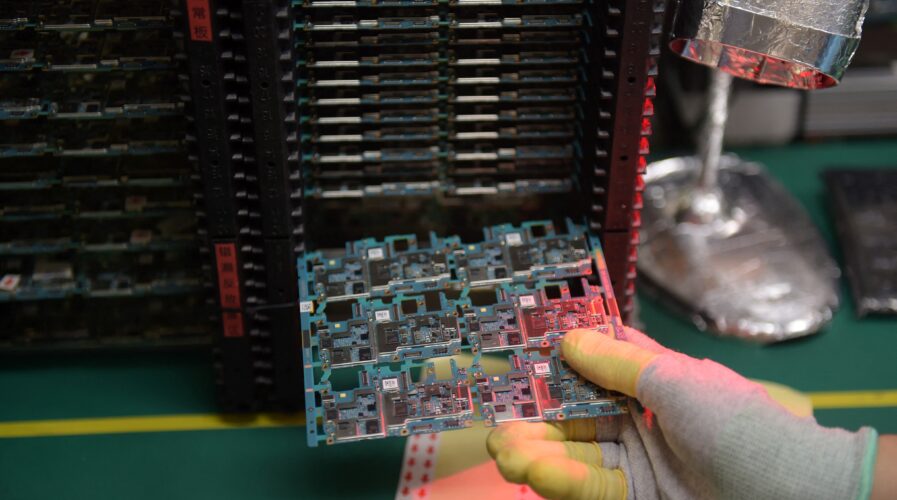

Two years later, are we finally reaching the end of a global chip shortage? (Photo by Nicolas ASFOURI / AFP) / TO GO WITH China-US-SKorea-telecommunication-wireless-Oppo, FOCUS by Julien GIRAULT

Two years later, are we finally reaching the end of a global chip shortage?

- Some experts and auto companies predict that the global chip shortage could ease by the second half of this year.

- Deloitte reckons many types of chips will still be in short supply throughout 2022, with some component lead times pushing into 2023.

- An oversupply by 2024 is possible especially after most of the pipeline foundry capacity announced recently is operational, a report suggests.

It has been two years since Covid-19 turned into a global pandemic. Numerous changes and events unfolded after, but one dilemma that still persists till date is the global chip shortage. It has left many countries and companies scrambling to keep supply chains running — all amidst mounting demand from around the world.

To put the severity into context, Goldman Sachs reckons that in total, 169 industries have faced the crunch, including automobiles, computers, medical equipment and other electronic devices. Under usual circumstances, within most industries, gaps in supply are addressed fast by ramping up businesses production and addressing bottlenecks.

The chip industry though has its own way of functioning. Hence, when supply was impacted due to the pandemic and global lockdowns, the world was left crippled. Factories were shut down, causing disruption in the supply of most companies, especially the ones that had no buffer stock. On the demand side, laptops and other electronic devices were products that were most in need.

Then lockdowns eased and the economy recovered, partially if not fully, and the same was with car sales too. All of which led to greater demand for chips. The magnitude of the demand can be seen through industry’s growth rate whereby the global semiconductor revenue rose 25.1% in 2021 to total US$583.5 billion. It was the first time the industry crossed the US$500 billion threshold, according to Gartner.

So when will the global chip shortage come to an end?

As Deloitte puts it: “The world is hungry for products enhanced by a growing volume of chips, but they’ll be kept waiting throughout 2022 until supply catches up with rising demand, especially for chips made locally.” The consultancy firm predicts that many types of chips will still be in short supply throughout this year, with some components even having lead times pushed into 2023.

In short, the shortage will have lasted 24 months before it recedes, similar to the duration of the 2008–2009 chip shortage, Deloitte noted. Separately, a handful of experts reckon the chip shortage plaguing the semiconductor and electronics industries will most likely ease in the second half of this year after automotive-related backlog is addressed in the first half.

The automotive industry is perhaps most widely known to have been affected by the chip shortage. “Post-Covid economic rebounds in 2021 caused shortages in the supply chain that hit the automotive industry particularly hard, ” Gartner’s research VP Andrew Norwood said.

While some automakers are less convinced that the end to the global chip shortage is anywhere in sight, the general consensus is that it may ease by the second half of this year. German automaker Volkswagen believes the semiconductor shortage will go on in the first half of 2022, and the situation should ease slightly in the second half of the year, according to Reuters.

In a separate Reuters report, other automakers including General Motors, Ford and Hyundai similarly predict that the chip shortage will ease in the second half of this year, however automotive chip producers such as NXP and Infineon have forecast that supply will continue to be short.

“Supply limitations are far from over, and will persist well into 2022,” Infineon CEO Reinhard Ploss was quoted by Reuters as saying in an investor call, and Infineon is concerned that the spread of the Omicron variant of the virus would lead China to shut factories and limit supply. Meanwhile, NXP said that the industry would not be getting out of the supply-demand imbalance this year, the report wrote.

Lingering but with less severity

While the shortage will endure through 2022, Deloitte Global believes it will be less severe than in fall 2020 or most of 2021, and it will not affect all chips. “In mid-2021, customers were waiting between 20–52 weeks for multiple kinds of semiconductors, causing manufacturing delays or shutdowns which led to revenue losses in the tens or even hundreds of billions of dollars,” the firm said.

By the end of 2022, it predicts those lead times to be closer to 10–20 weeks and the industry will finally be in balance by early 2023. “Considering that chip shortages are likely to last through 2022, everybody should be prepared for longer lead times and possible delays. The extent of these will likely vary by industry and application,” Deloitte noted.

There is however one big challenge for semiconductor makers, distributors, and equipment suppliers would face: the boom-and-bust cycle which the industry is known for. “Historically, every shortage has been followed by a period of oversupply, resulting in falling prices, revenues, and profits,” Deloitte concluded.

READ MORE

- Strategies for Democratizing GenAI

- The criticality of endpoint management in cybersecurity and operations

- Ethical AI: The renewed importance of safeguarding data and customer privacy in Generative AI applications

- How Japan balances AI-driven opportunities with cybersecurity needs

- Deploying SASE: Benchmarking your approach