Carsome has trimmed hundreds of jobs twice since last year to cut costs for profitability ahead of a potential IPO.Source: Carsome

Is the Carsome unicorn status in Malaysia overhyped amidst recent layoffs?

- Carsome has undergone two rounds of significant layoffs, cutting hundreds of jobs since last year to enhance profitability before a potential IPO.

- The company is cutting jobs across Southeast Asia, with Indonesia and Thailand being the most affected.

- The company anticipates breaking even this year and aims for its first full year of profitability in 2024.

After going through an “optimization of the workforce” in September 2022, Malaysia’s only tech unicorn, Carsome, appears to be gearing up for additional layoffs in the coming months. According to several reports, the move comes as the Southeast Asian used-car online marketplace accelerates its efforts to break even by the end of this year and reach full-year profit in 2024.

The company employs approximately 4,000 people across Malaysia, Indonesia, Thailand, Singapore, and, most recently, the Philippines. The first layoffs in late September 2022 only impacted its Malaysian workforce. Now, according to a Bloomberg report, the Temasek-backed unicorn is contemplating job cuts throughout Southeast Asia, with Indonesia and Thailand being the most affected.

Quoting individuals familiar with the situation, Bloomberg reported that Carsome has scaled down its operations significantly in those two markets it entered in 2017. The company had earlier outlined intentions for an initial public offering (IPO) and stock market listings in Singapore and the United States (US) in 2023. Still, some concerns exist that deteriorating macroeconomic conditions could dent its valuation.

In an interview with Nikkei Asia earlier this month, CEO Eric Cheng explained that Carsome is considering an IPO as one of the potential avenues for the future, and that timing considerations and favorable market conditions will influence the decision.

How is Carsome doing financially amid recent layoffs?

Southeast Asia’s largest integrated car e-commerce platform, Carsome Group Inc.

