India is now the second-largest phone manufacturing country after China, with two billion ‘Made in India’ smartphones produced between 2014 and 2022.Source: Shutterstock

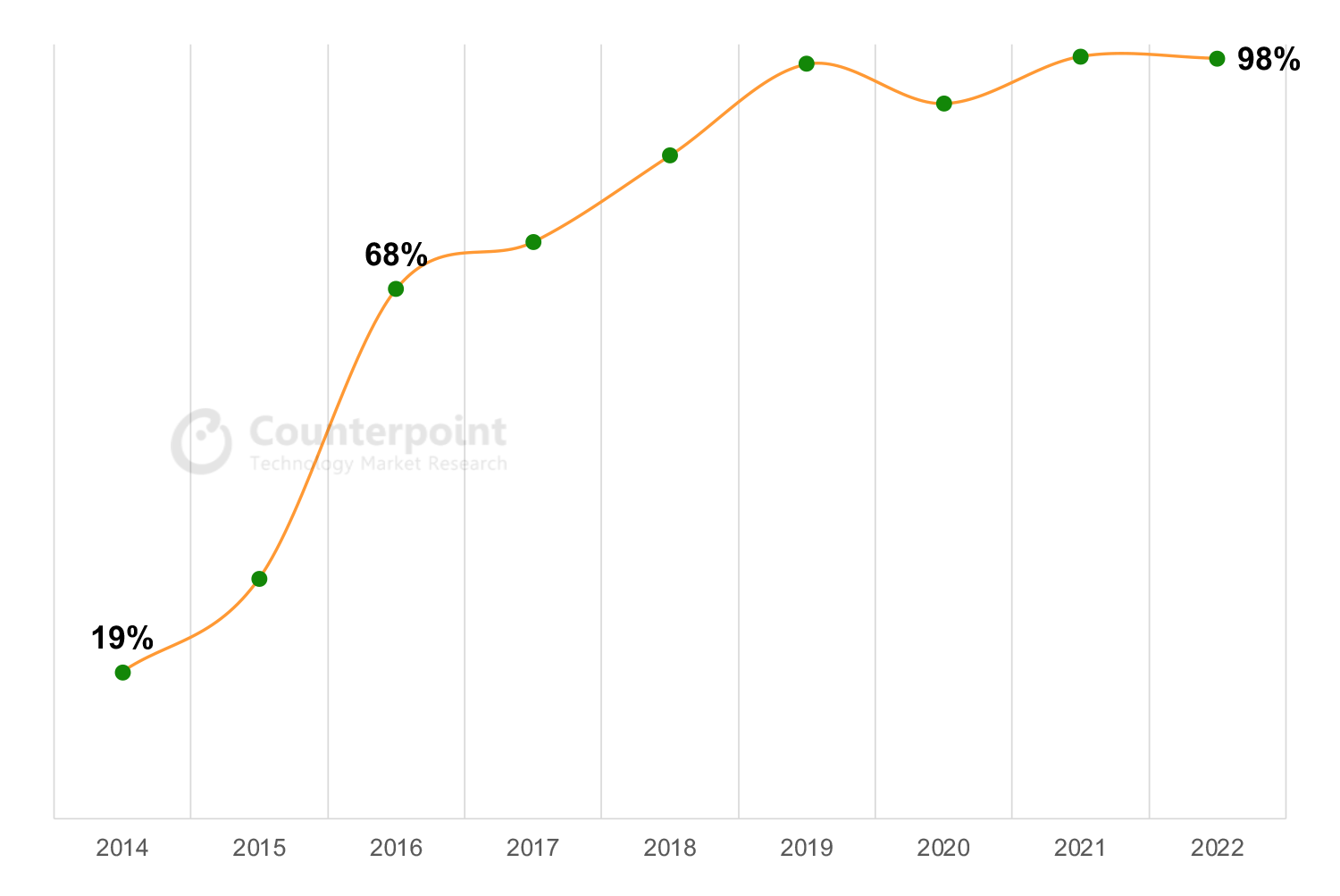

Over 98% of smartphones shipped in 2022 were Made in India

|

Getting your Trinity Audio player ready... |

- India is now the second-largest phone manufacturing country after China, with two billion ‘Made in India’ smartphones produced between 2014 and 2022.

