Pace’s BNPL joins the luxury bandwagon. (Photo by Bob Levey / GETTY IMAGES NORTH AMERICA / Getty Images via AFP)

Buy Now, Pay Later to acquire luxury brands around APAC?

- BNPL fintech Pace announced an exclusive regional partnership with luxury goods and retail specialist, Valiram

- The partnership will extend Pace as an alternative payment option to over 20 international brands represented by Valiram in the region

- The fintech company recently secured debt funding to grow its presence in APAC

Fintech group Pace Enterprise will soon be providing its ‘Buy Now Pay Later’ or BNPL offering to over 20 international brands within the Asia Pacific (APAC) region – represented by luxury goods and retail specialist, Valiram, following a regional partnership between the two companies.

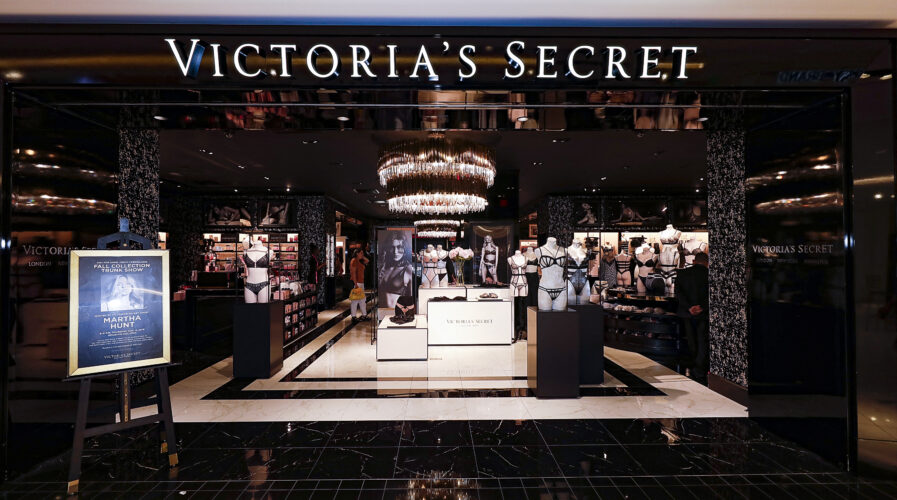

The deal will see Valiram’s brands offer Pace’s BNPL solution to all its customers in the territory and allow them to split their purchases over three interest-free installments, the companies said in a statement. This includes consumer brands such as Michael Kors, TUMI, Victoria’s Secret, Bath & Body Works, Steve Madden, as well as Nike in Thailand and Pedro in Malaysia.

Valiram joins Pace’s current stable of merchant partnerships, which includes ALDO, Miniso, Swee Lee, OG, Benjamin Barker, OSIM, FJ Benjamin, among others. The rollout will progressively extend to include more brands, Pace said. Payment via Pace will be available upon checkout across all points-of-sales, including websites, mobile apps, and over 200 points-of-sale in Singapore, Malaysia, Thailand, and Macau.

Pace’s founder and chief executive officer Turochas “T” Fuad told Tech Wire Asia that the group’s partnership with Valiram validates the effectiveness of Pace’s BNPL product in driving sales for retailers. “We’ve seen how our solution has boosted merchant sales by up to 25%, and increased basket sizes by up to 80% across multiple industries. With this partnership in place, we’re excited to take on the challenge of achieving even greater results across all the brands that Valiram represents, in all the geographies represented by this partnership.”

Pace’s BNPL solution

Basically, Pace’s BNPL solution splits users’ help purchases into three interest-free payments. Fuad also added that there are no interest fees or changes in a customer’s credit score, when using the service. “But there are late fees that are capped and are designed to encourage customers to pay on time,” he added.

Growth since inception

Headquartered in Singapore, Pace announced its launch in January this year, and the company has since secured an eight-figure debt financing round led by Genesis Alternative Ventures.

“Our success in such a short time span is an encouraging sign that our ambition of developing a digital financing engine, is one that truly resonates. We’re excited to be on this journey of creating financial inclusions at a global scale, by creating bespoke financial products for consumers and businesses,” Fuad told TWA.

The new debt financing facility will be used to grow Pace’s business in the region, where it claimed to have seen a 1,300% growth in users and 200% growth in merchant partners since January this year. “We now have 900 points-of-sale, tens of thousands of users and over 550% growth in GMV since January. We have also established partnerships with banks like OCBC and UOB where we introduced Pace to their existing debit and credit card user base. Besides targeting our joint users to our merchant partners, we get an opportunity to showcase our vision of developing banking as a service,” Fuad added.

At the moment, Pace is available in Singapore, Malaysia, Hong Kong, and Thailand. Fuad attributes the rise in payment trends mostly to younger audiences that are looking for ways to manage their finances better. “This has been happening across all sorts of payment modes even before Covid-19, and adoption has certainly accelerated beyond expectations because of the pandemic.”

Specific to BNPL, he also shared that usage in Asia is still behind countries like Australia and America, but it is definitely increasing rapidly and will continue to move towards being a mainstay in most Asian countries. On top of that, Pace’s merchants, according to Fuad, indicated that Pace’s BNPL solution has been contributing to larger shares of their overall sales transactions, with most stores reporting sales contributions of 20-35% after adopting Pace for a few short weeks.

Should the BNPL space be regulated?

Fuad claims that Pace has been working with regulators and that the fintech welcomes regulations and frameworks that protect customers. “While we don’t know what the implications are beyond our own numbers, our default rates are so significantly low that it hasn’t supported any indication that our BNPL offering is putting people in debt,” he said.

When Pace first launched its service, the company incorporated its artificial intelligence engine with a series of algorithms and signals to better understand its users during the account creation process, Fuad told TWA. “This feeds into our credit scoring engine where we make it clear to our users what their buying limit is. All of that is done in mere seconds.

“We believe that this bespoke process not only helps mitigate our risk, but also ensures that we provide our Pace BNPL account to those who would not abuse it,” he continued. “We do believe that a well-thought-out regulatory framework will certainly be helpful especially when it is mutually beneficial for all parties involved.”

READ MORE

- Ethical AI: The renewed importance of safeguarding data and customer privacy in Generative AI applications

- How Japan balances AI-driven opportunities with cybersecurity needs

- Deploying SASE: Benchmarking your approach

- Insurance everywhere all at once: the digital transformation of the APAC insurance industry

- Google parent Alphabet eyes HubSpot: A potential acquisition shaping the future of CRM