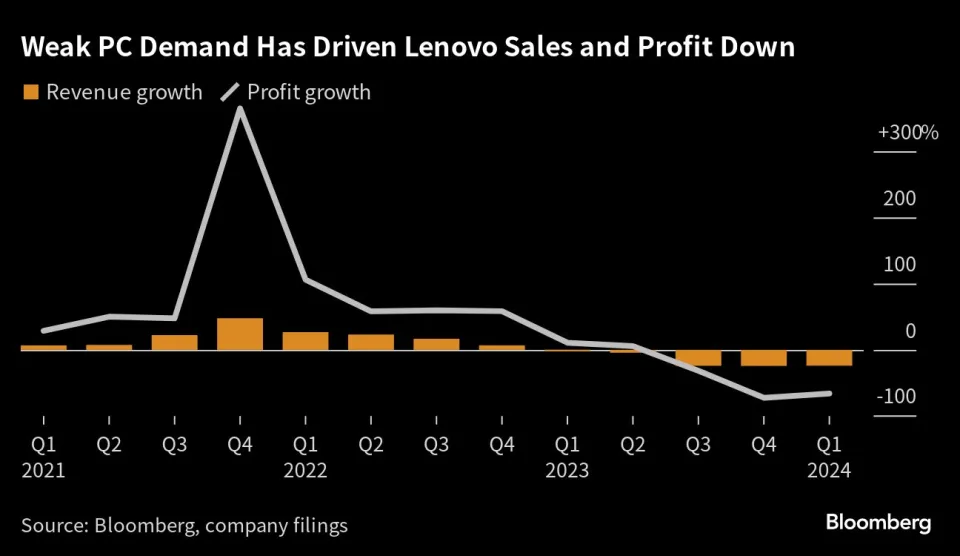

Lenovo saw its net income fall by a staggering 66% in the three months ended June as the PC market slid deeper into a demand slump.Source: Shutterstock

Lenovo: How the prolonged PC downturn is impacting the world’s biggest PC maker

|

Getting your Trinity Audio player ready... |

- Lenovo saw its net income fall by 66% in three monthsas the PC market slid more profoundly into a demand slump.

- Lenovo saw shipments shrink 18.4%, according to IDC.

- Lenovo said the unusual action of clearing inventory weakened profitability for its central business unit.

The pandemic boom may have long been over for the PC market, but demand is still falling. As it impacts all players in the industry, the world’s largest PC maker, China’s Lenovo Group Ltd, has not been spared either. Not only did Lenovo suffer its fourth consecutive quarter of sales decline, the company, for its April to June quarter this year, had posted a worse-than-expected fall in revenue.

In fact, Canalys data from July 2023 revealed that the worldwide PC market decline slowed in Q2 2023, with total shipments of desktops and notebooks down 11.5% year on year to 62.1 million units.

The prolonged slump in global demand for personal computers is bringing most industry players to their knees. Although Lenovo continued to lead the worldwide PC market, it underwent a significant shipment decline of 18% year-on-year (YoY), dropping to 14.2 million units. Lenovo’s net income fell 66% to US$176.5 million in the three months ended June, compared with the average analyst estimate of US$235 million.

Weak PC Demand Has Driven Lenovo Sales and Profit Down. Source Bloomberg

According to a company filing, revenue declined and did not meet consensus expectations at US$12.9 billion. The company even shared that the unusual action of clearing inventory weakened profitability for its central business unit. Chinese consumers are increasingly reluctant to buy smartphones, laptops, and other devices as the world’s second-largest economy slides into deflation.

Before the release of Lenovo’s results, Bloomberg Intelligence analyst Steven Tseng wrote in a memo that he anticipates “the intelligent devices group, which sells PC and smartphones and is the biggest source of revenue, is poised to be the main drag due to sluggish consumer demand and ongoing inventory digestion.”

Despite the past quarter’s challenging market and unfavorable macroeconomic conditions, Lenovo’s Chairman and CEO Yuanqing Yang sees signs of market stabilization and improvement, component prices bottoming out, and believes the client device market can be expected to recover and resume growth in the second half of this fiscal year.

“Last quarter, the macro environment presented challenges, and our hardware business remained in a phase of adjustment, but we persisted in executing our strategy. Our service-led business achieved strong growth and sustained profitability. Our non-PC revenue mix of the group revenue further increased YoY– demonstrating the effectiveness of our diversified growth engines,” Yang noted, adding that he is cautiously optimistic about Lenovo’s business recovery over the next several quarters.

What’s pushing Lenovo higher amidst the global PC slowdown?

Lenovo said the unusual action of clearing inventory weakened profitability for its central business unit. Source: Shutterstock

The world’s largest PC maker is pinning hopes on a new artificial intelligence-powered device to break the deadlock while its core personal computer business remains depressed. “AI could be a silver lining,” Yang told reporters Thursday during a quarterly earnings call. He added that Lenovo has been “embracing AI for years.”

The company has earmarked US$1 billion over the next three years for mainly AI-driven innovation to spur new growth. In a blog posting, Lenovo said it continues to embrace AI from all aspects, having built its advantages in computing power from client to edge to cloud and network.

The PC giant also shared that the US$1 billion in investment for AI in the next three years will focus on providing AI devices, AI-ready and AI-optimized computing infrastructure, and embedded AI-generated content into the intelligent solutions of vertical industries to help customers improve their productivity.

“Looking ahead, Lenovo is leading the transformative shift in personal computing – where to meet the needs of new generative AI workloads, the PC will also need to transform itself into an AI PC. Lenovo sees the future of AI PCs as a disruptive, hybrid blend of client, edge, and cloud technologies, ushering in enhanced functionality, speed, creativity, and immersive, realistic experiences,” the company concluded.

READ MORE

- Safer Automation: How Sophic and Firmus Succeeded in Malaysia with MDEC’s Support

- Privilege granted, not gained: Intelligent authorization for enhanced infrastructure productivity

- Low-Code produces the Proof-of-Possibilities

- New Wearables Enable Staff to Work Faster and Safer

- Experts weigh in on Oracle’s departure from adland