After dominating the Indian market for over five years, Chinese smartphones are slowly seeing their market share shrinking.Source: Shutterstock

Should Chinese smartphones stay in India?

|

Getting your Trinity Audio player ready... |

- After dominating the Indian market for over five years, China’s smartphone market share is shrinking.

- The Indian IT minister says foreign brands don’t need to be excluded to make way for Indian companies.

For almost five years, about half of the Indian smartphone market has been dominated by Chinese brands, including Xiaomi, Oppo, and Vivo. Home-grown smartphones have been losing their dominance to a gradual Chinese onslaught since 2017. By 2018, Xiaomi was the top player in India, accounting for 29.7% of all smartphone shipments (IDC data).

The company—which introduced itself with competitively priced devices—has slowly built its base in the country over the past five years and has been reaping the benefits. Xiaomi’s aggressive pricing, value-for-money devices, and loyal customer base helped the company grow from strength to strength in the face of adverse competition.

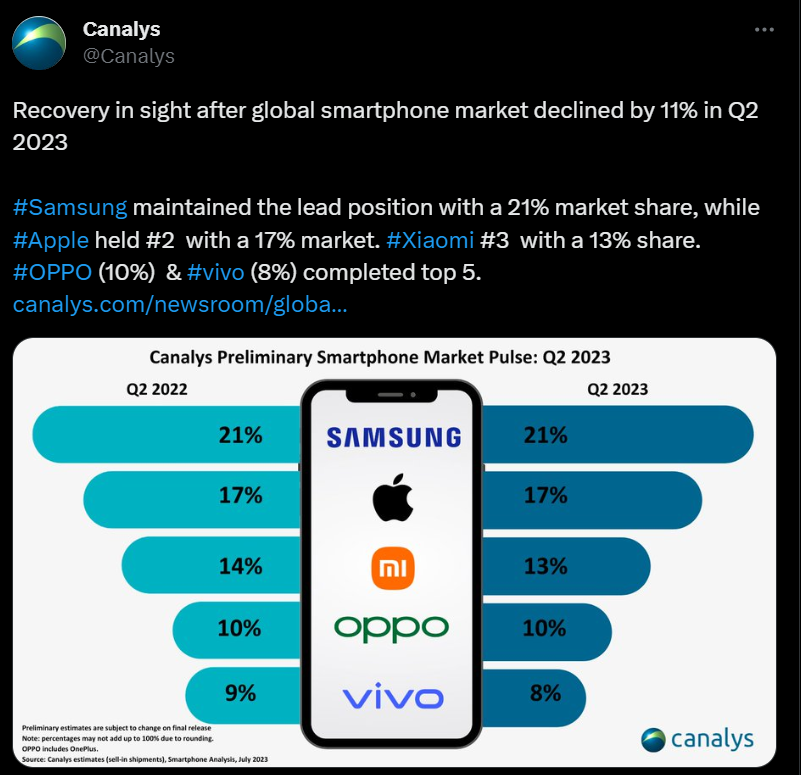

However, according to a report by Canalys, Xiaomi’s run as the number-one brand in India ended in the final quarter of 2022. “After 20 quarters, Xiaomi lost its leadership position in Q4 2022 and fell to third place with shipments of 5.5 million units,” noted Canalys in its quarterly report on the Indian smartphone market.

For the full year 2022, Xiaomi was still the number-one brand in India. Xiaomi’s market share, unfortunately, signals the broader Indian market sentiment on Chinese smartphones amid a series of alleged accusations by the Indian government over financial irregularities. The intensifying crackdown on Chinese companies in the country, as some market experts reckon, was encouraged by US support.

Indian smartphone shipments and annual growth. Source: Canalys’ Twitter

Many may not be aware that the entry of Chinese vendors opened up the Indian smartphone market, helping it grow in size and sophistication and driving the development of the local smartphone manufacturing industry. Now that India has become the second-largest mobile phone manufacturer in the world, the government is putting regulatory pressure on Chinese phone makers.

What did the Indian government most recently do?

On June 13, the Indian newspaper The Economic Times quoted sources saying the government has asked Chinese mobile phone makers in the country, including Xiaomi, Oppo, Realme, and Vivo, to appoint locals to crucial corporate positions, such as the chief executive, operating, financial and technical officers.

They were also reportedly asked to appoint Indian contract manufacturers and local distributors. In early June, the move came after Xiaomi received official notices over allegations of illegally transferring more than 55.5 billion rupees (US$677 million) to foreign entities. Since last year, the government has frozen a similar amount of Xiaomi’s funds, amounting to more than half of its 2022 net profit.

According to a South China Morning Post (SCMP) report, Xiaomi even explained that over 84% of the payment was a royalty paid to Qualcomm Group in the US. Still, the Indian authorities have so far refused to unfreeze the money. The behavior by the Indian authorities is seen as the ramifications of the local government’s goal to localize smartphone production, including through tariffs on imported parts, first encouraging local assembly, then component production.

While economic nationalism is not new to India, in recent years, however, the country’s crackdown on Chinese companies has been particularly severe. This has been linked to the deterioration in China-India relations and the rise in strategic competition between China and the US, which counts India as an ally.

Is the end of Chinese smartphones in India near?

In an opinion piece on SCMP, Liu Zongyi, a senior fellow and secretary general of the South Asia and China Center at the Shanghai Institutes for International Studies, reckon the Indian government’s crackdown on Chinese smartphone makers such as Xiaomi is only the first step. “Such a policy is likely to be extended to manufacturers in other industries, such as laptops, home appliances, and solar products,” he added.

A separate article by the Global Times suggested that while the Modi government has stepped up efforts to boost the development of India’s manufacturing sector, it still needs Chinese firms to achieve its goal in the mobile phone sector over the next decade. But what seems certain is that India has yet to make concrete plans to ban Chinese smartphones from its market entirely.

The country’s IT minister has said that though Indian companies have a crucial role in the country’s electronic ecosystem, it does not mean that foreign brands should be excluded to make way. What is certain, though, is that the government will continue to keep a close eye on Chinese companies.

READ MORE

- Safer Automation: How Sophic and Firmus Succeeded in Malaysia with MDEC’s Support

- Privilege granted, not gained: Intelligent authorization for enhanced infrastructure productivity

- Low-Code produces the Proof-of-Possibilities

- New Wearables Enable Staff to Work Faster and Safer

- Experts weigh in on Oracle’s departure from adland