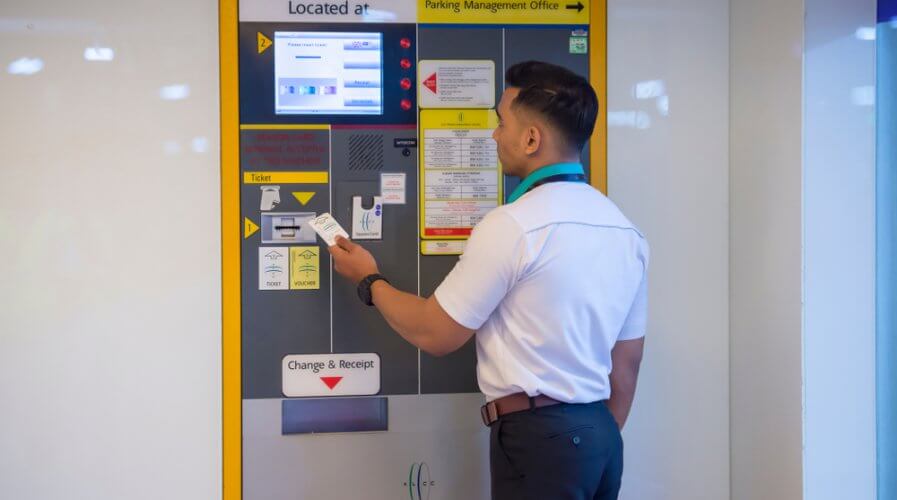

Malaysia has cashless options, but Malaysians prefer cash. Source: Shutterstock

What’s really preventing Malaysia from going cashless?

GOING cashless has many benefits for a nation, and Malaysia’s government is keen on creating the infrastructure to help its residents and businesses make that transition.

And although businesses in the country have made significant progress towards cashless payments, residents are struggling to make the leap.

According to a new Nielsen study, 67 percent of consumers in the country have used some form of cashless payment, with debit cards and online banking being the most preferred non-cash channels. However, a very small percentage prefer to use cashless payments to pay for meals, groceries, and other everyday expenses.

To be precise, while 63 percent percent of Malaysians have a debit card, 93 percent prefer cash when they dine out, 90 percent use cash when they buy groceries, 89 percent use cash for public transport, 81 percent for petrol, and 81 percent for taxis.

Despite the challenges to digital payments, the study revealed that Malaysians prefer to make recurring expenses such as phone and internet bills (53 percent), utility bills (47 percent), car loan installments (38 percent) and rent (37 percent) via online banking because of the sheer convenience it offers.

The growing opportunity for mobile wallets in Malaysia

Only 8 percent of Malaysians use mobile wallets — but Nielsen believes it represents a great opportunity for banking and fintech businesses in this space.

“Malaysia’s younger, more tech-savvy population, which may not have sufficient credit history to qualify for a card, could be more open to using e-wallets for everyday expenses due to the convenience factor,” said Nielsen Malaysia Consumer Insights Executive Director Anil Antony.

Given the high smartphone penetration and mobile data usage in Malaysia, mobile wallets have relatively fewer hurdles to cross before they hit critical mass in the market.

Consumer awareness is also quite high in the country, measuring up at 88 percent. The number is much higher compared to other markets such as Thailand and the Philippines, meaning convincing customers to try out mobile wallets is going to be easier for companies in Malaysia.

Nielsen found that existing mobile wallet users cite convenience as the biggest driver of usage, and believe that adoption will continue to rise driven by the increasing popularity of app-based online shops, ride-hailing services, online gaming, and cinema ticket bookings.

However, in order to make the most of the opportunity in this space, banking and fintech companies need to overcome the following challenges:

# 1 | Confidence

According to Nielsen, security is a top barrier to e-wallet adoption among non-users. Fifty percent of those not already using a mobile wallet are concerned about security/fraud related to digital money.

If the 92 percent of the country’s population not already using mobile wallets have to be convinced to give the technology a shot, banking and fintech companies must work on ensuring security concerns are alleviated.

# 2 | Control

Thirty-four percent of the respondents told Nielsen that concerns about overspending prevented them from moving away from physical cash to mobile wallets.

In order to overcome this challenge, mobile wallet providers must provide more control to their users by way of in-app and online checks and balances that help analyze and control expenditures without diminishing the overall experience of using mobile wallets.

# 3 | Convenience

Mobile wallets are only useful if a majority of the merchants in the country accept it as a form of payment.

At the moment, retail businesses in Malaysia are in the early stages of mobile payment adoption. It’s something that movie theaters, grocery and convenience stores, and some petrol stations accept but not many malls and taxi drivers welcome mobile wallet payments. That needs to change.

According to Nielsen, 27 percent of non-users cite low merchant acceptance as the reason for staying away from mobile wallets.

Although this represents a massive opportunity for companies, it means that banking and fintech companies that want to succeed in the market need to work on getting more merchants onboard.

READ MORE

- Ethical AI: The renewed importance of safeguarding data and customer privacy in Generative AI applications

- How Japan balances AI-driven opportunities with cybersecurity needs

- Deploying SASE: Benchmarking your approach

- Insurance everywhere all at once: the digital transformation of the APAC insurance industry

- Google parent Alphabet eyes HubSpot: A potential acquisition shaping the future of CRM