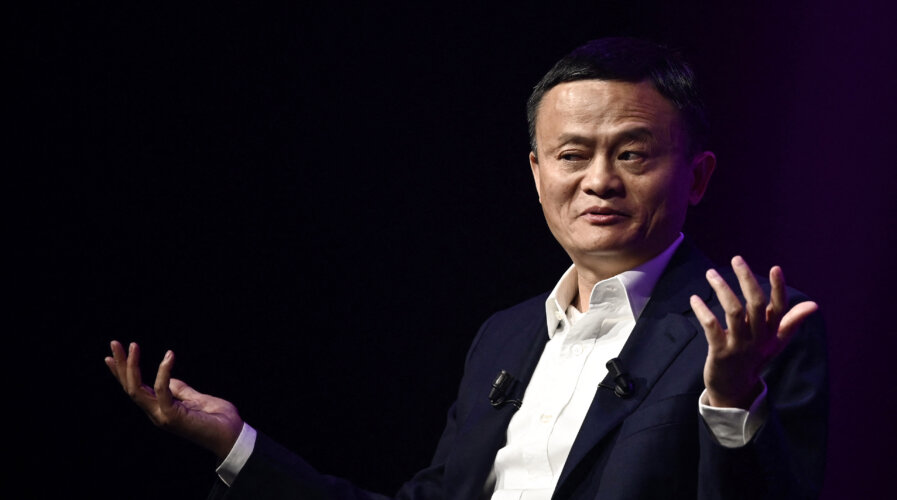

The dismantling of Alibaba Group, Jack Ma’s 24-year-old empire. Here’s everything we know.(Photo by Philippe LOPEZ / AFP)

The dismantling of Alibaba Group, Jack Ma’s 24-year-old empire. Here’s everything we know

- Alibaba Group announced this week that it would split its company into six separate business groups, each with the ability to raise funding externally and go public.

- In a statement, Alibaba said the move is “designed to unlock shareholder value and foster market competitiveness.”

China is about to witness its largest technology conglomerate, Alibaba Group Holding, undertake its most significant corporate restructuring since its establishment 24 years ago. This week, the sprawling US$257 billion empire announced that it plans to split itself into six independently run entities to shorten its decision-making process, effectively dismantling Jack Ma’s empire.

In a letter to employees on Tuesday, Alibaba said it would reorganize its group of businesses into six independently run entities, namely Cloud Intelligence Group, e-commerce under Taobao-Tmall, Cainiao’s smart logistics operations, Local Services group, Global Digital Business Group, and the Digital Media and Entertainment Group.

The letter, written by Daniel Zhang, Alibaba’s chief executive, stated that the holding company structure made sense for Alibaba because the natures of the six business groups were different, with various stages of development and disparate needs. Once dismantled, each unit will be free to seek fundraising avenues through initial public offerings (IPOs).

Why did Alibaba Group choose this path?

To Alibaba, the agility, responsiveness, and innovativeness of a company with 200,000 employees are “severely restricted.” The fact that the most significant breakthroughs today have come from start-ups and small companies with a few hundred staff is proof of the new tendency in the technological world, Alibaba said.

“If the subsidiaries can focus on their businesses, it will help them to be more professional in their services. The restructuring will also help them capture the wave of new technologies … Technological updates and product iterations will be fast,” Zhang said in his letter. All six business units will be set up with their boards of directors.

Zhang also shared that he will serve as chief executive of the Cloud Intelligence Group, the company’s cloud computing and artificial intelligence division, on top of being the head of the holding company. He, however, will devolve all operational decisions, including hiring and firing, research, profit, and losses, to the CEOs of each business unit, according to his letter to the company’s employees.

“This transformation will empower all our businesses to become more agile, enhance decision-making, and enable faster responses to market changes,” Zhang said. The objectives of the overhaul are to streamline the management and shorten the decision-making process based on the plan in the letter.

According to a South China Morning Post report, a media entity owned by Alibaba, the group will also set up corporate entities for other operations following a “1+6+N” structure. According to the letter, one refers to the group, six refers to the six business units, and N refers to future business units. None of the teams would be evenly matched in size or business scope.

For context, nearly 70% of Alibaba’s 170 billion yuan (US$24.7 billion) in third-quarter revenue came from the world’s largest e-commerce platforms, mostly Taobao and Tmall Marketplace. Perhaps that’s why Taobao Tmall Commerce Group will be the only one to remain a wholly owned Alibaba entity.

Does this mark the end of Alibaba’s defiance?

It was only recently that the Chinese government started relaxing its regulatory stronghold on the technology sector after a tumultuous three years. That is also how long Alibaba’s billionaire founder, Jack Ma, has been gone from the public eye. It all started after Ma criticized Chinese regulators in 2020 for stifling innovation at Ant Group, Alibaba’s financial technology sister company.

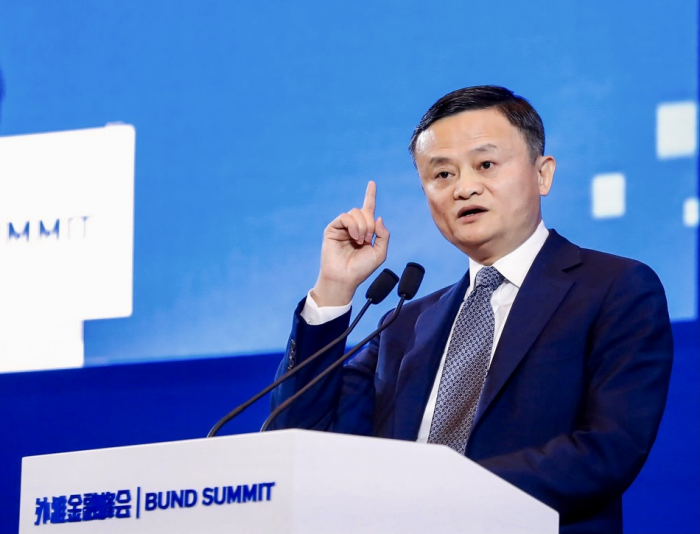

Jack Ma Speech at The Bund 2020 in Shanghai

Following Ma’s remarks, Chinese officials suspended Ant Group’s plans for a blockbuster initial public offering. Instead, regulators forced Ant to register as a financial holding company and separate its payment app from its financial services. The spectacle cost the Alibaba Group US$2.8 billion in fines for “abusing its dominance,” and the IPO plan was shelved for good.

Then came January this year when Ant Group said Ma had planned to relinquish company control. Around the same time, the top Communist Party official at China’s central bank said the so-called rectification campaign into the biggest technology companies was “basically complete.”

Frankly, Alibaba Group was not alone. No powerful companies were immune from the scrutiny of Chinese regulators. Still, Alibaba, an internet conglomerate with businesses in various sectors, has become a cautionary tale for many. It shows, loud and clear, the cost of challenging China’s ruling Communist Party and the extent of Beijing’s campaign to curb the power of its technology giants.

If the decision to dismantle the Alibaba Group is to ease the government’s concerns about the tech giant’s dominance and influence, it may just be the start of a new dawn in China.

READ MORE

- Strategies for Democratizing GenAI

- The criticality of endpoint management in cybersecurity and operations

- Ethical AI: The renewed importance of safeguarding data and customer privacy in Generative AI applications

- How Japan balances AI-driven opportunities with cybersecurity needs

- Deploying SASE: Benchmarking your approach