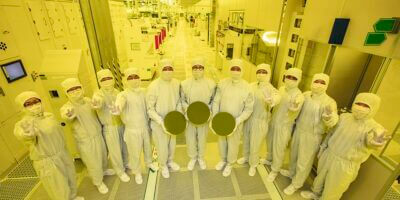

(Source – Shutterstock)

Chip Alliance: The hefty price Taiwan is paying for choosing US over China

- Taiwan pledged to work closely with the US and other allies to prevent China’s military from acquiring state-of-the-art technology.

- After a year of preparation, a preliminary meeting of the Us-led Chip 4 group took place last week.

- Taiwan’s Deputy Economy Minister said that the country would use the group to protect the interests of its local semiconductor industry.

The struggle for supremacy between Washington and Beijing, especially when it comes to technological advancement, is intensifying. Numerous countries—from Japan and South Korea, to even Taiwan—are finding themselves in a crossfire: having the United States (US) as their security ally and China as their top trading partner. Taiwan specifically has been the beneficiary of worsening relations between Washington and Beijing — however, it has been anything but a smooth sailing journey for the country that is home to the world’s most significant chip player.

Frankly, democratic Taiwan, which China claims as its own, has come under increasing military and political pressure from Beijing, especially after Chinese war games in early August following a Taipei visit by US House Speaker Nancy Pelosi. For context, there have been mounting expectations for Taiwan to join a US-formed Chip 4 alliance with other advanced democracies that produce high-end semiconductors like South Korea, Japan, and the US.

On top of that, demands from the US have been building on Taiwan to limit hi-tech exports to China. China on the other hand is urging Taiwan’s businesses to move in the opposite direction. Essentially, the more that Taiwan gets pulled into becoming the central flashpoint of major power rivalry, the more pressure Taipei would face to make alignment decisions between the US and China.

Where does Taiwan stand between the US and China?

At this point, it is clear that Taiwan’s economy will not be able to decouple from its biggest trade partner, China. In 2021 alone, the mainland accounted for 28.21% of Taiwan’s total exports, by value. Integrated circuits, also known as chips, accounted for 62% of the island’s exports to the mainland last year, with the value reaching US$155 billion, according to China Customs figures.

And in the first half of this year, the mainland imported US$79 billion worth of chips from Taiwan. Even Taiwan’s largest importer has been mainland China since 2014 with a total of 21.62% of Taiwan’s imports in 2021, by value, came from the mainland. In contrast, the island ranked only 11th among buyers from the world’s biggest exporter in 2021, in terms of import value.

Having such a tight-knit economic relationship, Taiwan said it will only implement “very firm” export controls to keep advanced technologies from China’s military. In fact, Taiwan will use the new US-led “Chip 4” group to safeguard the interests of Taiwanese companies and to ensure supply chain resilience.

Coincidentally, just last week, a preliminary meeting of the Chip 4 alliance took place, attended by representatives from Taiwan, the US, South Korea and Japan. To that, Taiwan deputy economy minister Chen Chern-chyi told reporters in Taipei that chipmaking required collaboration to ensure a “very resilient supply chain”. Separately, even Taiwan President Tsai Ing-wen has said that the island is committed to ensuring its partners have reliable supplies of semiconductors and has urged allies to boost collaboration amid intensified threats from China.

The so-called Chip 4 alliance, an idea formed last year by the US, is meant to secure the global semiconductor supply chain, synchronize policies, grants, and joint research and development (R&D) projects. At last, Taiwan’s position as a leader in semiconductor production remains vulnerable. Estimates by the US National Security Council project that a Chinese invasion and the loss of TSMC could disrupt the world economy to the tune of more than $1 trillion, around twice the value of the entire semiconductor industry’s annual global sales.

READ MORE

- Strategies for Democratizing GenAI

- The criticality of endpoint management in cybersecurity and operations

- Ethical AI: The renewed importance of safeguarding data and customer privacy in Generative AI applications

- How Japan balances AI-driven opportunities with cybersecurity needs

- Deploying SASE: Benchmarking your approach