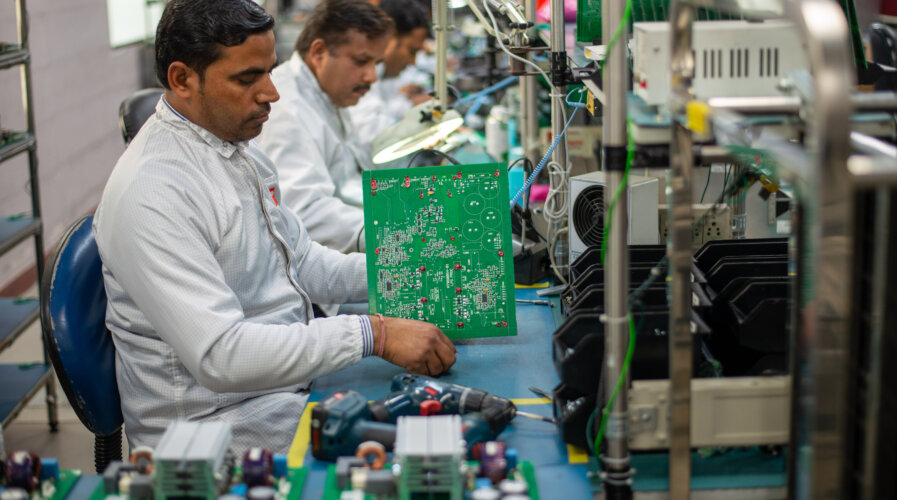

The semiconductor market in India could be worth more than US$64 billion by 2026Source: Shutterstock

The semiconductor market in India could be worth more than US$64 billion by 2026

|

Getting your Trinity Audio player ready... |

- Counterpoint Research forecasts that in three years, telecom stack and industrial applications will account for two-thirds of the total semiconductor market value in in India.

- Over 70% of the project costs for semiconductor manufacturing are incentivized by the Central and State Governments in India, of which the Central Government funds 50%.

- New Delhi plans to reopen the application process for US$10 billion in incentives and assistance to encourage local chipmaking.

India has been on an ambitious journey to becoming a global leader in the semiconductor industry. At the heart of the South Asian nation’s push for semiconductor self-reliance lies a goal to reduce dependence on imports and establish domestic manufacturing capabilities. One of India’s key advantages is its vast and burgeoning market potential.

In a recent report by Counterpoint Research, the Indian semiconductor market is forecasted to witness stellar growth, with market value expected to surpass US$64 billion by 2026. For context, the chip industry was valued at US$22.7 billion in 2019, a joint report by Counterpoint Research and the India Electronics & Semiconductor Association (IESA) shows.

Counterpoint reckons both domestic and export markets will drive the 2026 forecast with significant demand from the consumer electronics, telecom, IT hardware, and industrial sectors. “India’s ‘telecom stack’ and industrial applications are expected to account for two-thirds of the total,” the report reads.

Meanwhile, components leveraging mature technology nodes (28nm and higher) are expected to see significant short-term opportunities as they support India’s growing automotive and industrial sectors. Tarun Pathak, Counterpoint’s Research Director, reckons that in the short term, a huge opportunity is being driven by domestic demand across applications like sensors, logic chips, and analog devices.

Pathak also emphasized, “Local sourcing is already happening significantly.” Counterpoint said local sourcing alone accounted for around 10% of the overall market in 2022. The report by Counterpoint came after the research firm recently hosted a series of webinars with key industry speakers to discuss the opportunities in India for establishing a semiconductor manufacturing base and becoming a key destination for supply chain diversification.

India Semiconductor Market Size by Application. Source: Counterpoint Research, IESA

The webinar was co-hosted by Invest India, the National Investment Promotion and Facilitation Agency, and India Semiconductor Mission (ISM). At the global level, the Government of India has committed to being a reliable partner in the semiconductor supply chain, introducing various incentives and programs that facilitate foreign investments across multiple sectors.

ISM’s CEO Amitesh Kumar Sinha, during the webinar also, shared that “More than 70% of the project costs for semiconductor manufacturing are incentivized by the Central and State Governments in India, of which the Central Government funds 50% on an upfront basis while the State Governments cover the rest.”

Then there’s the Semicon India Program, which has an outlay of about US$10 billion, and funds 50% of the semiconductor manufacturing project costs with 2.5% of the budget earmarked for R&D, skill development, and training. Sources claim that New Delhi plans to reopen the application process for US$10 billion in incentives and assistance intended to encourage local chipmaking, a Bloomberg report shows.

To recall, Prime Minister Narendra Modi’s government initially gave companies just 45 days from January 1, 2022, to apply for fiscal support. The state pledged to fund as much as half the cost of building a chip fabrication plant. But the short window led to just a few applicants, including a partnership between Agarwal’s Vedanta Resources Ltd and Taiwan’s Hon Hai Precision Industry Co, and a consortium that includes Tower Semiconductor Ltd.

The people said the latest approach would also keep the process open-ended, doing away with a previous 45-day requirement for submissions. In short, India plans to accept applications until its budgeted US$10 billion in incentives is exhausted.

READ MORE

- Safer Automation: How Sophic and Firmus Succeeded in Malaysia with MDEC’s Support

- Privilege granted, not gained: Intelligent authorization for enhanced infrastructure productivity

- Low-Code produces the Proof-of-Possibilities

- New Wearables Enable Staff to Work Faster and Safer

- Experts weigh in on Oracle’s departure from adland