryptocurrency and its value are not necessarily technological – rather they are financial and regulatory.

The elephant in the room is the rise of bitcoin’s value against fiat currency. The mainstream’s slow realization of the existence of bitcoin has probably led to it becoming more noticeable in 2017, but the actual rate of increase is not particularly out of the ordinary.

Since its first trades in 2010, the value of bitcoin has seen annual rises in value of 9,500 percent (2010), 1410 percent (2011) and nearly 6,000 percent (2013). So, 2017’s 1,643 percent rise to a whisker under US$17,000 for a bitcoin is not necessarily remarkable.

So, how far will bitcoin’s value rise? Some hedge fund managers have said that 2020 may see the value of a single bitcoin hit US$1 million, which, while a headline-grabber, is not all that special considering the annual rate rises required to reach that milestone. If bitcoin was to hit US$100,000 by the end of 2018 (a rise of 500 percent or so), then the rate required to reach US$1 million would be only around 670 percent per year – which, from a historical standpoint, is pretty small beer for the cryptocurrency that even the staidest of financiers have been captivated by.

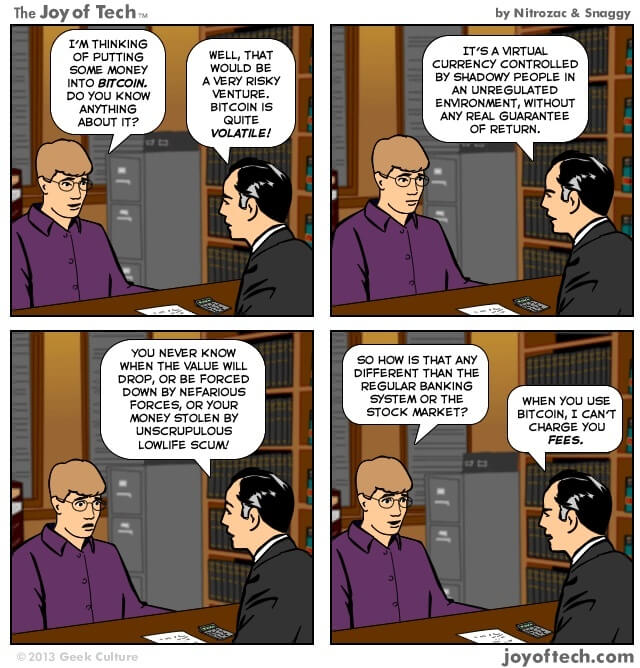

The captivation of “old money” players is a key factor in both driving the currency’s value and bringing awareness of the currency to a broader audience, albeit one that does not necessarily understand the whys and hows of the distributed ledger.

At present, bitcoin trading is taking place with the currency as just another commodity. And therein lies at least some of the currency’s problems for broader acceptance: if a currency is unstable, institutions and people are not willing to base trade on it, as any held funds may be subject to rapid deflation as dictated by volatile trading.

Bitcoin itself also has problems as an everyday currency. It is currently struggling to scale, in part due to the speed of transactions being too slow, and often too costly – typically, the quicker the processing, the more it costs.

So, if bitcoin is failing as a method of exchange, what else does it achieve? Its anonymity and safety have been proven not to be entirely watertight, as the recent hacking of Nicehash proves. And while cryptocurrency’s lack of a centralized control mechanism is seen by the crypto-anarchists as a way of freeing the masses from the shackles of government control, that probably isn’t enough to guarantee a future.

Being an open source technology, the blockchain community has proposed solutions to bitcoin’s problems with speed and fecundity. Increases in block size and/or sidechaining, both proposed to help make the cryptocurrency scale have both failed as yet to take hold (in terms of broad acceptance). New currencies appear in order to “solve” problems or to address a specific issue: Monero is the “solution” to truly anonymous exchange, Telcoin is the “solution” to empower those whose only network access is by their phone provider.

The great new hope of Segwit2x (with an increased blockchain size and sidechaining possibilities), which would have made bitcoin transactions quicker and less dependent on the hashing power owned by huge organizations, has stalled, with its inventor – does anyone see a pattern here? – starting a new currency, Metronome.

So predictions are hard to make, but if 2018 sees a rise in bitcoin’s value, it will be notable, probably not for its relative percentile growth (2013’s 6,000 percent growth will be difficult to match), but for the way that the currency will continue to garner headlines and wannabe speculators.

And in that, a positive comes out of 2017. If a few thousand geeks with the prescience (or luck) to get rich on the back of a speculative commodity that happens to be technologically complex, then at least the way is better paved for a cryptocurrency future’s wider acceptance.

If this author had to make a call, the following may not be out of the question:

- Bitcoin to hit US$200,000 at some stage before 2018’s end (perhaps as early as May), but then fall back, albeit still in six figures, as profits are taken.

- A different currency to come more widely accepted as a trading medium in bitcoin’s place, with bitcoin becoming a quasi-gold standard rather than a means of exchange: Ethereum, LiteCoin or bitcoin cash are likely candidates, with bitcoin cash the most likely.

- Governments, largely, to be increasingly distrustful of cryptocurrencies and to regulate as best they can against them.

- The financial markets to become increasingly involved in speculative activity, sensing a fast buck.