Public cloud market in China to triple in value by 2025: McKinsey (Photo by AFP)

The resurgence of Covid-19 in China did not drag its cloud spending down

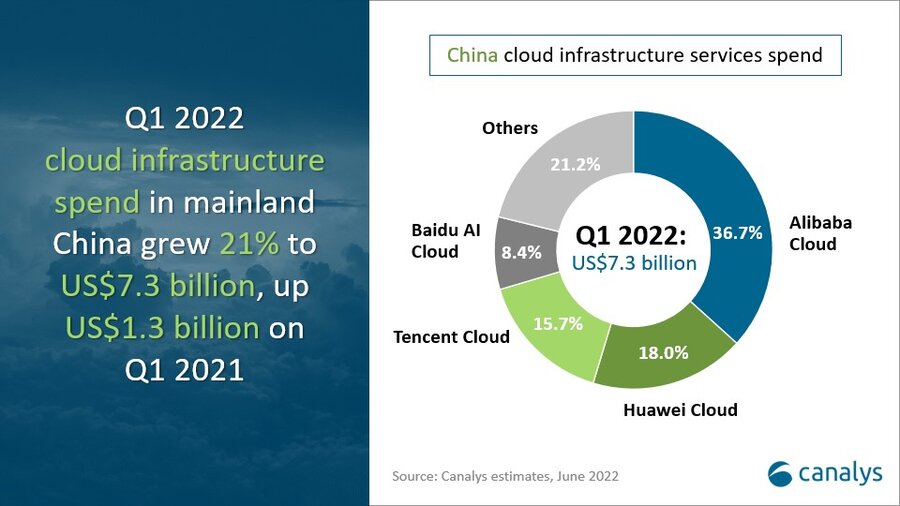

- Mainland China saw its expenditure on cloud infrastructure grow 21% YoY to US$7.3 billion in the first quarter of this year–making up to 13% of global cloud infrastructure spend.

- The market leaders in China remained unchanged with the top four cloud service vendors being Alibaba Cloud, Huawei Cloud, Tencent Cloud and Baidu AI Cloud.

- The top four providers have benefited from the expansion of cloud use and accounted for 79% of total expenditure in China, an increase of 19% YoY.

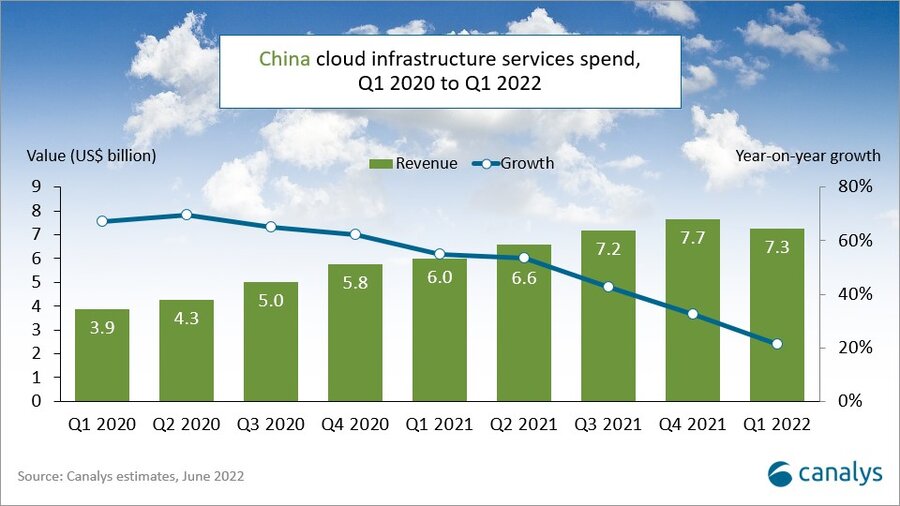

Like most parts of the world, China has been experiencing a breakneck growth within its public cloud markets, driven mainly by the pandemic and heightened digital transformation. Just last year alone, the country’s cloud infrastructure services market grew 45% to a total of US$27.4 billion and lasting pandemic-related consumption drivers, such as remote working and learning, ecommerce and content streaming remained important contributors.

