Huawei emerges as major stakeholder in TD Tech. Source: Shutterstock

Could 2023 be a year of resurgence for Huawei?

|

Getting your Trinity Audio player ready... |

- Huawei has been finding ways to compensate for lost sales and seek growth after Western sanctions.

- Huawei sealed a multiyear patent cross-licensing deal with Ericsson for 5G and other technologies.

- Huawei is also said to be building a network of semiconductor fabs in China.

On December 30, 2022, Chinese telecommunications giant Huawei Technologies Co Ltd announced that it has exited the “crisis status” it entered in response to the US sanctions enacted against it in 2019. By 2023, Huawei announced that its consumer business had returned to growth after a substantial decline in its smartphone sales in the past two years.

“2022 is the year that we pulled ourselves out of crisis mode. We’re back to business as normal,” Chief Financial Officer Meng Wanzhou declared. Within the first six months of this year, Huawei’s total revenue grew 3.1%, reaching 310.9 billion yuan (US$43.1 billion), higher than the 0.8% revenue growth seen in the first quarter and the 0.9% growth for 2022.

Huawei’s chief financial officer Meng Wanzhou delivers a speech during the first day of the Mobile World Congress (MWC) in Shanghai on June 28, 2023. (Photo by Pedro PARDO / AFP)

The company’s performance signals that the telco giant has found ways to survive despite US sanctions. Therefore, rumors from research institutions and industry sources about the prospect of Huawei returning to the 5G smartphone market in the latter half of 2023 are feasible.

But there were more indicators to prove that in the face of the technological crackdown launched by the US, Huawei is more fragile than to be defeated. After all, if Huawei can overcome the stranglehold of the US crackdown and relaunch its 5G phones, it will be possible for the tech giant to return to the forefront of the global smartphone market.

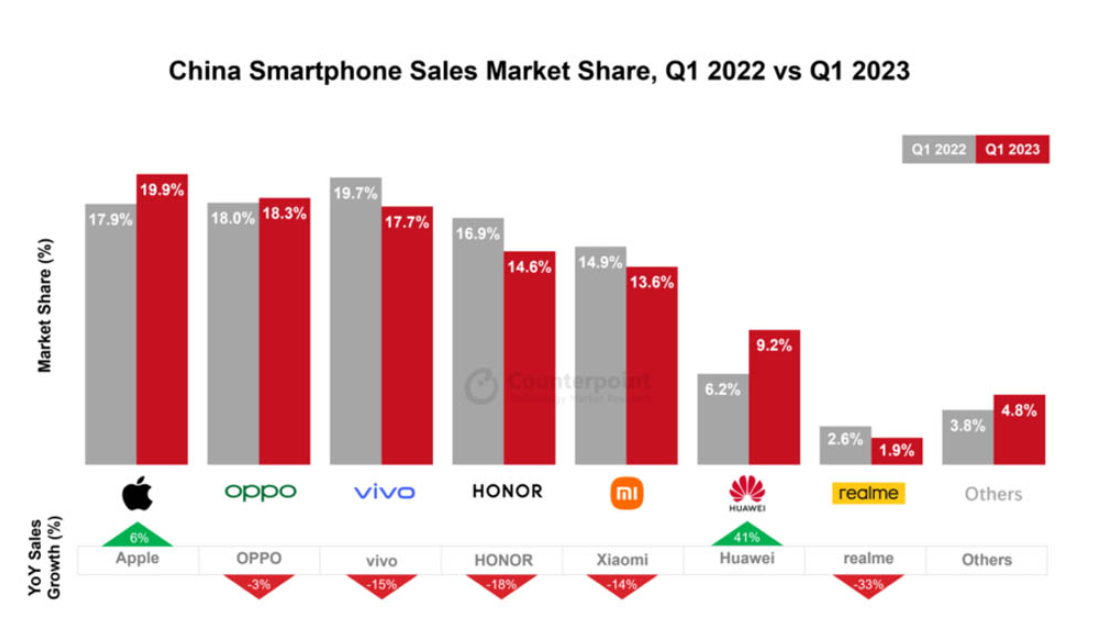

To top it off, Huawei is also dipping its toe back in the smartphone market share despite lacking 5G in the newest flagship devices. According to data from Counterpoint Research, Huawei has achieved 41% year-over-year growth in smartphone sales in the first three months of 2023.

