(Source – Shutterstock)

Grab vs Gojek vs AirAsia: Superapps compete for supremacy in Southeast Asia

- The race among Grab, Gojek and AirAsia is intensifying in Southeast Asia when it comes to regional superapps and their offerings, mainly beyond the respective companies’ core business.

In China, superapps permeate almost every aspect of the people’s digital life, and before we knew it, the same concept started rapidly gaining traction across Southeast Asia, South America, and even the West. However, outside of China, the only place that is seeing enormous success with superapps is Southeast Asia, where the likes of Grab, Gojek, AirAsia, and even a handful of others, successfully enforced the idea of one app providing a single interface to access a diverse range of products and services.

One of the prime examples of a successful superapp is in fact from China. Known as WeChat, the Tencent-backed platform has grown from a simple messaging platform into the world’s first and most used superapp. Till date, the app has amassed over 1.2 billion users with an ecosystem of more than a million mini programmes within its app. As is the case with every superapp, WeChat too started as a single service app with payments integration, but increasing customer demand opened the door for further development through the integration of a multitude of other services.

Inevitably, pandemic purchasing too led to the rise of superapps as people appreciated the ease and convenience. In fact, many companies around the world wanted to replicate WeChat’s sturdy success. By the second year of the pandemic, big names in Southeast Asia like GoJek, Grab and even AirAsia have grabbed a slice of the superapp pie themselves — all by allowing their users to do almost everything within their ecosystem.

According to a report jointly published by Google, Temasek, and Bain & Company early this year, an increase in the use of digital services is indicative of an upcoming “Digital Decade” in Southeast Asia, where its internet economy could reach a gross merchandise value (GMV) of US$1 trillion by 2030. “Of these digital services, e-commerce and food delivery are the primary drivers of growth; both services are the mainstays of superapps, pointing to their outsized role in bringing about the digital decade,” the report emphasized.

Tech Wire Asia looked into three of Southeast Asia’s leading superapp –Gojek, Grab, AirAsia– and carved out their unique propositions to understand what sets them apart from each other.

Singapore’s Grab: From e-hailing to everything in between

A unicorn born out of Singapore, Grab was established in 2012 as a ride-hailing service. The company eventually expanded its operations in not just the ride-hailing sector but also in new business verticals such as food delivery, grocery shopping, logistics delivery, financial services, and a myriad of others, depending on the Southeast Asian nation it’s operating in.

Amongst its most significant services, Grab is known for its QR code-based mobile payment application known as GrabPay which is available in all six nations of Southeast Asia, it is operating in, namely Singapore, Malaysia, Vietnam, Thailand, Indonesia, and the Philippines. The payment, mainly made to complement its ride-hailing and food delivery services, all supports in-store purchases and fund transfers.

GrabPay eventually extended its financial services towards offering a postpaid and installment payment option in some of the countries to ride on the buy now pay later trend. Adding to that and as part of its strategy to emerge as a superapp, Grab also started offering food delivery services under the name GrabFood in May 2018. The service is now provided to more than 200 cities across several Southeast Asian countries.

(Source – Shutterstock)

Indonesia’s most valuable: Gojek

Unlike China’s WeChat which began as a messaging service, Grab and Gojek both offer ride-hailing as their core service and quickly grew to become ‘must-own’ apps in the regions. Over the past several years, the two companies have burnt through billions as they’ve jostled to establish dominant positions across the region and outcompeted world-class rivals.

Founded in 2010 in Indonesia as a motorcycle ride-hailing & courier service call center, Gojek launched its app in 2015. Today, the company also operates in Thailand, Vietnam, and Singapore. Despite its international expansion, Indonesia, the single largest market in the region, is the epicenter Gojek; the country accounts for over 90% of its city operations.

