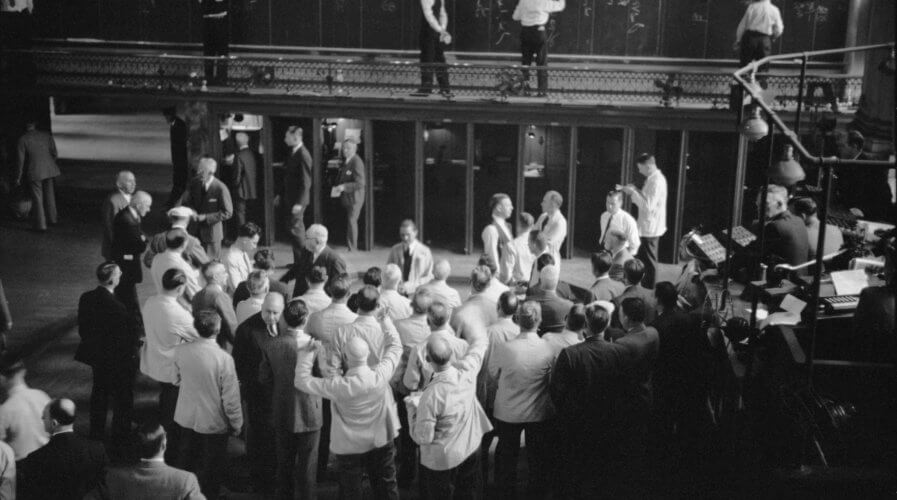

By being adopted by the established futures market, Bitcoin’s acceptance takes a giant leap forward. Source: Shutterstock

Bitcoin’s future’s in futures (trading)

CME Group’s announcement on Oct 31 that it would begin trade in Bitcoin futures helped push the cryptocurrency to new value highs, with the exchange rate touching US$7000 at one point.

CME Group operates the world’s largest options and futures exchange and owns the Dow Jones stock and financial indexes.

Interested observers will note that this move goes a long way to ensuring the cryptocurrency’s mainstream acceptance, but specifically, it brings wholescale trade for goods and services in Bitcoin one step closer.

Apart from the credibility that the CME Group brings to the trade in Bitcoin – which is seen less and less as a nefarious practice – the acceptance into a “proper” futures market means that traders will be able to “go short” on Bitcoin.

Big news, traders. @CMEGroup will launch #Bitcoin futures in Q4 2017. #BTC. https://t.co/6JnEH1u7k3 pic.twitter.com/1ZJL8w6TuL

— CME Active Trader (@CMEActiveTrader) October 31, 2017

For those who are not party to the jargon of the financial markets, “going short” is the mechanism by which commodities’ prices are effectively guaranteed for a specific period of time in the future.

Energy suppliers, for instance, would not be able to operate effectively if they were subject having to buy their raw materials (fossil fuels, for instance) at daily fluctuating prices.

In order to counteract this uncertainty, traders lock in prices on the commodity in question by “hedging”. Rather than buy huge amounts of materials and store them, energy companies buy and sell specific types of options on the futures markets. This activity sets prices so the utilities can plan accordingly.

This aspect of the financial world is relevant to Bitcoin (and eventually other cryptocurrencies) because of the effect it will have, in time, on large retailers.

When exchange rates achieve predictability, companies will be able to trade using Bitcoin as payment, knowing that it can be immediately converted into cash, or hedged, on a huge, regulated exchange that is, for want of a better phrase, the epitome of respectability.

The current risks to wary retailers without this backing are:

- It’s risky to hold Bitcoin as values fluctuate against fiat currencies.

- The new, small companies required to process Bitcoin payments are not yet considered trustworthy.

- There is a risk of inadequate liquidity for Bitcoin: lack of buyers who’ll exchange crypto for fiat.

- Regulatory concerns: counterparties to deals not being in full compliance.

Large companies such as Alibaba or Amazon have careful risk management strategies that, because of all or some of the above, will predicate against adoption of cryptocurrency-based trades.

The acceptance of Bitcoin by the established futures market will mitigate those risks, it is believed.

As liquidity builds and retailers become more aware of the possibilities of Bitcoin (sales tax evasion tax liability optimization may be popular), its adoption should become mainstream, in time.

Once the currency is useful to consumers, the relative price of Bitcoin against fiat currencies will further rise: in classical economics, demand for a currency in a finite supply will make it more pricey.

Until widespread adoption, of course, cryptocurrency is not much more than a speculative investment, like buying/selling gold (or pork bellies!).

A further aspect of the CME Group’s move is that it will provide an easy way into Bitcoin investment for large institutions, who historically have shied away from trades as the specialist outfits involved are small and untested.

By trading in futures, investors won’t have to sully their hands fraternizing with lowly Bitcoin shops. Trade will be in futures, which of course, do not actually involve trades in any form of cryptocurrency whatsoever (in the same way that gold futures trading does not involve any actual gold changing hands).

The futures markets can, however, have huge implications for commodity prices; witness the price variations in gold, silver, oil etc. What happens to Bitcoin prices in the next 8 to 12 months remains to be seen, therefore.