As for this year, within the first three months alone, cloud infrastructure services expenditure in mainland China grew 21% year-on-year (YoY) to reach US$7.3 billion. The first quarter numbers were US$1.3 billion more than in Q1 2021, making up 13% of global cloud infrastructure spend. Canalys, in its latest report highlighted that though spending was below expectations, China maintained to be the leading growth market.

“Since March 2022, a resurgence of Covid-19 has hampered the delivery of both new and ongoing projects, resulting in a dampening of overall revenue in the Chinese cloud infrastructure services market. But with accelerated deployments due to China’s New Infrastructure plan and the increasingly urgent need for the digital transformation of enterprises, cloud service providers are still capturing new opportunities for their infrastructure services,” Canalys noted.

The negative impact of the resurgence of COVID-19 on overall spending on cloud services is temporary.

Top cloud players in China remains the same

As with the last few quarters, the market leaders in China for 1Q22 remained unchanged, with the top four cloud service vendors being Alibaba Cloud, Huawei Cloud, Tencent Cloud and Baidu AI Cloud. Canalys noted that all four providers have benefited from the expansion of cloud use and accounted for 79% of total expenditure in China, an increase of 19% YoY.

Going into details, Alibaba Cloud still tops the cloud infrastructure services market chart in the first three months of this year, accounting for 36.7% of total spend, an increase of 12% YoY. While Alibaba Cloud is China’s perennial market share leader that continues to grow, its overseas expansion is also proceeding as planned, with Alibaba having announced the official opening of its data center in South Korea on March 30, 2022. It has also further developed its service ecosystem, announcing that 31 companies have joined its Cloud Native Accelerator Program, covering manufacturing, retail, healthcare and other key verticals.

China cloud infrastructure services spend

Huawei Cloud comes in as the second-largest cloud service provider in Q1, growing 11% to take an 18% market share. Tencent Cloud, the third-largest provider, accounted for 15.7% of the market. Tencent Cloud’s revenue fell slightly this quarter compared with the previous quarter, mainly due to its internal business restructuring and changes to its growth strategy, Canalys noted.

The fourth provider, Baidu AI Cloud, accounted for 8.4% of the market and grew by 43%. “With the differential advantages of combining cloud services with AI technology, alongside continued substantial investment in its business, it maintained high growth this quarter,” Canalys said. Baidu AI Cloud has also been increasing its adoption rate in manufacturing, water supply and energy through its Kaiwu Industrial Internet Platform.

The good news is that the negative impact of the resurgence of Covid-19 in China on overall spending on cloud services is temporary, the analyst firm reiterated. “The pandemic has changed the long-term business model for most enterprises, with more organizations relying on ecommerce and remote working to complete transactions. Coupled with policy guidance in China, the urgency for enterprises to migrate to the cloud is higher than ever,” it added.

To top it off, the difference in service capabilities among the cloud service providers is shrinking, leading to a state of “involution” and accelerating competition. Therefore, in response to this dynamic, China’s cloud titans have been enhancing their abilities to combine specific industry experience with cloud services by developing their service ecosystems, focusing on those partners with experience in key verticals.

Canalys Research Analyst Yi Zhang noted that “Cloud has become a popular choice for IT enterprises and cloud services are moving up the stack from data center offerings to more industry-specific solutions. Strategies of multi-cloud deployments and multi-service provider delivery are common in the market, and cloud vendors and ISVs from vertical industries are increasingly looking to build more flexible portfolios.”

Canalys VP Alex Smith also noted that at this point, China’s hyperscalers are rapidly expanding their abilities to provide solutions for specific industry customers. “But they are not doing this alone. Instead, they are growing their bases of specialized ecosystem partners across different vertical industries to achieve both technical and industry-specific problem-solving cap

READ MORE

- Ethical AI: The renewed importance of safeguarding data and customer privacy in Generative AI applications

- How Japan balances AI-driven opportunities with cybersecurity needs

- Deploying SASE: Benchmarking your approach

- Insurance everywhere all at once: the digital transformation of the APAC insurance industry

- Google parent Alphabet eyes HubSpot: A potential acquisition shaping the future of CRM