(Source- Shutterstock)

Consolidations and exits on the horizon for food delivery platforms

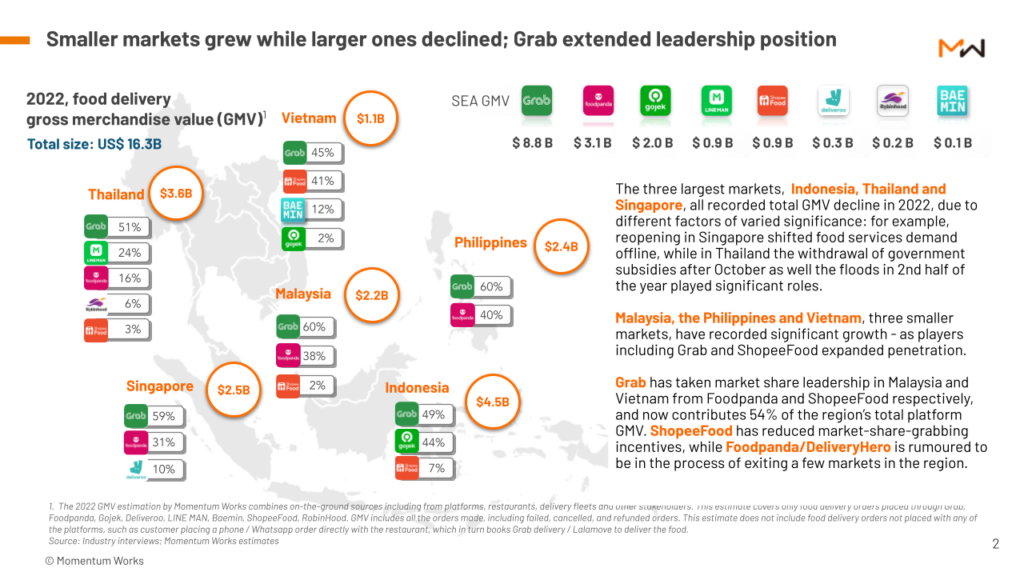

- Philippines, Malaysia and Vietnam led region’s food delivery platforms growth in 2022 – a first in three years.

- Grab accounts for 54% of the region’s food delivery GMV, followed by Foodpanda at 19% and Gojek at 12%.

- Consolidation and exits may be on the horizon as food delivery players rein in costs and push towards profitability.

Update: Singapore-based Foodpanda has laid off some of its employees in Southeast Asia citing global macroeconomic challenges.

Food delivery platforms were essential for businesses during the COVID-19 pandemic. Not only did it enable restaurants and eateries to operate by providing food deliveries, but it also led to the creation of more jobs in the gig economy.

In fact, many employees who lost their jobs due to the pandemic were able to avoid financial problems by working as riders for food delivery platforms. With lockdowns lasting almost two years in some countries, there was also a huge growth in food delivery platform operators.

For example, airline AirAsia was able to set up a food delivery platform via its super app to remain profitable. The period also saw increased food delivery platform startups in the region, each with unique offerings.

According to Momentum Works’ report on Food Delivery Platforms in Southeast Asia, total food delivery spending in the region grew a modest 5% to reach US$16.3 billion in 2022 after two years of Covid-driven boom.

For the first time in three years, growth was primarily driven by the region’s smallest food delivery markets including the Philippines (+US$0.8B), Malaysia (+US$0.6B) and Vietnam (+US$0.3B). Larger markets such as Singapore (-US$0.4B), Thailand (-US$0.4B) and Indonesia (-US$0.1B), recorded a GMV decline as Covid became endemic and economies reopened.

(Source – Momentum Works)

This all indicates a slowdown for the industry. Food delivery platforms are under pressure as employees return to the office and demand for their services lessened. Moreover, incumbent and new food delivery players have continued to cut back on their food delivery subsidies and compete based on service quality.

In late 2022, Grab, which also offers food delivery services, is estimated to account for 54% or US$8.8 billion of the region’s food delivery GMV, a 16% increase from the year before. Foodpanda, which was always focused on food delivery services, is estimated to contribute 19% or US$3.1 billion of the region’s GMV, a 9% decline from 2021. Gojek and Shopee, two companies that also only entered the food delivery service during the pandemic, are estimated to maintain their food delivery GMV at 2021 levels of US$2.0 billion and US$0.9 billion respectively.

Jianggan Li, Chief Executive Officer and Founder of Momentum Works pointed out that the competitive landscape became a lot more muted in 2022 compared to 2021. He explained that new entrants such as Shopee and AirAsia have gone back to focus on their core sectors, while incumbent players adopt conservative expansion strategy.

“With profitable growth being the biggest focus now, food delivery players are experimenting with a variety of strategies to improve delivery margins and strengthen consumer loyalty via advertising, subscription programs, and more. We believe profitability is attainable with volume, density and operational efficiency,” added Li.

Another interesting find from the report is that major players pivoted away from cost-intensive business models such as dark stores for groceries and dark kitchens for food delivery. This trend is expected to continue into 2023, with Shopee planning to refocus on its core business in e-commerce, and DeliveryHero rumored to be diverting operations in a few Southeast Asian countries.

At the same time, more players entered into strategic partnerships or acquisitions with point-of-sales and restaurant management solutions providers in 2022. These moves are expected to strengthen merchant retention and enable players to provide more and better-differentiated services to merchants by harnessing online and offline sales data. This is a tested strategy by Chinese players such as Meituan.

The report also showed major food delivery players have begun building advertising products to lock in more merchant investments. Many are also experimenting with subscription programs as a tool to improve consumer retention and encourage larger basket-size orders. Players that have a large consumer reach and merchant base will have an edge over others.

As food delivery continues to form a substantial part of a merchant’s overall sales, merchants are also creating more varied offerings and promotions for dine-in and food delivery to reduce cannibalization and maximize sales for both channels. Similarly, delivery players are also expanding into the offline space through features such as dine-in coupons, restaurant reviews, and more.

READ MORE

- Ethical AI: The renewed importance of safeguarding data and customer privacy in Generative AI applications

- How Japan balances AI-driven opportunities with cybersecurity needs

- Deploying SASE: Benchmarking your approach

- Insurance everywhere all at once: the digital transformation of the APAC insurance industry

- Google parent Alphabet eyes HubSpot: A potential acquisition shaping the future of CRM