Meanwhile, the company was operating at 6.2% in Q1 of 2022 – significant progress made within a year. Moreover, Huawei is also said to be selling the most foldable smartphones in China, with over 50% of the market share in the first half of this year.

China smartphone market share Q1 2023. Source: Counterpoint Research

Richard Yu Chengdong, chief executive of the company’s consumer business group and its car unit, declared that Huawei’s flagship smartphones are “making a comeback” as he unveiled the latest update of its own Harmony operating system. Even in the second quarter of this year, Huawei resurfaced as a top-five smartphone vendor in mainland China, according to data from research firm IDC, following the launch of high-end handsets, including its P60 series and foldable Mate X3 model.

Huawei shipped 14.3 million smartphones in China in the first half of 2023, up nearly 40% compared to the same period last year, IDC data showed. Notably, the smartphone market is one of many spaces in which Huawei has progressed since the US ban.

Circumventing the US ban with new revenue streams

So far, Huawei’s improved results are the results of its efforts to survive US sanctions by resurrecting the company’s handset business and diversifying into new industries, including cloud computing and electric cars. For instance, revenue from intelligent automotive solutions, another segment that Huawei has been banking on to diversify its business, reached 1 billion yuan in the first half of 2023.

Cloud computing and digital power generated 24.1 billion yuan and 24.2 billion yuan in sales, respectively, posting “strong growth,” according to Meng. Huawei has also been stepping up efforts to serve enterprise clients, hoping to upgrade their operations in traditional businesses.

