The US intends even to restrict cloud and computing access to China, but the regulation process is expected to be complicated.Source: Shutterstock

Is cloud computing the next target in the US-China tech war?

|

Getting your Trinity Audio player ready... |

- The US intends to restrict cloud and computing access to China.

- The regulation process is expected to be complicated.

- Cloud services provided by Amazon and Microsoft will be targeted.

The United States is going on offense with China, finding every loophole that allows the latter to bypass the export controls imposed by the former since last October. On top of plans to impose new restrictions on the export of artificial intelligence (AI) chips to China, the Biden administration has plans to restrict access by China to American cloud computing services.

In short, the US is still finding ways to pull out all the stops and restrict China’s companies and military with the computing power needed to advance. Quoting a person familiar with the discussions, Bloomberg said, “The US is considering restrictions on China’s access to computing over the Internet, or the cloud, to limit that country’s ability to develop AI capabilities.

The alleged new restrictions may require US cloud computing providers such as Amazon and Microsoft to gain government permission before providing service to Chinese clients to prevent Chinese AI companies from “gaining technologies” by bypassing the US government’s export controls, according to a report by the Wall Street Journal.

Based on the export controls released last October, the US government has banned the export of advanced chips, including the Nvidia A100, to China. Despite that, Chinese companies can access the chip from any cloud computing services provider, the Wall Street Journal report indicated.

Will the cloud computing restriction impact China?

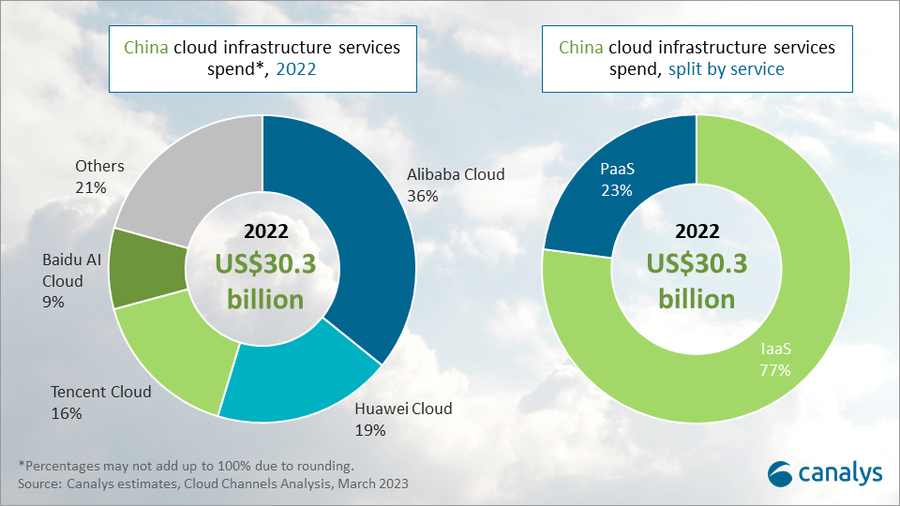

As per reports, the effort is a top priority for the Commerce Department, and officials are working to finalize the plan this summer. However, important details have yet to be decided. For context, International Data Corporation’s data showed that as of the end of 2022, Alibaba, Tencent, Huawei, China Telecom, and Amazon are the top five cloud computing companies in China, and the first four companies take over 64% of the market share.

Alibaba Cloud, Huawei Cloud, Tencent Cloud and Baidu AI Cloud, the top four cloud computing vendors in Mainland China in 2022, collectively grew 9% to account for a combined 79% share of customer spending.

Source: Canalys

US-based Amazon accounts for a mere 8.6%. Based on the market share, most domestic cloud computing is dominated by Chinese tech companies, which have phased into a relatively established ecosystem. That also means American companies, including Amazon and Microsoft, only hold a relatively small market share. Even Chinese experts said the move, aimed at pressuring China’s tech growth, may fail since cloud computing in China is already well developed.

The broader Commerce Department proposal also suggests that the US would revise export controls to make it harder to sell some chips to China without a license. As per Tech Wire Asia’s recent report, the move is aimed in part at Nvidia Corp’s A800 chip, which the US-based company designed to fit within the limits of the export controls.

More retaliation from China

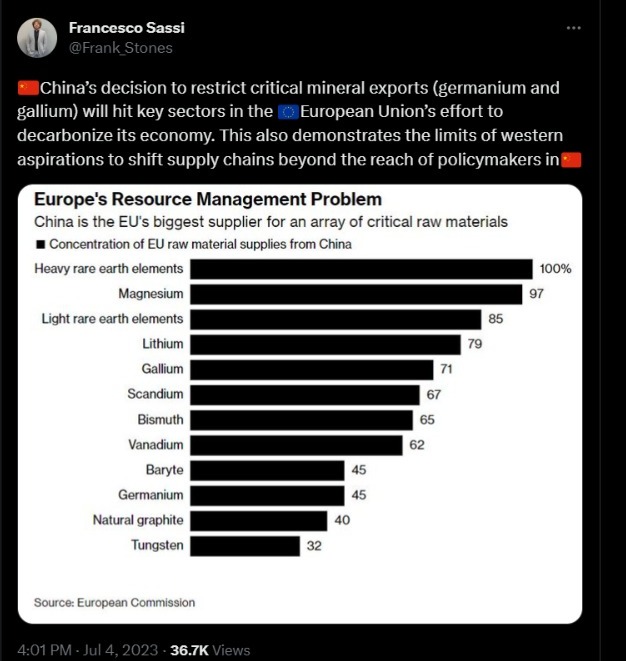

From the ban on Micron Technology, the first US chipmaker to have been slapped with restrictions from China to controls on exports of some gallium and germanium products, an influential Chinese trade policy adviser told Reuters that it is “just a start.”

Starting from August 1, the Ministry of Commerce China says the exporters will need to apply for license from the ministry if they intent start or continue shipping germanium and gallium out of the country, and will be required to report details of the overseas buyers and their applications. Source: Twitter

In short, Beijing will no longer sit and watch as the US slaps the Eastern powerhouse with more export controls. Instead, China intends to ramp up a tech fight with Washington. On July 5, former Vice Commerce Minister Wei Jianguo told the China Daily newspaper that countries should brace for more should they continue to pressure China, describing the controls as a “well-thought-out heavy punch” and “just a start.”

“If restrictions targeting China’s high-technology sector continue, countermeasures will escalate,” added Wei. Even analysts have described the move to restrict rare earth exports as China’s second – and bigger – countermeasure in the long-running US-China tech fight after it banned some vital domestic industries from purchasing from US memory chipmaker Micron in May.

Interestingly, in her upcoming visit to China, US Treasury Secretary Janet Yellen is expected to stress the need for both countries to “responsibly manage” their relationship, “communicate directly about areas of concern and work together to address global challenges.” Unless there is a truce between these two countries soon, the tit-for-tat tech war is anticipated to continue and amplify to something far more significant than it already is.

READ MORE

- Safer Automation: How Sophic and Firmus Succeeded in Malaysia with MDEC’s Support

- Privilege granted, not gained: Intelligent authorization for enhanced infrastructure productivity

- Low-Code produces the Proof-of-Possibilities

- New Wearables Enable Staff to Work Faster and Safer

- Experts weigh in on Oracle’s departure from adland