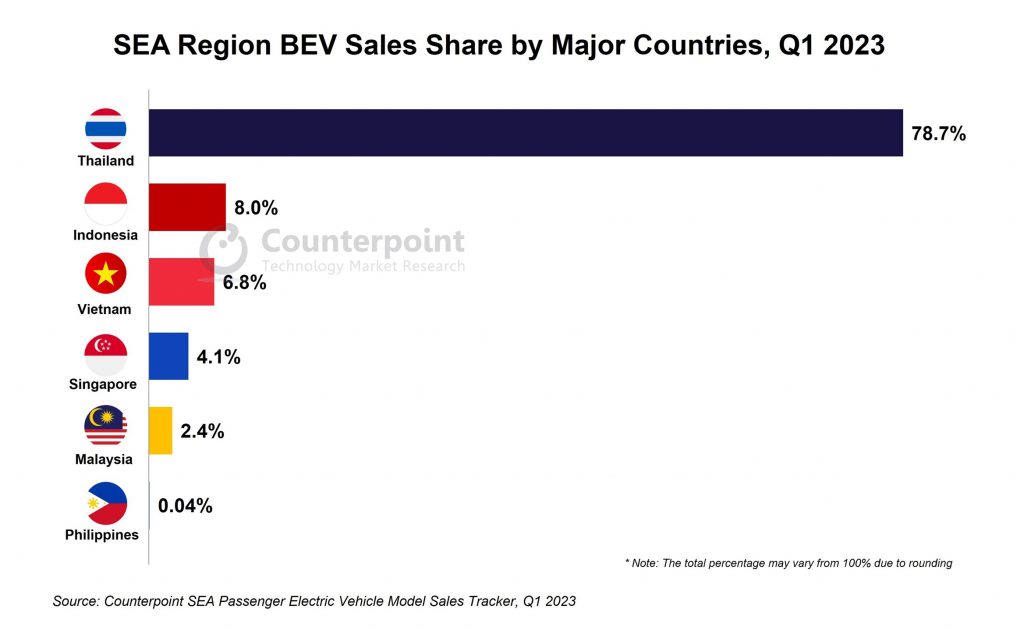

In the first three months of the year, Thailand accounted for over 75% of the battery-electric vehicle sales in the region.Source: Shutterstock

Thailand leads battery electric vehicle sales in SEA once again

|

Getting your Trinity Audio player ready... |

- In the first three months of the year, Thailand accounted for over 75% of the battery-electric vehicle sales in the region.

- Chinese automakers sold three out of every four BEVs in Southeast Asia.

- Overall, the region’s battery electric vehicle sales grew by almost ten times YoY in Q1 2023.

Thailand has long been an auto hub in Southeast Asia. Even as the pivot to electric vehicles has gathered pace over the last few years, the country managed to maintain its grip on the industry. In fact, after leading the region with the most EV sales in 2022, Thailand has emerged as the leading country, with the most battery electric vehicle sales in the first three months of this year.

Southeast Asia’s second-largest economy with a population of over 71 million, Thailand boasted the highest proportion of battery-electric vehicles in total passenger vehicle sales, followed by Singapore and Vietnam. According to the latest research from Counterpoint’s SEA Passenger Electric Vehicle Model Sales Tracker, the region’s passenger battery electric vehicle sales grew by almost ten times year-on-year (YoY) in the first quarter of 2023 (1Q23).

The share of BEVs in total passenger vehicle sales experienced significant growth in Q1 2023, reaching 3.8% compared to a mere 0.3% one year ago. However, plug-in hybrid electric vehicle (PHEV) sales saw a modest YoY growth of 5.8%. “Thailand emerged as the leading country, capturing over 75% of the BEV sales, followed by Indonesia and Vietnam,” the report stated.

For context, Thailand has the largest automotive industry in Southeast Asia and the 10th largest in the world, according to the Thailand Board of Investment (BOI). The country aims to transition 30% of its auto production to EVs by 2030. So far, the country’s emergence as an EV hub has been fast-tracked by highly favorable government policies that comprehensively incentivize investors in the EV sector’s supply chain and car buyers.

The number of BEV and PHEV sold in Thailand has seen a substantial growth between 2018 and 2022. Source: The International Energy Agency

The initial focus is to promote EV sales within the country, then replace its automobile export with EVs. So far, the production-led EV policy is bearing fruit — EV sales in Thailand comprised 3% of total automobile sales in 2022. “Thailand’s government-led efforts to promote EV sales have yielded positive outcomes, while Indonesia and Vietnam are also performing well in the region,” Counterpoint’s research analyst Abhilash Gupta said in a note last week.

Gupta, however, reckoned that Malaysia, the Philippines, and Myanmar require additional regulatory support and encouragement to foster EV growth. “Despite overall passenger vehicle sales remaining relatively stagnant, the sales of BEVs have experienced a significant and rapid expansion. Besides, the market for hybrid electric vehicles has experienced remarkable growth in SEA, playing a pivotal role in transitioning from traditional internal combustion engine (ICE) vehicles to EVs,” he noted.

Separately, Counterpoint’s senior analyst Soumen Mandal observed that Thailand’s EV sector had witnessed a significant rise in foreign direct investment in the past year. “Notably, several Chinese automakers, including Great Wall Motors, BYD, Hozon New Energy, and Changan Automobile, have shown interest in establishing or have already commenced the construction of production facilities in Thailand.”

Similarly, Mandal said Indonesia announced a subsidy package in March 2023 to promote the purchase and manufacturing of EVs, with a particular focus on increasing local production. The move is expected to accelerate the production and sales of EVs in the region.

Chinese automaker makes up 3 out of 4 BEVs sold in SEA

Counterpoint also highlighted that Chinese auto groups are experiencing rapid growth and outpacing their competitors in the SEA region, with their market share increasing from 38% a year ago to nearly 75%. For instance, in the first three months of this year alone, BYD Group emerged as the BEV leader in the SEA region, capturing the majority of sales, followed by Hozon New Energy and SAIC Group.

“These top three groups collectively accounted for over 68% of the BEV market. Geely Holding Group claimed the top position in the PHEV market, followed by BMW Group and Mercedes-Benz Group,” Gupta said. BYD’s Atto 3 was the best-selling BEV across SEA, followed by the Neta V and Tesla Model Y. In PHEVs, Counterpoint’s report indicated Volvo’s XC60 as the most sold, followed by the BMW 3 series and Mercedes-Benz E-Class.

READ MORE

- Safer Automation: How Sophic and Firmus Succeeded in Malaysia with MDEC’s Support

- Privilege granted, not gained: Intelligent authorization for enhanced infrastructure productivity

- Low-Code produces the Proof-of-Possibilities

- New Wearables Enable Staff to Work Faster and Safer

- Experts weigh in on Oracle’s departure from adland