India wants to ban budget phones from China — a blow to Xiaomi, Realme and peers. (Photo by Sajjad HUSSAIN / AFP)

India wants to ban budget phones from China — a blow to Xiaomi, Realme and peers

- India is apparently seeking to restrict smartphone makers from China, from selling devices cheaper than 12,000 rupees (US$150).

- India seems to be seeking to exclude Chinese smartphone giants from the lower segment of the world’s second-biggest mobile market.

- The government is concerned that brands like Xiaomi and Realme are undercutting local manufacturers.

In India, smartphones under US$150 (Rs12,000) contribute to a third of the country’s sales volume for the quarter through June 2022, according to International Data Corporation (IDC). Out of the total, smartphones from China account for up to 80% of those shipments, market tracker Counterpoint’s data shows. Considering the dominance, the Indian government is concerned about the livelihood of its local players.

Therefore, there are claims that the administration is considering restricting the sale of Chinese budget smartphones in the country — a move that would impact players like Xiaomi Corp, Realme, Transsion Holdings and others. “The move is aimed at pushing Chinese giants out of the lower segment of the world’s second-biggest mobile market,” Bloomberg reported, quoting people familiar with the matter.

As it is, there are mounting concerns about high-volume brands like Realme and Transsion undercutting local manufacturers, which Bloomberg too verified with their sources. Should the exclusion from the entry-level market be imposed, it would certainly hurt Xiaomi and its peers from China who have increasingly relied on India in recent years, to drive growth, as to also buffer the impeded growth in their home market.

Bloomberg Intelligence analysts Steven Tseng and Sean Chen reckon that Xiaomi smartphone shipments may fall by 11-14% a year, or 20-25 million units, with sales decreasing by 4-5%, should the ban on smartphones below US$150 be enacted in India. Those range of smartphones accounts for 25% of the segment in India, which is Xiaomi’s most important overseas market.

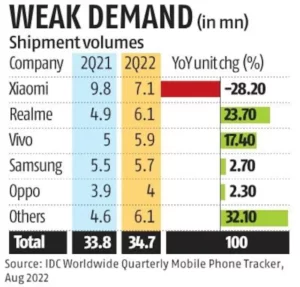

Based on IDC’s data, 66% of Xiaomi’s smartphones are priced under US$150. IDC also noted that Xiaomi continued to be the top-selling brand, although having witnessed a big drop in shipments due to supply constraints through the first half of 2022. IDC also shared that realme climbed to the second slot for a second time, with a strong YoY growth of 24%, highest among top five vendors in the second quarter of the year.

India top five smartphone companies in 2Q22.

Source: IDC

“It cemented its second position in the online channel with 23% share with affordable model offerings in the C-series. With two-thirds of its portfolio on UNISOC chipsets, realme ensured strong supplies in the entry-level price segment,” IDC said. Overall, the sub-US$200 segment has suffered the worst due to supply problems, IDC shared.

Interestingly, the premium segment of over US$500 was the highest-growing with 83% growth year-on-year (YoY), but it still makes just 6% of the market. The rumored move, should it materialize, wouldn’t affect Apple Inc. or Samsung Electronics Co., which price their phones higher.

To put it into context, the relationship between China and India has been in a state of limbo of late. New Delhi has already subjected Chinese firms operating in the country, such as Xiaomi and rivals Oppo and Vivo, to close scrutiny due to their finances, which has led to tax demands and money laundering allegations. The government has previously employed unofficial means to ban Huawei Technologies Co. and ZTE Corp. telecom equipment.

Just last week, India’s junior tech minister told the Business Standard newspaper that Chinese smartphone players now sell the vast majority of devices in India, but their market dominance has not been “on the basis of free and fair competition.” Apparently, the Indian government has also been asking Chinese executives to build local supply chains, distribution networks and export from India, suggesting New Delhi still very much wants their investment, Bloomberg noted.

READ MORE

- The criticality of endpoint management in cybersecurity and operations

- Ethical AI: The renewed importance of safeguarding data and customer privacy in Generative AI applications

- How Japan balances AI-driven opportunities with cybersecurity needs

- Deploying SASE: Benchmarking your approach

- Insurance everywhere all at once: the digital transformation of the APAC insurance industry