AI is revolutionizing the finance industry. (Image generated by AI)

AI in finance: Is it as good as it gets?

- AI in finance is more than just automation.

- Financial organizations want to leverage existing infrastructure to enable AI.

- It involves more of a shift from monolithic disconnected services to platform-based ecosystem-based banking services.

While organizations around the world continue to be amazed by the capabilities of generative AI, the financial services industry seems to be rather calm about it. That does not mean that financial services are not interested in the capabilities of the technology. Instead, they are more concerned about how they can use the technology while ensuring they meet regulatory requirements.

In fact, AI in the financial industry is no stranger. Even before the hype of ChatGPT and other generative AI models, banks and other financial institutions were already using automation and machine learning tools to not only provide better financial services but also to understand their customers better.

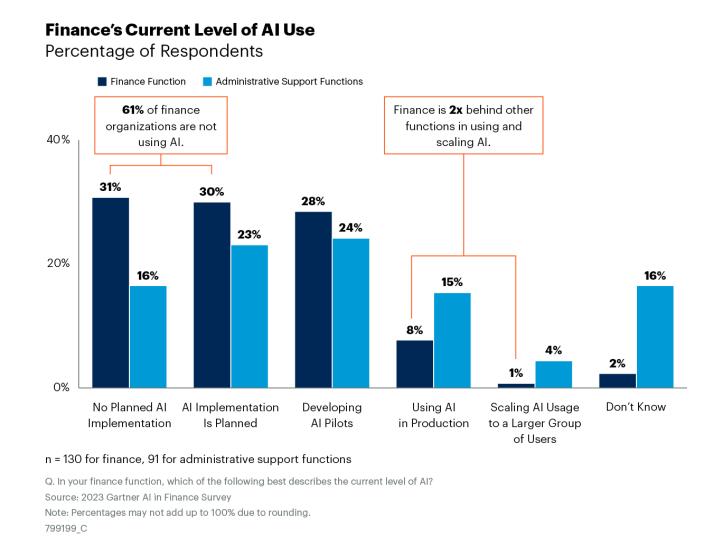

Despite this, a recent report from Gartner shows that most finance organizations have yet to adopt AI, despite optimistic leadership views towards the technology. The survey of 130 finance leaders and 91 associates in administrative support functions in June 2023 revealed that 61% of finance functions either have no plans for AI implementation or are still in the initial planning phase.

Only 9% of finance organizations are in the scaling and using phases, compared to 20% of other administrative support functions, such as HR, legal, real estate, IT, and procurement. Given that financial organizations are the most regulated industry in the world, the use of any emerging technology requires sufficient understanding, especially if it involves sensitive data and information.

AI uses in finance. (Source – Gartner)

Understanding AI use cases in the financial industry

To understand more about how AI can make a difference in the financial industry, Tech Wire Asia caught up with John Duigenan, IBM’s global leader in the financial services industry. Duigenan is an industry veteran and has held technical and business roles spanning the entire product, sales, and implementation lifecycle, with extensive development, service, sales, and technology leadership.

According to Duigenan, the potential of AI in finance can be very significant. It’s not just about helping employees to work better and more efficiently as well as evolving customer service but also looking at how to automate and optimize business processes.

John Duigenan, IBM’s global leader in the financial services industry.

“When I think about the applicability of virtual assistants, machine learning, natural language processing, deep learning and such, these are things that we’ve been engaged with for our clients for the last couple of years since the advent of Watson. Generative AI has been a fantastic development for all of us, in terms of creating the public consciousness and making it a daily topic of conversation that has triggered and stimulated pretty much every firm to look into generative AI and consider where the value, the benefits as well as where the productivity will be generated,” said Duigenan.

Duigenan believes Southeast Asia has some of the most innovative financial services in the world. This includes some of the breakthrough innovations around platform-based ecosystems as well as where some of the most innovative firms are, in terms of their adoption of hybrid cloud technologies.

Duigenan believes that this is a place where the value of generative AI can be delivered and can be realized quickly because there is an innovation appetite.

“We tend to think that the pandemic was the reason that everything changed. But if you think about all the things that have happened since the pandemic, and continue to happen in the world, there’s so much. If the pandemic indeed taught us something, it is that the only certainty is uncertainty. Because when you think about all the things that have happened in the world since the pandemic, it continues to impact how businesses and financial services firms run.

Whether it’s disruption in financial markets, increasing interest rates, inflation and unemployment, or whether it’s political instability in every region, all of these things are changing the way that firms do business,” explained Duigenan.

At the same time, Duigenan pointed out that all this uncertainty is a massive competitive destruction. As such, a traditional bank will not only have to deal with all this uncertainty, but also have new companies that come in to take the business from them.

“If you’re the CIO of a bank, you’ve got to deal with those situations. This includes grabbing, saving, complying, fortifying, and transforming your business to be ready for this disruption. Those are wild combinations of complexity. So, when you think about technology providers like IBM, we understand this space really well. We understand that disruption and we also have a strong vision for how to apply hybrid cloud and AI directly into these situations in a way that’s very suitable for regulated firms like financial services,” added Duigenan.

