Do RISC-V restrictions signal the failure of the US export controls on China?Source: Shutterstock

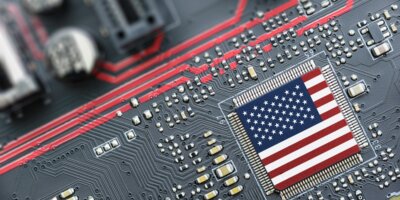

Can China achieve self-sufficiency in AI memory chips?

- The Chinese government has determined that the country must become self-sufficient in AI memory chips, even though it may take years.

- ChangXin Memory Technologies is the country’s best hope, but it may take up to four years to bring products to the market.

- The process is not dependent on high-grade equipment, so China can circumvent some US restrictions.

The rapidly rising popularity of generative artificial intelligence (AI) has made high bandwidth memory (HBM), the memory chips tailored for AI processors, highly sought-after components. Unfortunately, the sanctions Washington has imposed against China have left the Chinese government with little choice but to become self-sufficient in HBMs, even though it may take years.

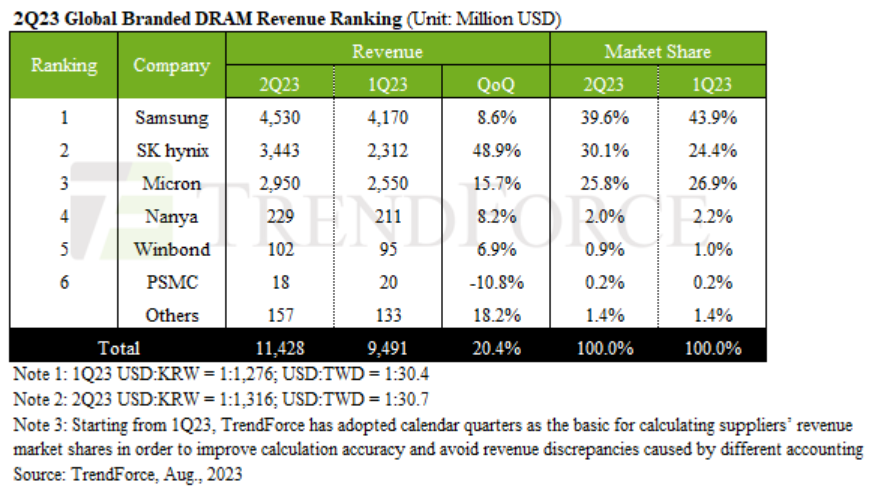

Currently, South Korea’s SK Hynix and Samsung Electronics control 90% of the global market in HBM chips, crucial components needed to train AI systems such as OpenAI’s ChatGPT. According to researchers at TrendForce, SK Hynix had a 50% share of the global HBM market last year, followed by Samsung at 40% and US rival Micron Technology trailing at 10%.

Both Korean companies have unveiled plans to double their HBM chip production next year, even as they scale back elsewhere in the memory sector amid a supply glut that has slashed operating profits. SK Hynix became the first to mass produce cutting-edge fourth-generation HBM3 chips used in Nvidia’s H100 graphic processing units (GPUs).

A brief explanation of how HBM is adopted

HBM vertically stacks memory chips, much like the floors in a skyscraper, effectively shortening the distance information has to travel. These memory towers are designed to connect to a CPU or GPU through an ultra-fast interconnect called the ‘interposer.’ Nvidia set a new industry standard by using HBM chips to speed up data transfers between GPUs and memory stacks, according to TrendForce.

According to the company, Nvidia’s much-sought-after H100 GPU features an HBM3 memory system, delivering three terabytes per second of memory bandwidth. SK Hynix said that HBM technology was a “prerequisite for Levels four and five of driving automation in autonomous vehicles.”

Last week, the company announced that it had successfully developed HBM3E, the next-generation high-end DRAMs for AI applications, and provided samples to a customer for product performance evaluations. Mass production is scheduled for the first half of 2024, with clients such as US chip firms AMD and Nvidia reportedly lining up for the new product.

TrendForce forecasted that demand for HBM chips will grow by almost 60% this year. Unfortunately, China will have only its local production to rely on, putting it in a race against time.

TrendForce reports that rising demand for AI servers has driven growth in HBM shipments.

Is China officially in the AI memory chips race?

