Worldpay from FIS: The thriving digital payments landscape of APAC. (Photo by NICOLAS ASFOURI / AFP)

Worldpay from FIS: The thriving digital payments landscape of APAC

- In conversation with Worldpay from FIS, Yvonne Szeto, vice president for commercial APAC shared with TWA her thoughts on the digital payments landscape in Asia and what the future holds for the region.

At this point, it is a known fact that Asia has outpaced all other regions in terms of payments-revenue growth over the past several years. In fact, the Asia Pacific region have outpaced North America and even Europe in the adoption of digital payments and it is APAC where digital wallets first took hold as the dominant e-commerce payment method. Today, that dominance shows no signs of abating.

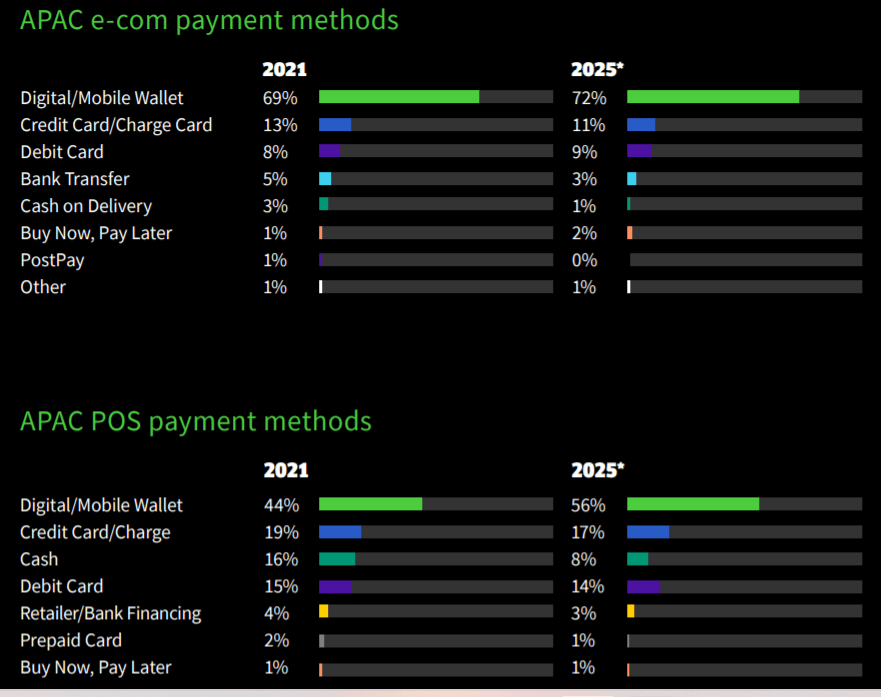

Data from the latest Global Payments Report by Worldpay from FIS shows that digital wallets represented 68.5% of regional e-commerce transaction value in 2021. That amount is now projected to expand to over 72% of transaction value by 2025. “While cards and digital wallets dominate e-commerce payments, a competitive mix of traditional and alternative payment methods make for a diverse regional landscape,” the report reads.

Tech Wire Asia recently got into a conversation with Yvonne Szeto, VP for commercial APAC at Worldpay from FIS during Tech Week Singapore, discussing the payment trends within the APAC region and what could possibly shape the global digital payments landscape ahead. The interview below has been slightly edited for brevity and clarity.

Would you say that the pandemic has permanently reset payments industry trajectory in this region?

No, I don’t think there’s actually a better time to join the payments industry than actually during the pandemic, particularly if you’re on the e-commerce side. Maybe not so much on the point of sale, I think that really suffered, for obvious reasons. Even prior to the pandemic, it was already a trend that people were cashless and moving away from the traditional payments method towards digital payments, which I think the pandemic had really accelerated.

In hindsight, the pandemic was really an exciting period depending on the industry you are in and considering my diverse portfolio. For instance, in my travel and airline segment, there were not much happening and in fact, it was really all about supporting our customers to help them as much as we can. In terms of digital content and retail, those segments were taking off in real big ways.

What are some of the expected trends involving digital payments and what could it like for the sector in the near future?

In Asia, the payments landscape is actually still very fragmented, so experiences are very varied. I think in Singapore, digital payments is not a new concept as the government has been behind the whole initiative of digitizing. To top it off, during the pandemic, one of the newer developments is the QR code payment, which grew substantially over the last two years.