Is AI really disrupting financial services? (Image generated by AI)

AI and regulations in finance

As financial institutions have a lot more regulations to comply with compared to any other industry, adopting new technologies has its fair share of challenges, too.

While most regulators are open to banks and other financial service providers using new technologies to improve their products and services, they need to make sure the technology has been well-tested and will not be easily compromised.

When it comes to AI, the regulations grow beyond just financial regulators, especially with governments also coming together to ensure the technology is developed in a way that is beneficial and does not cause problems.

For Duigenan, the success of AI in financial services comes down to how the industry uses the technology. This not only includes the use of AI but also the use of the cloud and other technologies in their digital transformation journey.

“When you run a bank, you need your transactions to work, you need to use technology, like the IBM mainframe, where we assure the quality of those transactions and the security and the throughput. But it’s important for banks to use their existing technologies in new ways. It’s about extending the value of those existing investments. For example, wrapping APIs around COBOL modules, to enable that code to be used in new ways.

One of the most exciting areas where we work is in helping our clients deliver digital transformation, in harmony with the necessary modernization that needs to happen in many systems. Companies don’t want to spend millions. They want to take their existing assets and use them in new ways,” he explained.

For example, within the Watsonx Code Assistant for IBM Z. IBM Z has the ability to use generative AI to look at existing code assets in COBOL and use them in new ways. Duigenan believes this is game-changing for developer productivity.

IBM watsonx Code Assistant.

As such, while regulations are key to AI in finance, there is also the need for banks to use their existing systems and their existing data, especially since data in most financial services firms are still in siloes.

“Opening access to data, opening code for use in new ways, and being able to meet the regulatory moment. That’s exactly how AI in finance should be. And that’s exactly how we work with every kind of financial services firm, to support them on their transformation and modernization journeys.

When we work with large financial services firms anywhere in the world, every single one of them pretty much, even if they’re only a few years old, has technical debt. Some have the technical debt of firms that are now 60 years old. And whatever the situation, we work with firms to help them understand what they have,” said Duigenan.

When it comes to AI, the regulations grow beyond just financial regulators. (Image generated by AI)

The case of false positives

As banks and other financial services providers look to AI to improve their products and services, one of the use cases of AI in the industry is for fraud detection. In fact, AI for fraud detection has been around for a longer time compared to other AI use cases in the financial industry.

While AI in fraud detection has helped the industry manage and detect fraud better, there are still concerns about false positives. Duigenan highlighted that false positives have been around for some time and that firms are trying to deal with them. He also believes that having false positives could be a good thing.

“Money laundering systems, or specifically transaction monitoring are the best examples of false positives. Transaction monitoring systems will look at every single transaction going through and make a determination about two fundamental things. Is this a potential financial crime? Is this a potential fraud? In those situations, you’re more inclined to accept false positives, because a false negative means that you allowed a crime.

So false positives may not always be a bad thing. It means your algorithms are being cautious, or your machine learning models are being cautious. And from a regulatory point of view, that’s probably a good thing. Regulators want those algorithms to be effective to catch fraud to catch money laundering,” he explained.

“However, firms will still need to investigate and look at the false positives. Machine learning can help in determining which of a selection of false positives could be auto-disposed. If a firm can determine false positives automatically, and reduce the volume by 30 to 50%, that’s productivity and safety right there.”

For optical character recognition, around document processing and such, the technology has made it massively better now compared to what it used to be. Depending on the type of document being processed, whether it is machine-generated or handwritten, the accuracy is significantly better.

Duigenan added that natural language processing can also be applied to optical character recognition and anticipate what the content should be with a reasonable level of accuracy.

AI can help with fraud detection and also reduce false positives. (Image generated by AI)

The future of AI in finance

Given the increasing developments in AI, Duigenan believes that the disruption that’s happening in banking is really about the shift from monolithic disconnected services to platform-based ecosystem-based banking services. That’s where it’s exciting and that’s where every bank’s journey is.

“For us from a technology point of view, all of those platform-based services, ecosystem services, where fintech and banks are interconnected, that all run on hybrid technologies, like APIs and microservices, and run hybrid cloud technologies like Red Hat OpenShift, and IBM Financial Services cloud. AI will be in every part of the product on the operation lifecycle, every single part.

“Whether it’s customer insight, customer marketing, contextual customer service, automated onboarding, automated fulfillment, automated decision-making or automated operations. A massive impact of AI is in how the operation of federated platforms-based services runs across the multiple elements of a hybrid cloud.

“AI will be everywhere, in the business processes and the technology services that run these new platform-based ecosystems,” concluded Duigenan.

READ MORE

- Safer Automation: How Sophic and Firmus Succeeded in Malaysia with MDEC’s Support

- Privilege granted, not gained: Intelligent authorization for enhanced infrastructure productivity

- Low-Code produces the Proof-of-Possibilities

- New Wearables Enable Staff to Work Faster and Safer

- Experts weigh in on Oracle’s departure from adland