Tencent’s approach into foundation models. (Source – Shuttersock)

How Tencent is redefining AI with foundation models

- Tencent is building a “proprietary foundational model” to compete with early leaders such as Baidu Inc and SenseTime Group Inc.

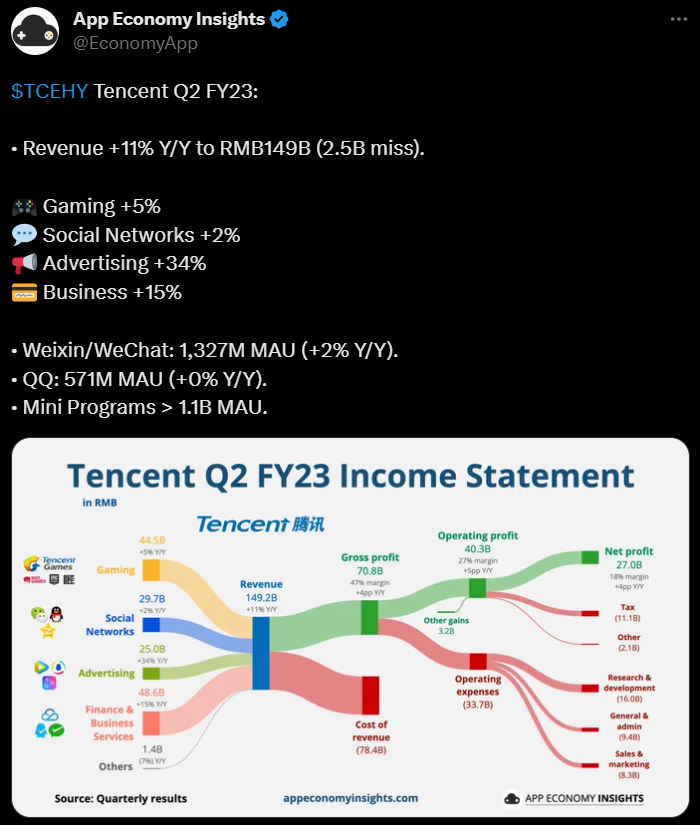

- Tencent’s Q2 revenue growth of 11% misses expectations. The company remains focused on innovating generative AI.

Since its debut in November 2022, OpenAI’s ChatGPT has intrigued the public and business leaders, showcasing how generative AI can revolutionize our daily lives and professional settings. The introduction of GPT-4 represents a culmination of many years of groundbreaking work in foundation models.

As consumer-facing generative AI solutions like Google’s Bard and OpenAI’s ChatGPT gain traction, projections suggest the generative AI sector will skyrocket. Bloomberg Intelligence (BI) predicts its growth from a modest US$40 billion in 2022 to an impressive US$1.3 trillion within a decade.

In light of this trend, Nikkei Asia highlighted Tencent Holdings’ intentions to introduce its generative AI foundational model later this year, coinciding with the firm announcing its substantial quarterly revenue growth.

A new era in foundation models begins

While many perceive AI primarily as chatbots, Tencent envisions a far-reaching impact. The company is building a “proprietary foundational model,” hinting at a more profound AI assimilation within its services. This integration promises enhancements like tailored content on platforms like WeChat, enriched gaming interactions, sophisticated user insights, and breakthroughs in unexplored domains. Tencent aims for a comprehensive AI implementation rather than isolated applications.

This foundational model is considered one of China’s elite, indicating the internet behemoth’s ambitions to rival early frontrunners like Baidu Inc and SenseTime Group Inc.

Baidu is one of the early players in the foundation models space. (Source – Shutterstock)

After presenting its financial results, Tencent’s leadership spoke positively about the rise of AI. Its progress in cultivating a substantial language model to fuel generative AI and other tools is reportedly on track. Although the gaming colossus has often been seen as lagging behind its local competitors — partly due to its reticence on the subject — it’s been piloting its model, Hunyuan, in areas such as cloud computing and search functions.