Today, even your traditional hawker stalls that have once refused any digital payments method, have more to embrace QR code payment methods. Then there is Malaysia and India, which I think are probably on the same page as there are still a lot of unbanked population in both countries. These are the countries where cash still has relevance but there tends to be a rise of alternative payment methods.

Most of those alternative payment methods are leveraging real time payments. However, being such a large country like India, newer payment method adoptions are much more prevalent in tier one cities, and over time it would progress to tier two cities and other regional areas. In short, it will take time for adoption to be more widespread and that is largely due to education around the subject matter.

Global Payments Report by Worldpay from FIS

When it comes to cross border payments, more countries within the region are connecting their payment systems. What are your thoughts on that trend?

It is already happening, for instance Singapore, Thailand and Malaysia have announced their own cross-border payments recently. Generally, I think Asia is leading the charge and the rest of the world is watching. Like how India has been leading the way when it comes to real time payment. Imagine what a big impact it will be for businesses making cross border payments, because it can be done within minutes instead of the usual one to two working days. The fees that are incurred with all the correspondent banks that we have to use today will also be much more cost efficient.

Can the Western market learn from Asia in terms of the digital payments landscape?

For starters, markets around the world can look at what is actually enabling this. I think it’s like payment standards like ISO 20022, which is basically standardizing financial messages that enables interoperability between financial institutions, market infrastructures and the Banks’ customers. But I think there are also nuances between different markets, so there are still some improvements to actually streamline. And I think more countries should think about interoperability and make it scalable.

So do you think that interoperability would work in the Western market as well as it has been in the Asian market?

I don’t see why not. If you think of the EU, they have had one currency, so it shouldn’t be an issue.

So there has also been a huge rise in Buy Now Pay Later, especially in Asia. What are your thoughts on that and where do you see it going in the coming years?

Yeah, I think within Asia, it started earliest in Australia. In Asia, it started in the last five years or less, so it is still in its nascent stage. It is growing and based on our Global Payments Report, we projected it to have a compound annual growth rate of 36% through 2025. It is going to be the fastest payment method and it’s mainly because of convenience. Apart from the user experience, 64% of millennials actually don’t have a credit card, so BNPL is targeting the underbanked populations.

I think the pandemic also compounded the idea of being cautious about budgeting. But as usual, anything that sort of takes off rapidly in terms of adoption, always gets the attention from the regulators, so there are a lot of countries such as Australia and even Singapore, talking about building a self-governing body, where BNPL players come together to come up with some standards and guidelines so that they don’t actually end up creating an issue of credit burden.

Do you think that would actually make it a little bit harder for BNPL players to target those underbanked population?

I think it depends on what they’re trying to solve. If it eventually impacts the user experience, that will definitely take away the shine of a wildly successful product. But if they are trying to mitigate credit exposure, such as creating more transparency then I think it is towards the right direction.

The payments industry is no doubt fragmented. Do you think consolidation is the way forward?

I think it’s already happening. If you look at the valuation of some of the really big financial companies, they have really dropped and a lot of the venture capitalists aren’t really investing in them. I think that’s a reflection of too much competition. However, I do believe that BNPL has its place, it serves a purpose and I think in order for it to be successful, there has to be consolidation. Some of it’s already happening in fact as players are really focused on turning the existing footprint into a profitable business.

Lastly, what are some of the payment trends that you foresee shaping up in this region?

The hottest trend right now is embedded finance which is essentially offering financial solutions to consumers at the point that they are re needed and it is by non-financial institutions. So it really relies on partnership between banks, as well as non banks, and other technology providers for that really beautiful experience. Think about your in-app services like GrabPay, that is a perfect example, it is essentially invisible.

You do your shopping, and at the last bit of checkout, you just click pay and then you’re done. So it is really about seamless user experience. Then there is the BNPL trend which we have discussed about. There is also embedded insurance, which is basically just a part of the user’s journey without needing them to separately jump on other separate apps or sites to get it.

READ MORE

- Ethical AI: The renewed importance of safeguarding data and customer privacy in Generative AI applications

- How Japan balances AI-driven opportunities with cybersecurity needs

- Deploying SASE: Benchmarking your approach

- Insurance everywhere all at once: the digital transformation of the APAC insurance industry

- Google parent Alphabet eyes HubSpot: A potential acquisition shaping the future of CRM