The Vedanta and Foxconn JV was reportedly “struggling” to tie up with a technology partner.Source: Shutterstock.

What happened to the US$19.5b Vedanta-Foxconn deal in India?

|

Getting your Trinity Audio player ready... |

In September 2022, Vedanta, one of India’s leading multinational groups, and Foxconn, the world’s largest electronics manufacturing company, formed a joint venture (JV) company to manufacture semiconductors in India. The JV led to both companies signing a memorandum of understanding (MoU) with the state of Gujarat, India, to set up a US$20 billion semiconductor and display unit.

By May this year, the joint venture was reportedly “struggling” to tie up with a technology partner. After all, it was commonly known that both Vedanta and Foxconn had no prior semiconductor experience or technology and were expected to source technology from a partner.

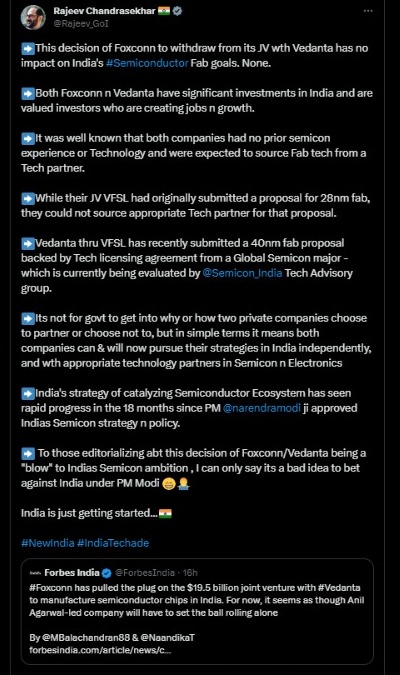

Rajeev Chandrasekhar, Union Minister of State for Entrepreneurship, Skill Development, Electronics & Technology. Source: Twitter

Vedanta and Foxconn timeline since the JV

According to the tweet by Union Minister Rajeev Chandrasekhar, Vedanta, and Foxconn had initially submitted a proposal for a 28nm fab, but they couldn’t source an appropriate tech partner for the proposal.

Following that, Vedanta, through Vedanta-Foxconn Semiconductors (VFSL), submitted a 40nm fab proposal backed by a tech licensing agreement from a global semiconductor major – which Rajeev said is currently being evaluated by India Semiconductor Mission tech advisory group.

“It’s not for the government to get into why or how two private companies choose to partner or choose not to, but in simple terms, it means both companies can & will now pursue their strategies in India independently,” he said in his tweet.

In a statement dated July 10, Foxconn said that it has determined it will not move forward on the JV with Vedanta without elaborating on the reasons. The company said it had worked with Vedanta for over a year to bring “a great semiconductor idea to reality.” Still, they had mutually decided to end the JV and remove its name from an entity now owned by Vedanta.

On the other hand, Vedanta said it is fully committed to its semiconductor project and had “lined up other partners to set up India’s first foundry.” Vedanta has redoubled its efforts to fulfill Modi’s vision, it added in a statement.

Reuters reported other problems encountered by the Vedanta-Foxconn project were deadlocked talks to involve European chipmaker STMicroelectronics as a tech partner. While Vedanta-Foxconn managed to get STMicro on board for licensing technology, India’s government had made clear it wanted the European company to have more “skin in the game,” such as a stake in the partnership.

Unfortunately, a source has said that STMicro disliked that, and the talks remained in limbo. Reuters reported that the Modi government raised questions last year over an application submitted by the Vedanta-Foxconn venture seeking federal funds under a US$10 billion incentive scheme.

Not a blow to the Indian semiconductor industry

Both Foxconn and Vedanta are committed to Prime Minister Narendra Modi’s Make In India policy and India’s semiconductor program. Source: (Photo by PUNIT PARANJPE / AFP)

After the announcement that Taiwan’s Foxconn was leaving the US$19.5 billion joint venture, many said the changes were a “big blow” to the semiconductor industry in India. In response, Rajeev tweeted, saying, “To those editorializing abt this decision of Foxconn/Vedanta being a “blow” to India’s Semicon ambition, I can only say its a bad idea to bet against India under PM Modi.”

When it was first reported last year, it was made clear that the joint venture obtained subsidies, including capital expenditure and electricity from Gujarat, to set up units near the western state’s largest city, Ahmedabad.

According to Gujarat, the investment of 1.54 trillion rupees was the largest ever by any group in an Indian state. The advantages of the semiconductor plant, among others, include creating more than 100,000 jobs in Gujarat, India.

The plan entails Vedanta setting up a display manufacturing unit with an investment of 945 billion rupees (US$11.95 billion) and separate chip-related production units by investing 600 billion rupees (US$7.58 billion), the state government said in its statement. The dynamics are such that Foxconn is acting as the technical partner, while oil-to-metals conglomerate Vedanta is financing the project as it looks to diversify into chip manufacturing.

“Both Foxconn and Vedanta are committed to Prime Minister Narendra Modi’s Make In India policy and India’s semiconductor program. Foxconn withdrawing from the joint venture with Vedanta will not impact India’s semiconductor program,” Union Minister for Communications, Electronics, and Information Technology Ashwini Vaishnaw said.

India, the world’s fifth-largest economy, forecast its semiconductor market to be worth US$63 billion by 2026 under Modi’s “Make-in-India” scheme as American firms like Apple look to diversify their supply chains away from China.

Last year alone, under the Semicon India Program, the country received three applications to set up plants. They were from the Vedanta-Foxconn JV, a global consortium ISMC that counts Tower Semiconductor as a tech partner, and Singapore-based IGSS Ventures Pte Ltd.

READ MORE

- Safer Automation: How Sophic and Firmus Succeeded in Malaysia with MDEC’s Support

- Privilege granted, not gained: Intelligent authorization for enhanced infrastructure productivity

- Low-Code produces the Proof-of-Possibilities

- New Wearables Enable Staff to Work Faster and Safer

- Experts weigh in on Oracle’s departure from adland