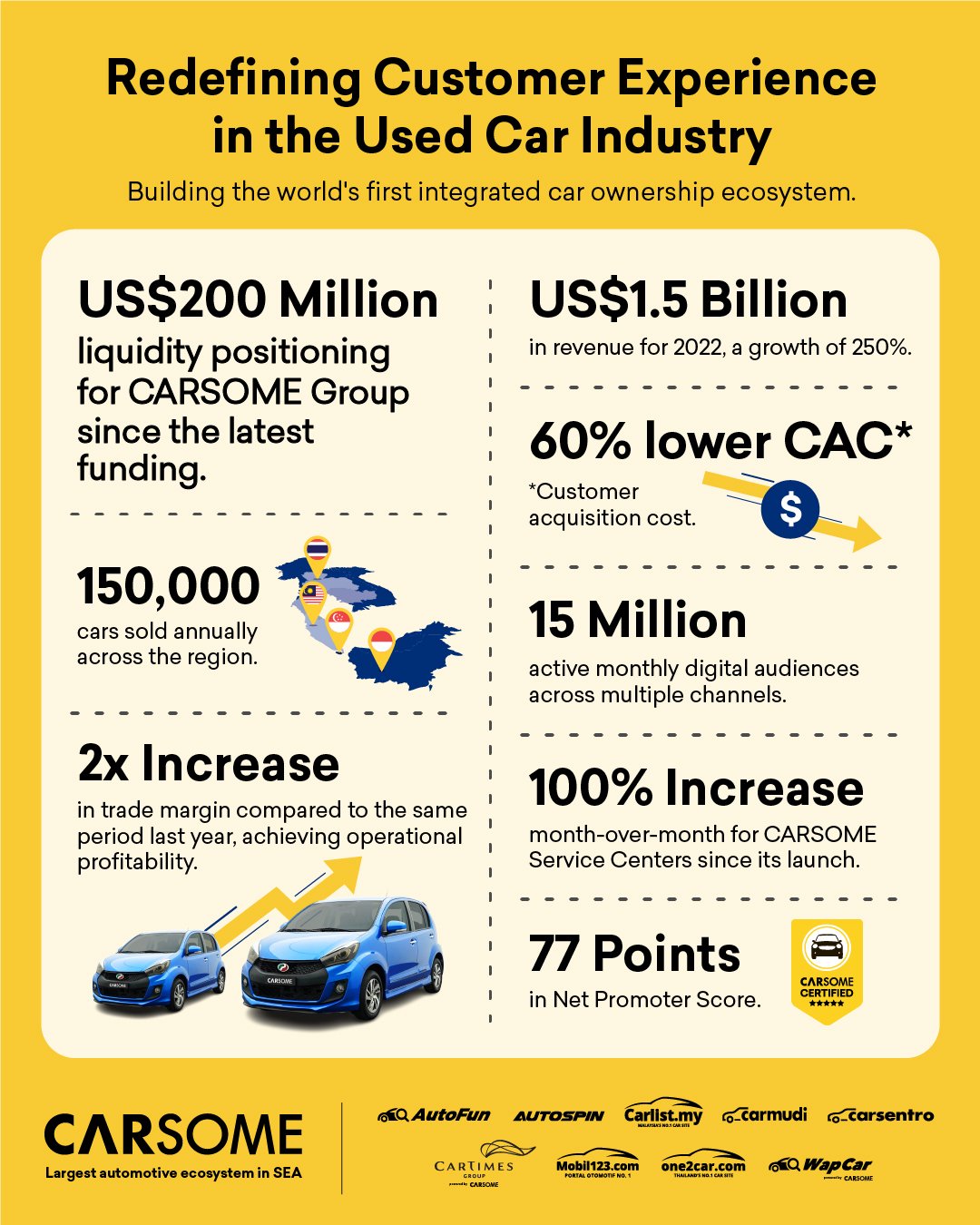

The driving force behind Carsome’s profitability is its retail arm, which provides refurbished cars and ancillary services like auto financing, insurance, and post-sale services. Launched approximately three years ago, the retail business (Carsome Certified) contributed 35% of Carsome’s US$1.5 billion revenue in 2022.

In an interview with Forbes, Cheng noted that the trade margin, representing the transaction profit after subtracting associated operating costs, stands at 13% – twice that of the core wholesale business. According to Cheng, Carsome, which claims to be the region’s largest online used-car platform by revenue and transaction volume, sold more than 150,000 vehicles last year, equivalent to a 3% market share of Southeast Asia’s used-car e-commerce market.

By the first three months of 2023 (1Q23), the group achieved its operational profitability milestone for the first time, primarily driven by a significant growth of trade margin, which doubled compared to the same period last year. “Notably, more than 80% of the trade margin came from high-quality transaction margins, far ahead of most of its global peers,” Carsome noted in a blog post.

In terms of funding, in September 2023, Carsome secured US$170 million in Series D2 round funding, elevating the company’s valuation to US$1.3 billion. That funding round marked Carsome’s most significant equity investment, with participation from international investors such as Catcha Group, MediaTek, Penjana Kapital, and Emissary Capital, alongside existing partners like Asia Partners, Gobi Partners, 500 Southeast Asia, Ondine Capital, MUFG Innovation Partners, and Daiwa PI Partners.

Are layoffs the only way for Carsome to be profitable?

The company also secured new credit facilities of US$30 million, bringing its total liquidity to approximately US$200 million, enabling the company to pursue various growth initiatives. These initiatives encompass extending auto financing, insurance, and after-sale services beyond Malaysia to other markets where Carsome operates.

Cheng expressed to Forbes the company’s goal for the upcoming year: sustaining growth, increasing market share from 3% to 5%, and aiming for 10% in subsequent years while maintaining profitability amidst pursuing diverse opportunities.

But should the workforce of 4,000 employees be trimmed further to achieve the company’s goals? Carsome “makes adjustments to its workforce where necessary,” the company said in an emailed response to Bloomberg, declining to comment on specific numbers. “We remain committed to investing in all of our current markets and plan to accelerate profitable growth in 2024,” it added.

Carsome has trimmed hundreds of jobs twice since last year to cut costs for profitability ahead of a potential IPO.

(Source – Shutterstock)

Are layoffs a prerequisite to the stock market listing?

While layoffs might indicate a company’s readiness to go public, it’s not a definitive signal. Other factors, like financial challenges or shifts in business strategy, could also prompt layoffs. However, it is crucial to understand that a decision to go public doesn’t automatically signify financial stability or success for a company.

Nonetheless, it’s conceivable for companies to trim their workforce to enhance their financials before undergoing an IPO. Following the first round of layoffs last year, some avid Carsome followers expressed dissatisfaction with the startup’s direction. “Over the next quarter, we could see more layoffs coming from Carsome, all because the top management doesn’t know what to do with the money from investors,” Crazy Tan argued in a post.

But Carsome has publicly claimed its profitability, leading many to begin questioning the rationale for laying off hundreds of staff to achieve further financial gains. Perhaps Carsome is reversing its efforts after going on a hiring spree until early 2022. Now, workers are bearing the brunt of pullbacks.

READ MORE

- Safer Automation: How Sophic and Firmus Succeeded in Malaysia with MDEC’s Support

- Privilege granted, not gained: Intelligent authorization for enhanced infrastructure productivity

- Low-Code produces the Proof-of-Possibilities

- New Wearables Enable Staff to Work Faster and Safer

- Experts weigh in on Oracle’s departure from adland