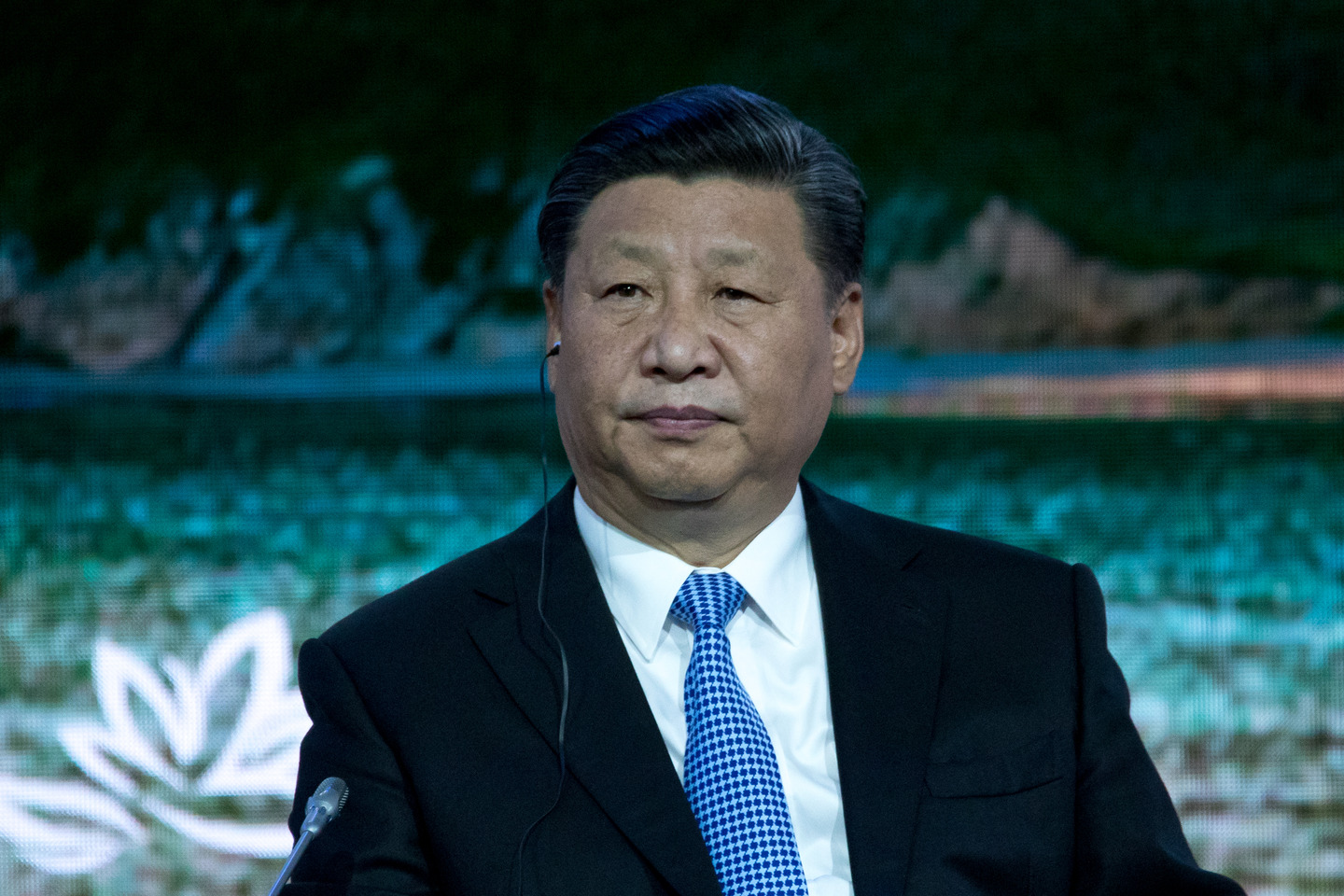

If China under Xi Jinping has set its heart on catching up in AI memory chips – it will find a way.

Beijing’s ambitions to join the world’s top memory chipmakers and replacing imports with local products in the domestic market have increasingly been at risk as the world’s leading players adopt cutting-edge technologies. At the same time, China’s ability to catch up is hampered by US sanctions.

Not long ago, China was seen as catching up quickly with international suppliers in both advanced 3D NAND flash and dynamic random access memory (DRAM). Now though, the gap is widening daily in the era of ChatGPT as China’s Yangtze Memory Technologies Corporation (YMTC) and Changxin Memory Technologies (CXMT) have been unable to press ahead with catch-up efforts, due to the US export restrictions.

China is reportedly exploring ways to produce its own HBM as part of its self-sufficiency push. “While it will be an uphill battle to catch up with global leaders like SK Hynix, Samsung Electronics, and Micron Technology given the impact of Washington’s sanctions, the Chinese government has determined that the country must become self-sufficient in HBMs even though it may take years,” the South China Morning Post (SCMP) reported.

Quoting industry sources, the SCMP stated that China’s top DRAM maker, ChangXin Memory Technologies, is the country’s best hope for HBMs; however, it may take up to four years to bring products to market. But, if CXMT or other Chinese chip makers decide to go ahead, they will inevitably be hindered by using less advanced technologies to manufacture the powerful DRAM chips, the sources added.

Players are stepping forward to make China’s AI chips.

The upside, according to industry insiders, is that despite their high performance, producing HBM chips does not necessarily require cutting-edge lithography technology such as extreme ultraviolet (EUV) tools. That means China can make its own versions even without the latest equipment.

Due to the need to integrate several chips vertically, high-density packaging technologies such as through-silicon-via (TSV) are required. Still, as the SCMP noted, China has relatively advanced players in this field, such as Jiangsu Changjiang Electronics Technology.

Ultimately, China is known for keeping its cards close to its chest regarding its latest technologies, leaving the outside world guessing about its progress in achieving self-sufficiency.

READ MORE

- Safer Automation: How Sophic and Firmus Succeeded in Malaysia with MDEC’s Support

- Privilege granted, not gained: Intelligent authorization for enhanced infrastructure productivity

- Low-Code produces the Proof-of-Possibilities

- New Wearables Enable Staff to Work Faster and Safer

- Experts weigh in on Oracle’s departure from adland