(Photo by Kirill KUDRYAVTSEV / AFP)

Increasing cybersecurity awareness vital as digital payments become mainstream in APAC

Cybersecurity awareness is still not as high as it should be today. While businesses continue to advocate the importance of cybersecurity to its employees, the awareness normally wears off when it comes to doing non work tasks.

The COVID-19 pandemic has led to an increase in digital payments around the world. While online banking has been dominant, more users are now preferring to transact over mobile banking or e-wallets.

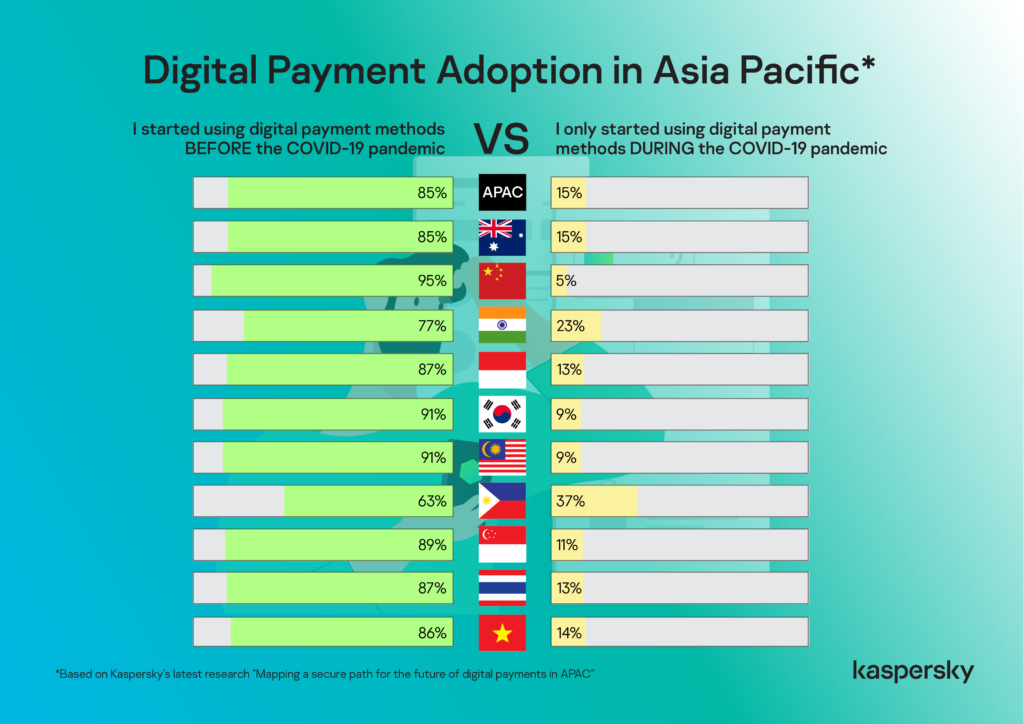

According to findings from Kaspersky’s “Mapping a secure path for the future of digital payments in APAC”, 90% of the Asian respondents have used mobile payment apps at least once in the past 12 months, confirming the fintech boom in the region. Nearly 2 in 10 of them only started using these platforms after the pandemic. In fact, the Asia Pacific (APAC) region is the largest contributor to global payments revenue, with analysts expecting the sector to exceed US$ 1 trillion revenue by 2022 or 2023.

The research studied local users’ interactions with the available online payments in the region and examined their attitudes towards them, which hold the key to understanding the factors that will further drive or stem the adoption of this technology.

For Chris Connell, Managing Director for the Asia Pacific at Kaspersky, the figures clearly indicate how consumer behaviors have changed. Tech-assisted shopping has created new opportunities for retailers while mobile devices influence shopping behaviors as well. The use of cash is no longer prioritize for hygiene reasons as well. But with increasing digital payments, digital risks increase as well, and a lack of cybersecurity awareness is concerning.

“The surging demand for digital payments has transformed the way we transact both online and offline. Businesses are now digitalizing their operations to capture additional revenue through digital payments, while consumers are heavily reliant on it due to the ease and convenience it offers. It is clear that the demand for quick, efficient, and low-cost payment experiences will encourage further innovation in this space, and we are seeing that happening with the emergence of real-time payment rails,” commented Chris.

(Source – Kaspersky)

The Philippines logged the highest percentage of new e-cash adopters at 37%, followed by India (23%), Australia (15%), Vietnam (14%), Indonesia (13%), and Thailand (13%). The lowest number of first-time online payment users are China (5%), South Korea (9%), and Malaysia (9%).

China has been a notable leader in mobile payments in APAC. Even before the pandemic, its top local platforms, Alipay and WeChat Pay, have witnessed significant mass adoption and served as an example to follow for other Asian countries.

Adhering to social distancing was one of the reasons why digital payments are increasing despite some security concerns. However, for 29% of users, digital gateways are more secure now compared to the pre-COVID-19 era and the same percentage also appreciate the incentives and rewards providers offer.

At the same time, cybersecurity awareness is slowly increasing among some users. For example 48% of users is high as they fear they will lose money online while another 41% are afraid of storing their financial data online. Almost 4 in 10 also revealed they do not trust the security of these platforms. More than a quarter also find this technology too troublesome and requires many passwords or questions (26%), while 25% confessed their personal devices are not secure enough.

“To drive a secured digital economy forward, it is important for us to know the pain points of our users and identify the loopholes that we need to address urgently. It is a welcome finding that the public is aware of the risks that come with online transactions and because of this, developers and providers of mobile payment applications should now look into the cybersecurity gaps in each stage of the payment process and implement security features, or even a secure-by-design approach to fully gain the trust of the future and existing digital payment adopters,” added Connell.

During his session at the Marking the Money Movement: The Latest Financial Threats in APAC, Cornell suggested the following steps when using digital payment platforms on any device:

- Be wary of fake communications and adopt a cautious stance when it comes to handing over sensitive information. Do not readily share private or confidential information online, especially when it comes to requests for financial information and payment details.

- Use own devices and network when making payments online. Public computers and networks may have spyware running on them recording everything typed on the keyboards, or the Internet connection has been intercepted by criminals waiting to launch an attack.

- Never share passwords, PIN numbers, or one-time passwords with anyone. While it may seem convenient, or a good idea, these provide an entryway for cybercriminals to trick users into revealing personal information to collect bank credentials.

- Adopting a holistic solution of security products and practical steps can minimize the risk of falling victim to threats and keeping your financial information safe. Utilize reliable security solutions for comprehensive protection from a wide range of threats to help check the authenticity of websites of banks, payment systems, and online stores visited, as well as establish a secure connection.

At the end of the day, users need to have cybersecurity awareness and be vigilant when using digital payments. After all, humans are the weakest link whenever it comes to any cyberattack or breaches. The same applies for digital payment adoption as well. Taking security lightly when using digital payment platforms may just cause more problems in the future.

READ MORE

- Strategies for Democratizing GenAI

- The criticality of endpoint management in cybersecurity and operations

- Ethical AI: The renewed importance of safeguarding data and customer privacy in Generative AI applications

- How Japan balances AI-driven opportunities with cybersecurity needs

- Deploying SASE: Benchmarking your approach