India is now officially the second-largest mobile phone-producing country after China, as the government has crossed the threshold of two billion locally produced smartphones within less than a decade. The latest research from Counterpoint shows that ‘Made in India’ mobile phone shipments crossed the two-billion cumulative units mark, registering a 23% compound annual growth rate between 2014 and 2022.

For context, the ‘Make in India’ initiative was launched globally in September 2014 as a part of India’s renewed focus on manufacturing. In the eight years under the initiative, the Indian government has introduced schemes and initiatives such as the Phased Manufacturing Program (PMP), Make in India, Production Linked Incentive (PLI), and Atma-Nirbhar Bharat (Self-Reliant India) to increase local manufacturing and value addition.

Therefore as Counterpoint’s research director Tarun Pathak puts it, “We have seen local manufacturing increase over the years to meet domestic demand. In 2022, more than 98% of shipments in the overall Indian market were ‘Made in India,’ compared to just 19% when the current government took over in 2014.”

Source: Counterpoint’s ‘Made in India’ Research, 2022

Pathak also noted that his research firm has seen increasing local value addition and supply chain development in the country. “Local value addition in India currently stands at an average of more than 15%, compared to the low single digits eight years ago,” he added.

He highlighted how the impetus has been that many companies are setting up units in the country for manufacturing mobile phones and components, leading to growing investments, increasing jobs, and overall ecosystem development.

“The government intends to capitalize on its various schemes to make India a ‘semiconductor manufacturing and export hub.’ As we advance, we may see increasing production, especially for smartphones, as India aims to bridge the urban-rural digital divide and become a mobile phone exporting powerhouse,” Pathak added.

Before the research report, the government of India revealed in Parliament that due to the PLI Scheme, India stands as one of the fastest-growing mobile phone manufacturers in the world. In fact, since the first quarter of this year, local government data suggest that India has emerged as the world’s second-largest manufacturer of mobile handsets in volume terms.

Frankly, the Indian government has launched and executed many schemes, which have resulted in a big jump in mobile phone manufacturing over the years. Under the ‘Make in India’ initiative, the government introduced the Phased Manufacturing Program and increased import duties on entirely built units and some critical components over the years to push local manufacturing and value addition.

Then under the Self-Reliant India scheme, the government introduced the PLI scheme for 14 sectors, including mobile phone manufacturing. To recall, PLI Scheme for large-scale electronics manufacturing, effective since April 1, 2020, provides financial incentives on net incremental sales to eligible companies involved in mobile phone manufacturing and manufacturing of specified electronic components, including Assembly, Testing, Marking, and Packaging (ATMP) units, for five years.

“Due to all this, exports from India have increased. Going forward, the government is focused on making India a semiconductor hub. It has proposed a semiconductor PLI scheme and now is focusing more on infrastructure with a proposed investment of US$1.4 trillion,” Counterpoint’s senior analyst Prachir Singh said.

Apple to boost Made-In-India smartphones

Apple chief executive Tim Cook met with Prime Minister Narendra Modi in New Delhi (Photo by HO / PIB / AFP) /

According to data from India’s commerce ministry, Apple’s iPhones have propelled smartphones into the top-five most exported commodities from India in the fiscal that ended in March this year. India’s smartphone exports nearly doubled to US$10.9 billion during the year from US$5.4 billion the year before that.

Even in 2022, India-made iPhones surged in volume and value as Apple shifted some production away from China to diversify its supply chain. The shipment volumes of iPhones made in India grew 65% year-on-year, while their value gained 162%, according to Counterpoint’s report in late March.

Overall, Apple last year accounted for 25% of the value of India’s total smartphone shipments, up from 12% in 2021. Looking at the trend, a similar outcome, if not more, can be anticipated for the rest of this year. After all, iPhone sales in India also grew substantially – double-digits – to a new high in its recently concluded fiscal third quarter.

Even Apple’s CEO Tim Cook reckoned India is “at a tipping point.” In short, Apple could continue being a good impetus for and push the Make in India smartphones export higher.

READ MORE

- Safer Automation: How Sophic and Firmus Succeeded in Malaysia with MDEC’s Support

- Privilege granted, not gained: Intelligent authorization for enhanced infrastructure productivity

- Low-Code produces the Proof-of-Possibilities

- New Wearables Enable Staff to Work Faster and Safer

- Experts weigh in on Oracle’s departure from adland