According to a blog posting by Gojek, the superapp have so far garnered more than 125 million downloads, nearly half the population of Indonesia, with total order volumes growing 6600x in 36 months. Gojek already has over two dozen products and every year, the company adds more ammunition to its arsenal. Gojek sees its payments services as its biggest moat. “Once you’re handling money for a user, you can build a castle of services within it,” it said.

For context, GoPay is accepted by close to 300,000 online and offline merchants in Indonesia, and processes up to US$6.3 billion of annualized Gross Transaction Value (GTV) if not more than. Just last year, Gojek finalized its acquisition of Tokopedia to form GoTo Group, Indonesia’s biggest technology group. The merger between the two tech behemoths is the biggest in Indonesia’s history.

Pundits reckon the deal, combining Tokopedia’s ecommerce business with Gojek’s ride-hailing and payments operations, forms a ‘WeChat of Southeast Asia’.

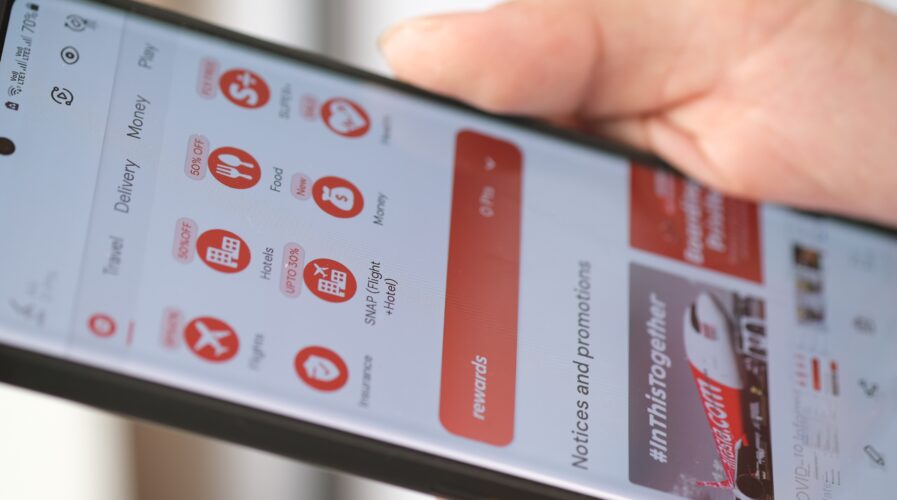

The ASEAN app: AirAsia super app

When the world went on a standstill during the pandemic, the sector most hard-hit by the lockdown measures were travel and aviation. As Southeast Asia’s favorite low-cost carrier, AirAsia saw the pandemic-caused setbacks as an opportunity to speed up its digital transformation and pivot its business to something more than just an airline.

So to rise to the challenges of running an airline during a global pandemic, AirAsia decided to focus on developing its digital and other non-passenger airline businesses. That was how an AirAsia superapp was formed in several Southeast Asian markets—Indonesia, Malaysia, Singapore, and Thailand. In those countries, AirAsia, through its superapp, offers food delivery, ride-hailing, flight ticket and accomodation booking, grocery shopping, financial services, e-commerce platform as well as cross-border e-commerce logistics.

The company has also been vigorous in its expansion around the region, and had even acquired Gojek’s Thailand operations as part of its plan to spread its wings. What sets AirAsia apart from Gojek and Grab is the fact that it holds a trove of data from years of its operations as a low-cost airline and that has allowed the company to grow and tailor services based on what consumers want and need, at a rate far quicker than both Grab and Gojek.

With that said, all three superapps have their strengths and weaknesses. At the end of the day, consumers are finding these apps increasingly convenient for them. It remains to be seen which will be the best in the region but with the competition growing, these apps will only continue to add more features for consumers in the future.

READ MORE

- Strategies for Democratizing GenAI

- The criticality of endpoint management in cybersecurity and operations

- Ethical AI: The renewed importance of safeguarding data and customer privacy in Generative AI applications

- How Japan balances AI-driven opportunities with cybersecurity needs

- Deploying SASE: Benchmarking your approach