Despite many companies applying for the scheme, many leading firms are absent.Source: Shutterstock

Is the second time a charm for India’s PLI scheme for IT hardware?

- 27 companies, including Acer, Asus, Dell, HP, and Lenovo, join India’s ‘Make in India’ initiative under the PLI scheme.

- 23 out of 27 approved applicants are prepared for day-zero manufacturing, with four starting production in the next 90 days.

- The PLI 2.0 Scheme for IT hardware closed in August and received applications from 38 companies.

The production-linked incentive (PLI) scheme introduced in India in March 2020 had a tepid start, experiencing a significant shortfall. Crafted to stimulate production in 14 sectors, with an outlay of ₹1.97-lakh crore (about US$26 billion), the PLI initiative is a cornerstone of the government’s vision to bolster domestic manufacturing, positioning India as a global export hub.

It all started with the government targeting mobile manufacturing, electric components, pharmaceuticals, and medical device manufacturing. Since then, the concept has expanded to cover multiple sectors, fostering manufacturing capabilities and export-oriented production. Ultimately, the Indian government aims to enhance local supply chain capacities, introduce new downstream operations, and attract investments into high-tech production.

The PLI scheme targeting IT hardware was only introduced in February 2021, encompassing the production of laptops, tablets, all-in-one PCs, and servers, with an allocated budget of 73.5 billion rupees (US$1.02 billion). But the program faced low participation levels due to the incentives being perceived as insufficient. So, India decided more incentives would be the best bet in luring electronics manufacturers.

In May 2023, Delhi unveiled a 170 billion-rupee (US$2.1 billion) financial incentive plan (PLI 2.0 scheme for IT hardware) to draw laptop, tablet, and other hardware makers to the South Asian nation, especially in the wake of the China-US trade tensions, creating an opportune moment for companies to explore alternative production options. It was only through the PLI 2.0 scheme that the Indian government began noticing better uptake.

How successful is the uptake of the PLI 2.0 scheme?

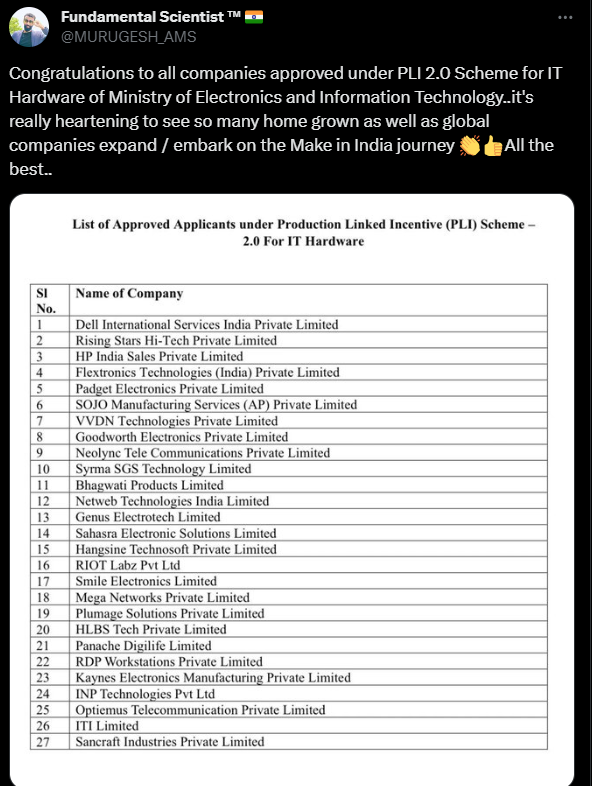

According to an official statement on November 18, New Delhi has approved subsidy applications from 27 companies out of 40 applicants. The approved companies include Apple supplier Foxconn Technology Group, computer giant Lenovo Group, Dell, HP, and AsusTek Computer.

Ashwini Vaishnaw, the Union Cabinet Minister for Railways, Communications, Electronics and Information Technology. (Photo by TAUSEEF MUSTAFA / AFP).

“23 out of 27 approved applicants are ready to start manufacturing on day zero,” Ashwini Vaishnaw, India’s Minister for Railways, Communications, Electronics and Information Technology, said. “Four companies will start production in the next 90 days.”

During the initial year of the PLI scheme, companies are permitted to maintain their regular import practices, with a gradual reduction in the import quota commencing after September 2024, according to local reports. All companies were required to provide their import data for the past three years, specifying the source from which they import the devices.

Vaishnaw also noted that India expects the PLI-approved companies, covering domestic assembly of desktop and laptop PCs, tablets, and other tech hardware, to directly create 50,000 jobs and indirectly, around 150,000 more jobs under the scheme, based on a total investment of US$360 million. He also said the estimated value of information technology hardware production would reach US$42 billion.

Neither Apple nor Samsung applied for the scheme

It appears that Apple has chosen not to participate in India’s PLI 2.0 scheme for IT hardware, mainly because laptops and tablets covered by the scheme constitute a relatively small share of Apple’s total sales in the Indian market, as per an ET report. The report indicates that Apple has no immediate intentions for local production of these products.

Quoting sources, the report also stated that Apple’s manufacturing strategy deviates from the traditional model, relying on global electronic contract manufacturers instead of establishing its production facilities. Apple also chose not to participate in the smartphone PLI scheme, as highlighted by the executives. Approximately 80% of Apple’s revenue in India is derived from smartphones, the cornerstone of the company’s product lineup.

As a result, Apple’s strategic emphasis is on expanding iPhone production within the country. It’s noteworthy that, even for smartphones, the tech giant did not pursue PLI benefits, although its manufacturing partners, such as Foxconn and Wistron, submitted applications for the scheme.

On the other hand, despite benefiting from the smartphone-focused PLI initiative, Samsung, the South Korean tech giant, has opted not to participate in the PLI 2.0 scheme. This decision is influenced by Samsung’s relatively limited presence in the laptop market, with the tablet sector contributing little to the company’s revenue stream.

Companies approved under PLI 2.0 Scheme for IT Hardware. Source: X.com.

READ MORE

- Safer Automation: How Sophic and Firmus Succeeded in Malaysia with MDEC’s Support

- Privilege granted, not gained: Intelligent authorization for enhanced infrastructure productivity

- Low-Code produces the Proof-of-Possibilities

- New Wearables Enable Staff to Work Faster and Safer

- Experts weigh in on Oracle’s departure from adland