Tencent’s President, Martin Lau, has termed generative AI a pivotal catalyst for business expansion. This sentiment echoes Tencent’s confidence in AI’s transformative capacity across industries. Lau’s accentuation on areas like public utilities, travel, and finance suggests Tencent’s holistic view of AI, not just as a tech upgrade but as a driving force for societal advancement and economic prosperity.

In aiming its AI tools at mid-tier firms that accumulate user data, Tencent’s goal appears to be making advanced AI accessible and beneficial to a broader business spectrum.

Tencent’s Q2 revenue: Breaking down the numbers

While Tencent reported an 11% revenue growth in the second quarter, primarily due to its online advertising prowess, it slightly missed expert predictions. This discrepancy is attributed to concerns regarding the pace of China’s economic resurgence.

From April to June, Tencent declared total earnings of 149.2 billion yuan (US$20.6 billion). Contrasting this, Refinitiv’s analysis had anticipated a 13.2% revenue escalation. Nevertheless, within this window, the firm’s net profit impressively climbed by 41% to 26.2 billion yuan.

Online ad revenue, accounting for 17% of Tencent’s overall earnings, witnessed a 34% annual growth, reaching 48.6 billion yuan. This uptick is attributed mainly to the increased demand for advertisements within Video Accounts, an integral feature of Tencent’s flagship app, WeChat.

Tencent’s Chairman and CEO, Pony Ma, commented, “We achieved notably rapid growth in the advertising business, benefiting from deploying machine learning on our advertising platform and from Video Accounts monetization.”

Tencent’s dive into generative AI

Tencent remains dedicated to fostering innovation, specifically in generative AI. The company is offering a diverse model library to collaborators through the Tencent Cloud Model-as-a-Service (MaaS) initiative, while simultaneously refining its unique foundational model.

Earnings from “value-added services,” encompassing global and local games, rose by 4% to 74.2 billion yuan compared to last year’s quarter. This growth was, however, below the anticipated 8.9%.

Domestic video game revenues remained consistent year-on-year at 31.8 billion yuan over the three months. In contrast, international gaming revenue surged by 19% to 12.7 billion yuan. A dip in new content for domestic games this quarter compared to the initial quarter affected these figures.

Tencent Q2 FY23 Income Statement. (Source – App Economy Insights)

In a call, Chief Strategy Officer James Mitchell mentioned that upcoming releases would augment domestic gaming revenue in the subsequent quarter. He further stated that Tencent is poised to unveil multiple game titles for local and global audiences.

An emerging revenue stream for Tencent lies in casual mini-games playable within the Weixin chat application. As highlighted by CFO John Lo, these mini-games currently contribute a small percentage to the firm’s online ad revenue and social networking earnings without disclosing precise figures.

Fintech earnings, including WeChat Pay, rose by 15% over the quarter, driven by an uptick in online transaction services. Meanwhile, Tencent’s cloud offerings witnessed moderate growth, and an e-commerce resurgence led to increased merchant fees from livestreams on Video Accounts. For clarity, WeChat is the global variant of Weixin.

Many hoped that the 2.99 billion yuan penalty levied on Tencent’s payment arm, Tenpay, in July for previous regulatory transgressions would mark an end to China’s stringent stance on the firm and the broader tech landscape. However, investor confidence remains shaky regarding the sector’s potential return to dynamic growth. Notably, Ant Financial, backed by Alibaba, faced similar financial penalties during this period.

Reflecting on various business segments, Lau expressed seeing a shift towards a more standard regulatory environment, citing the recent fines as evidence of this change.

READ MORE

- 3 Steps to Successfully Automate Copilot for Microsoft 365 Implementation

- Trustworthy AI – the Promise of Enterprise-Friendly Generative Machine Learning with Dell and NVIDIA

- Strategies for Democratizing GenAI

- The criticality of endpoint management in cybersecurity and operations

- Ethical AI: The renewed importance of safeguarding data and customer privacy in Generative AI applications