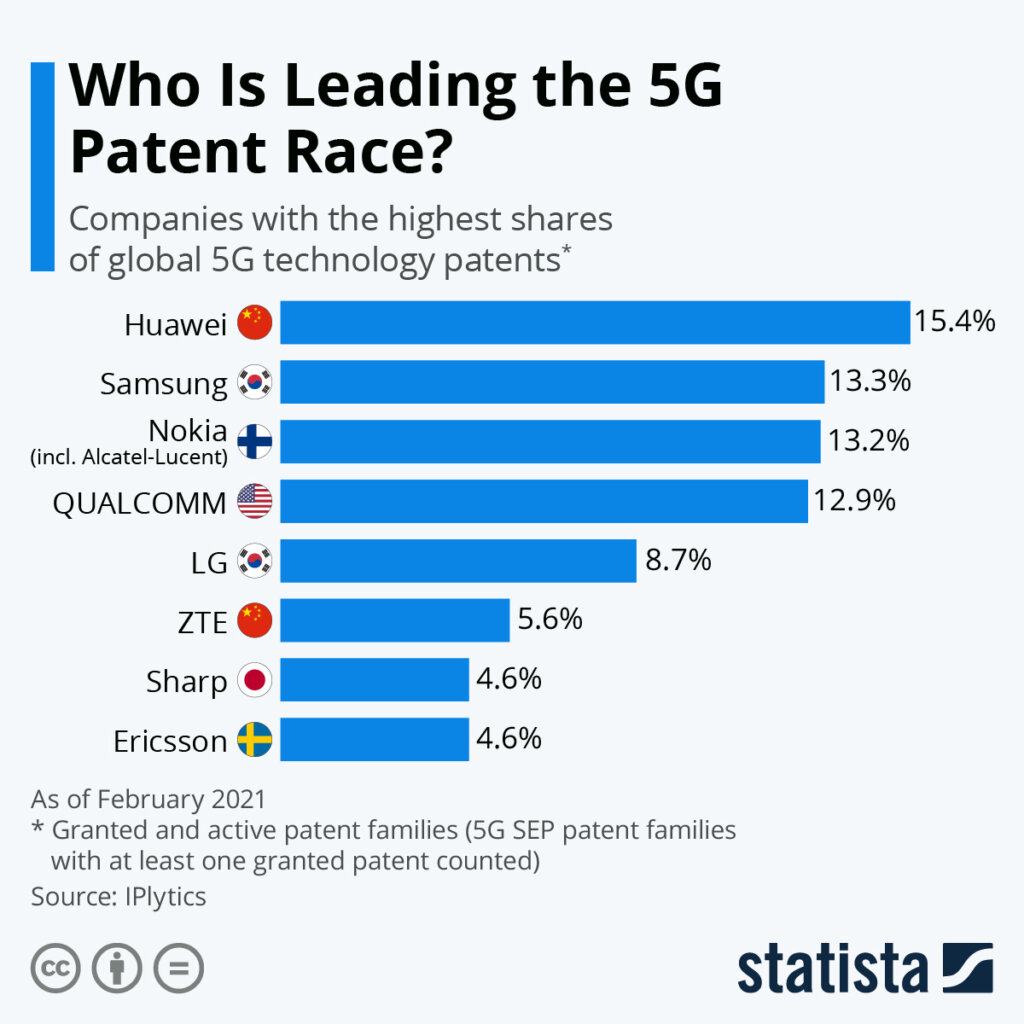

In 2021, Huawei accounted for 15.4% of global 5G patent families.

Source: Statista

Last month, Huawei joined the heated artificial intelligence race (AI) with the third generation of its Pangu model that focuses on industrial uses in coal mining, finance, and government sectors. “Huawei has been investing heavily in foundational technologies to harness trends in digitalization, intelligence, and decarbonization, focusing on creating value for our customers and partners,” Meng added.

From January to June, the company said revenue from Huawei’s information and communications technology business – its key segment that includes 5G network gear – reached 167.2 billion yuan. As the Chinese group searches for ways to generate revenue after being banned from telecom networks or subjected to curbs in several countries, Huawei, last week, sealed a multiyear patent cross-licensing deal with Ericsson for 5G and other technologies.

The plan is to develop and monetize patents for Huawei to make up for lost sales and seek growth after being squeezed by Western sanctions. With the agreement, the rival equipment makers can access each other’s patents essential for the “3G, 4G and 5G cellular technologies” used in network infrastructure and consumer devices, Huawei announced on Friday.

Huawei and the Swedish company already had a patent license, but this is the first long-term agreement between the pair, Huawei said without disclosing further details. Huawei is the world’s largest 5G patent owner, with 20% of global patents. In 2021, the company began charging smartphone makers a royalty to use its patented 5G and other technologies.

The company disclosed that the royalty rate cap for 5G handsets is US$2.5 per unit, which, according to legal experts who spoke with the Financial Times, is significantly lower than the industry average. Huawei’s licensing revenue was US$560 million last year, meaning it brought in more patent income than it paid out in fees to other companies to use their patents for a second year.

Huawei and chip plants?

On August 25, the Semiconductor Industry Association (SIA) reportedly informed its members that Huawei has acquired two existing plants and is building three more. It has also received some US$30 billion in government subsidies to help. As Bloomberg reported, it is “a shadow manufacturing network that would let the blacklisted company skirt US sanctions and further the nation’s technology ambitions.”

Simply put, the move into chip fabrication makes sense for Huawei, given its difficulty selling networking gear and its government’s desire to build more chips at home. According to the Washington-based SIA, the controversial telecommunications gear maker, which sits at the heart of US-China tensions, moved into chip production last year and is receiving an estimated US$30 billion in state funding from the government and its hometown of Shenzhen.

In a presentation to SIA members seen by Bloomberg, Huawei has not disclosed its role in this expansion, according to people close to the SIA, who asked not to be identified as sharing non-public information. The US Commerce Department put Huawei on its entity list in 2019, prohibiting it from working with American companies in almost all circumstances.

“But if Huawei is constructing and buying facilities under the names of other companies without disclosing its involvement, as the SIA contends, the telecom giant may be able to circumvent those restrictions to indirectly purchase American chip-making equipment and other supplies that would otherwise be prohibited,” Bloomberg’s report reads.

READ MORE

- Safer Automation: How Sophic and Firmus Succeeded in Malaysia with MDEC’s Support

- Privilege granted, not gained: Intelligent authorization for enhanced infrastructure productivity

- Low-Code produces the Proof-of-Possibilities

- New Wearables Enable Staff to Work Faster and Safer

- Experts weigh in on Oracle’s departure from adland