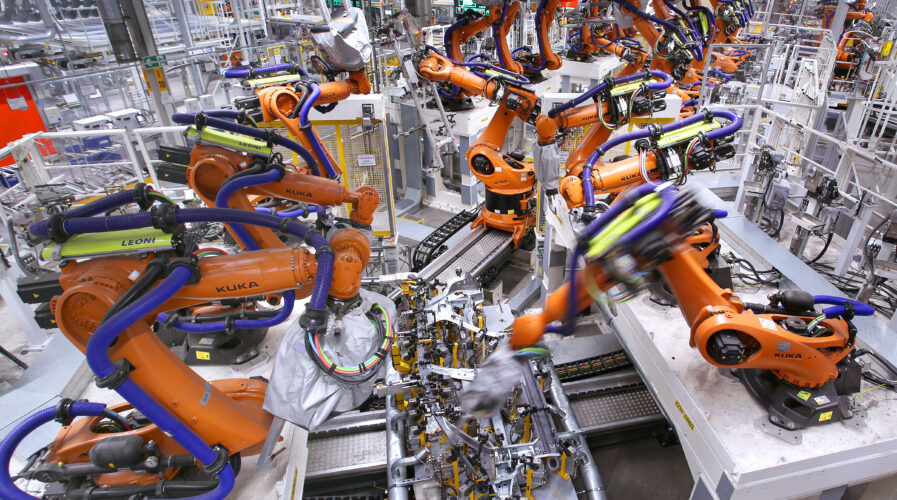

(Photo by RONNY HARTMANN / AFP)

Optimizing operational efficiency is a prerogative for the manufacturing industry

As the manufacturing industry looking to enhance productivity and output, the adoption of emerging technologies to enable this increases as well. Over the years, more manufacturing companies have increased their usage of robots, and automated processes, reducing the reliance on manual labor as well.

According to findings from a Forrester study commissioned by Aruba, three in four manufacturers in the Asia Pacific are prioritizing innovation and automation for greater operational efficiency and resilience over the past 12 months. The High-Tech Manufacturing Begins with High-Performance Networking and Security Solutions study looked at the impact of high-performance networking and security solutions on connected and smart high-tech manufacturing operations.

The study found that edge solutions, IoT applications, and networks were essential to driving innovation for 63% of respondents, with 61% indicating they had optimized manufacturing processes with automation and robots. Meanwhile, 69% of respondents said they were either piloting or already using cloud-managed networking and security solutions to benefit from improved flexibility, scalability, and defense capabilities.

For Mark Verbloot, Senior Director, Product, Solutions and Systems Engineering, Asia Pacific Region at Aruba, a Hewlett Packard Enterprise company, the turbulence in manufacturing and the supply chain seen in the last two years have underscored the need for manufacturers to accelerate their transition from mass production and economies of scale to prioritizing market and customer responsiveness.

“We embarked on this study to shed light on the challenges that high-tech manufacturers are facing to better understand their priorities amidst the constant unpredictability of market forces. In response to the issues they face, high-tech manufacturers are increasingly aligning their technology investments to secure and optimize operations while addressing data privacy and security concerns even as they build greater resilience in the long-term.”

In fact, the survey indicated that 66% of respondents see a rise in the importance of enabling consistent network operation and remote monitoring, and a similar percentage of respondents said modern, resilient operations are just as important. This is followed by 64% of respondents who indicated their intention to build on previous investments in AI-powered software to optimize operations, implement predictive capabilities, and optimize productivity.

Addressing data privacy and security concerns in the manufacturing industry

Now, with the increased usage of emerging technologies, especially in connectivity and digitalization processes and operations, the collection, transmission, and utilization of the breadth of data are becoming critical to the sectors’ ability to scale operations and address the challenges posed by privacy and security concerns.

Hence, it is no surprise that more than half of APAC decision-makers (52%) ranked data privacy and security concerns within their top five challenges when implementing networking solutions, while 48% said the lack of cybersecurity features in legacy IoT devices is one of their top five challenges. About 18% ranked the information technology/operational technology (IT/OT) divide as one of their top two networking challenges.

In the past few years alone, cybersecurity incidences in the manufacturing industry have increased as well. This includes increased cases of ransomware as well as espionage cases targeting critical infrastructures. Factories and manufacturing plants leveraging automation, IoT technologies, and such should be vigilant about using them and ensure there are sufficient data protection policies in place.

Adding to that, to deal with the rising data privacy and security concerns, manufacturers have plans to leverage emerging technologies and automation to secure their operations in the next 24 months. These solutions include cloud-managed networking (38%) and SD-WAN (37%). More than 50% of manufacturers are also expanding, upgrading, or planning to invest in Zero Trust Edge solutions in the same timeframe, while 57% said identity-based traffic segmentation helps them to achieve their business goals.

“As we emerge from the pandemic, there is a need for the manufacturing industry to develop greater agility and flexibility in their operations. Innovation is at the heart of decision-makers’ priorities but manufacturing leaders need to act now by leveraging high-performance network and security solutions to help the smart manufacturing industry scale effectively,” commented Mark Verbloot, Senior Director, Product, Solutions, and Systems Engineering, Asia Pacific Region at Aruba.

READ MORE

- Ethical AI: The renewed importance of safeguarding data and customer privacy in Generative AI applications

- How Japan balances AI-driven opportunities with cybersecurity needs

- Deploying SASE: Benchmarking your approach

- Insurance everywhere all at once: the digital transformation of the APAC insurance industry

- Google parent Alphabet eyes HubSpot: A potential acquisition shaping the future of CRM